What is a M&A deal and how does it work?

Whether you’re planning to join forces with another business or not, knowing the ins and outs of merger and acquisition deals is essential for anyone who wants to thrive in business.

Otherwise known as “M&A” deals, consolidating your company with another can be a complex process and it’s important to know how to approach it for the best results.

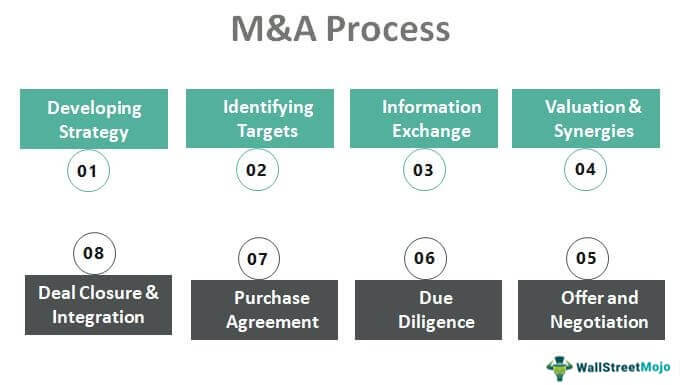

We’ve broken down everything you need to know when making an M&A deal step-by-step.

What is an M&A deal?

An M&A deal is a deal that involves one company consolidating with another, whether that’s through a merger or an acquisition.

Sometimes used interchangeably, a merger differs from an acquisition in that it involves companies merging to create a larger entity.

Acquisitions, meanwhile, involve one company acquiring another.

Usually the process is initiated in order to stimulate growth for a company or companies.

What is an M&A deal structure?

Simply put, the M&A deal structure is the binding agreement between two parties involved in an M&A deal.

The structure outlines the obligations and rights of both parties involved in the deal, as well as what each party is entitled to.

In essence, an M&A deal structure represents the terms and conditions of the deal.

A thorough M&A deal structure should consider issues that may arise in the future, including risks that could impact the deal.

It will also consider ways to mitigate these risks along with timelines and conditions for the deal.

What are the responsibilities of M&A deal stakeholders?

There are usually several different stakeholders involved in the M&A deal process. This includes:

- The buyer

- The seller

- Advisors and intermediaries

- Governments and regulators

Each of these parties will have different responsibilities in the M&A deal.

While the buyer is responsible for identifying target companies and acquiring them at the best time to maximise gains, the seller’s responsibility is maximising value for their own company and shareholders, providing accurate information to the buyer.

Intermediaries in M&A deals include consultants, investment bankers, corporate lawyers and other financial advisers.

Their role is to help close the deal with the best possible outcome for their client, whether this is the seller or the buyer.

Governments and regulators, meanwhile, have the role of scrutinising M&A deals to make sure they are in the best interests of the public.

Deals deemed to be creating a monopoly on the market, for instance, may be vetoed.

With all this understanding behind you, you’re now well-placed to enter into a deal that works in your best interests.