With a Section 1045 rollover, founders can salvage QSBS before 5 years – TechCrunch

The tax code accommodates provisions that encourage investments within the expertise startup ecosystem and small companies by rewarding founders, VCs and traders for taking excessive ranges of threat in founding or investing in a startup. One in all these provisions is the Qualified Small Business Stock (QSBS) or Section 1202 stock, which gives the chance to remove capital positive factors tax totally if particular necessities are met.

You will need to observe that this 100% capital positive factors exclusion, made everlasting by the Obama administration, has been included within the draft laws by the Home Methods and Means Committee, and features a proposed minimize from 100% exclusion to a 50% exclusion for positive factors acknowledged on the sale of QSBS. For the aim of this text, I’ll converse particularly to the 100% exclusion.

You possibly can be taught extra concerning the QSBS guidelines and necessities here. One rule we talk about as we speak is that stockholders should meet a five-year holding interval to qualify. Nevertheless, not everybody can time when to promote their firm. The truth that many acquisitions occur earlier than 5 years leaves some founders and traders wanting qualifying for these highly effective tax financial savings.

Stockholders can multiply — or “stack” — the advantage of a 1045 rollover by spreading the QSBS exclusion to multiple new funding.

Part 1045 can salvage the chance in some instances.

What’s Part 1045?

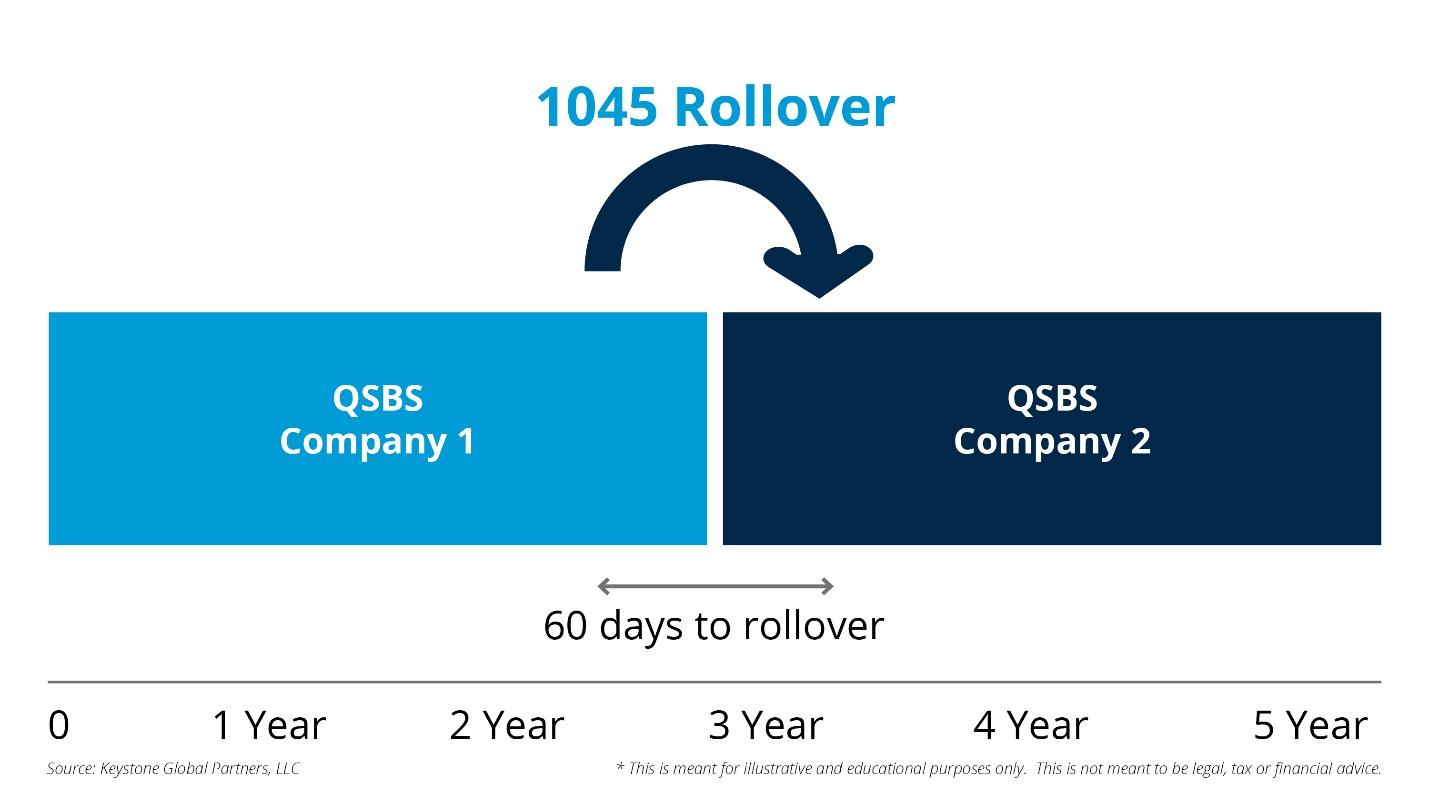

Part 1045 permits a founder or stockholder whose firm has been bought earlier than the five-year holding interval to defer the capital positive factors by rolling the sale proceeds right into a alternative QSBS.

Advantages and alternatives

A 1045 rollover permits founders and traders to make the most of a number of tax advantages and alternatives they might in any other case miss.

Prolonged tax deferral

With a 1045 rollover, the stockholder can defer taxes on the sale of the unique QSBS by investing in a alternative QSBS. Underneath the appropriate circumstances, tax might be deferred till the alternative QSBS is bought.

If the mixed holding interval is 5 years and different necessities (mentioned beneath) are met, no federal capital positive factors taxes are due. But when the necessities usually are not met, then taxes will probably be due upon the sale of the alternative QSBS.

Shortened holding interval

Usually, the holding interval for all taxable exchanges will start the day after the change. Nevertheless, the holding interval for the alternative QSBS consists of the holding interval of the unique QSBS, avoiding a reset of the five-year requirement. This implies a 1045 rollover shortens the following QSBS holding interval requirement and permits the clock to proceed ticking.

1045 Rollover. Picture Credit: Keystone International Companions