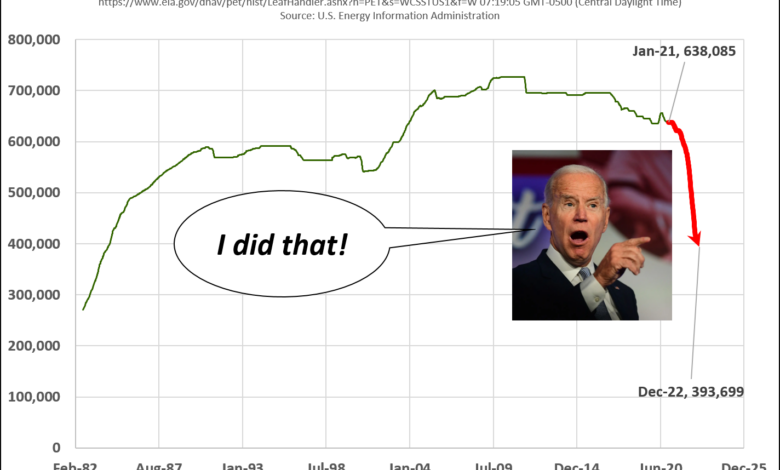

Bid to suck more oil from the SPR… Expect the oil industry to refill oil at $68-72 per barrel – Up with that?

Guest “Don’t underestimate Joe’s ability to [frack] everything up“By David Middleton”

Despite Biden’s best efforts to destroy the U.S. oil and gas industry, his dysfunctional Department of Energy expects U.S. domestic production “to hit a new record next year.” “…

This is so stupid…

The President’s announcement allows the DOE to release up to 180 million barrels from the SPR to serve as a wartime bridge as domestic production — expected to hit a new record next year — rebounds. This historic release of SPR crude has supplied approximately 165 million barrels of crude to the US economy – leading to supply certainty for US businesses and consumers.

DOE plans to ship up to 3 million barrels of sour crude and 12 million barrels of sweet crude for a total of 15 million barrels, with deliveries between December 1, 2022 and December 31, 2022 from three locations. SPR archives are listed below.

SPR is already at lowest level since 1984, before the crazy decision to pull another 15 million barrels of crude from there. The sale of 15 million bbl in December would bring the SPR below 400 million bbl.

400 million barrels equals about 20 days domestic gasoline consumption or about 130 days of net crude oil imports (imported goods – export). The minimum allowable level is less than International Energy Program Agreement is the 90-day net import value.

Curiously, the Department of Energy didn’t figure out how to incorporate Biden’s mistake into this explanation of the purpose of the SPR:

About SPR

The Strategic Petroleum Reserve (SPR), the world’s largest emergency supply of crude oil, was established primarily to reduce the impact of oil product disruptions and fulfill US obligations. Under the international energy program. Federally owned oil reserves are stored in giant salt caves underground at four locations along the coast of the Gulf of Mexico. The sheer size of the SPR (allowed storage capacity is 714 million barrels) makes it a significant deterrent to oil import cuts and an important foreign policy tool.

SPR oil was sold competitively when the President found that, under the conditions set forth in the Energy Policy and Conservation Act (EPCA), it was necessary to sell. Such a situation has only existed three times, most recently in June 2011 when the President directed the sale of 30 million barrels of crude oil to offset supply disruptions caused by the unrest in Libya. During this time of severe energy supply disruptions, the United States acted in concert with its partners in the International Energy Agency (IEA). IEA countries have exported a total of 60 million barrels of petroleum.

In addition, the Secretary of Energy may authorize limited release in the form of exchanges with entities that are not part of the Federal Government. The agency allows the SPR to negotiate an exchange in which the SPR ends up receiving more oil than it issues; thus obtaining additional oil. With the exception of the 2000 Heating Oil Exchange, SPR has entered into negotiated contracts at the request of private companies to address short-term, urgent supply disruptions to normal operations. refinery in some cases.

The senior geniuses at the Department of Energy have also developed a plan to refill SPR at a great price…

The administration is also reinforcing its commitment to add SPR to previous levels, with the goal of providing price certainty to taxpayers and a constructive acquisition approach to bring certainty to the industry. . Today, DOE complete a rule allowing the purchase of crude oil futures at a fixed price to replenish the SPR at a lower price than the barrels sold, while providing certainty to the industry that will help incentivize production in the short term. Relative to conventional purchase contracts that expose producers to volatile crude oil prices, fixed-price contracts can provide producers with the assurance to invest today, knowing the price they receive when sold to SPR will be left unchanged, providing them with some protection against downward movements in the market.

Think about it. WTI is currently averaging $80 per bbl and the Department of Energy wants to buy it for around $70/bbl.

The question is whether oil companies will react to the increase in output when the Department of Energy also said they want to buy back SPR oil at $68-72 a barrel.. a price much lower than that of the SPR. Currently? Why invest in expensive new production if you are being told prices are falling, at the same time your costs are going up?

Ignore the fact that they filled the SPR with an average price of $29.70/bbl, who will lock in $68-72/bbl when they can sell it on the open market for $80-90/bbl? EIA’s current STEO has WTI rebounding to $90 in 2023. Biden & Co. is giving oil companies an “opportunity” to protect future production at below-market prices… Unbelievable… Come on, buddy!

With many, if not most, oil companies still suffering excessive hedging losses in 2020, most have reduce or suspend hedging. There’s a higher chance Biden says complete sentences than filling SPR at ~$70/bbl in this environment.

What if (or when) oil prices crash again? Will the US government really honor long-term contracts to buy crude at $70/bbl, when it trades between $30 and $40? Yes, Joe?