Chip shortages are falling – but only for some

But the change is far from uniform. Everstream data shows lead times for some of the cutting-edge chips needed for medical devices, telecommunications and cybersecurity systems to be around 52 weeks, compared with the previous average of 27 weeks.

Auto companies have been hit hard by the pandemic because they initially canceled parts orders then were hampered by soaring demand and no spare inventory and little bargaining leverage when increasing returns again. Modern cars may have thousands of chips, and future models are likely to have even more computing power, thanks to more advanced in-car software and autonomous driving functionality.

“Any automotive product – or competing in terms of capabilities,” said Jeff Caldwell, global director of supply management at MasterWorks Electronics, a maker of printed circuit boards, cables and other electronic products. with cars – there are still many limitations. Actify CEO Dave Opsahl, whose company sells operations management software to car companies, said chip supplies have not improved for automakers, and raw material shortages as plastic and steel, as well as labor, also worsened.

Frank Cavallaro is the CEO of A2 Global, a company that finds, procures and tests electronic components for manufacturers. He said that the current situation reflects the complexity of the chip market and the supply chain. Many end products include many semiconductor components sourced from all over the world and require the devices to be packaged by companies primarily located in China. “It’s macro, it’s micro, it depends on the region,” he said.

Everstream’s Gerdman said that the appearance of new BA5 Covid variant in China has raised concerns that draconian lockdowns could hamper the production of chips and other products. She adds that uncertainty about future capacity – as well as geopolitical restrictions on chip exports – makes planning ahead difficult.

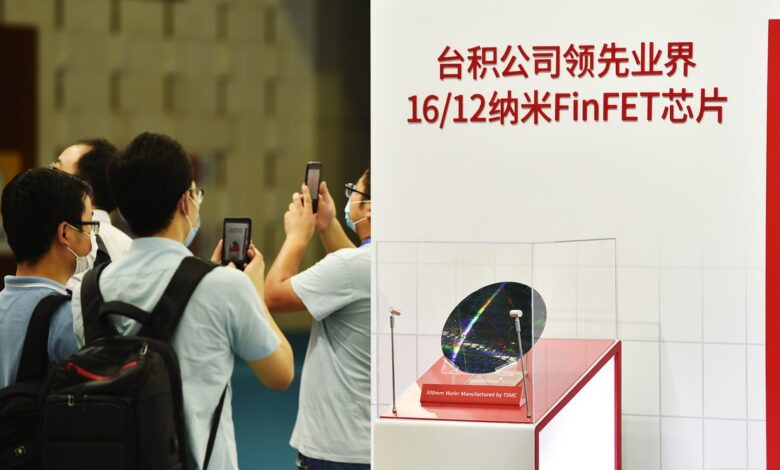

The geopolitical picture could significantly increase the capacity of advanced chip production globally. Law overcome The US Senate will provide $52 billion in grants to increase domestic chip production. The US share of global chip manufacturing has fallen from 37% in the 1980s to 12% today. But while the chip shortage is attributed to those subsidies, much of the money will go toward remanufacturing the cutting-edge chips. The country’s most advanced technology, Intel, lags far behind TSMC, representing a potential weakness in US access to technology, which promises to be crucial to everything from AI to technology. biotechnology to 5G.

The current downturn may only contribute to instability in the semiconductor supply chain. “Unfortunately, a slowing economy puts some suppliers at risk,” said Bindiya Vakil, CEO of Resilinc, a company that sells AI-based supply chain management tools. into financial distress or liquidity recession. “This can lead to many risks in the supply situation. Companies should really monitor the financial health of their suppliers and work closely with the suppliers to offer them favorable payment terms, prepayment, etc. to make them solvency. clause”.

The cyclical nature of the semiconductor industry even has some, including Syed Alam, head of global semiconductor operations at consulting firm Accenture, who envision shortages turning into excesses. . “The growing concern for 2023 is the possibility of excess capacity for chip production,” he said. “Companies need to focus on building a resilient and resilient supply chain over the long term and be prepared to react.”