Britain’s biggest water company struggles with $19.7bn debt

Engineers from a Thames Water leak detection team unload equipment from their truck during a night shift in London, UK, on Wednesday, May 2, 2023. The chief executive of Britain’s largest water supplier resigned with immediate effect on Tuesday.

Bloomberg | Bloomberg | Getty Images

LONDON — British regulators on Thursday took the unprecedented step of placing the water company that supplies London and parts of southern England into special measures, as it seeks fresh funding from investors to shore up its future.

Regulator Ofwat said Thames Water would be subject to increased scrutiny and must reassess its plans to improve its performance, supply and financial resilience. Ofwat approved £16.9 billion ($21.8 billion) for the company to invest in improving customer service and the environment — a lower amount than the £19.8 billion Thames Water had requested.

Meanwhile, the regulator has granted the company permission to increase customers’ bills by an average of £99 a year over the next five years, almost half the amount it had asked for.

In a statement on Thursday, Thames Water said its spending proposal aimed to “maintain a reliable supply of safe, high-quality drinking water and the efficient treatment of wastewater across London, the Thames Valley and the Home Counties now and into the future”.

Company asked Ofwat said the company’s business plan was “inadequate”, but said it would provide the regulator with further evidence to support its proposals, noting that a final decision would not be made until December 2024.

The troubled company has more than 16 million customers and is seeking to avoid consequences that could include temporary nationalization or a breakup. This spring, shareholders discarded object its bid for a £500m investment, while parent company Kemble default.

Thames Water is owned by a group of institutional shareholders spanning pension funds, sovereign wealth funds and private equity. The company’s largest outside shareholder is the Ontario Municipal Employees Retirement System, one of Canada’s largest pension plans.

The company’s liabilities have skyrocketed over the past two decades, and on Wednesday, the company reported net debt of £15.2bn in the year to March 2024. The company said that under its current base case it would not run out of cash until the end of May 2025, assuming it could continue to draw on its revolving credit facilities and use all its cash resources.

Thames Water — and other British utilities — have been heavily criticized about the sharp increase in sewage discharged into UK waterways, including the River Thames.

Thames Water chairman Adrian Montague said on Wednesday the company’s plans would attract “much-needed investment”, adding that he believed it could “turn the business around”.

In its results, Montague said the UK water industry needed significantly higher levels of investment in the coming years and was competing for debt and equity in a “very competitive market, at a time of increasing legal and political risk and uncertainty”.

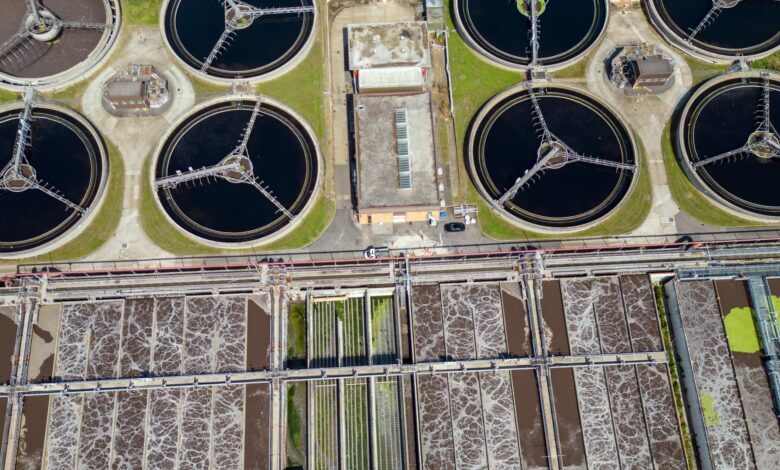

An aerial view of wastewater treatment at Thames Water’s Longreach Wastewater Treatment Plant on August 10, 2023 in Dartford, UK.

Carl Court | Getty Images News | Getty Images

Achieving a “market-led solution” will require working with regulators and governments to drive change and ensure investors have incentives to continue investing in UK water companies, he added.

On Wednesday, S&P Global dealt another blow to the company, as is set The company’s A and B debt are at risk of being downgraded, which the company said reflected a belief that Thames Water may not be able to maintain adequate liquidity – raising market concerns about a “junk” rating.

S&P said the company’s position is under further pressure due to the large capital investment program required, which will offset free operating cash flow and limit the company’s ability to deleverage.

Correction: The title of this article has been updated to correctly reflect Thames Waters’ total debt converted to US dollars.