Bailey says forward guidance could be made after comments on rate hikes

Andrew Bailey has said the Bank of England may stop issuing central bank policy guidance ahead of meetings after he was accused of being an “unreliable boyfriend” over comments he made. put forward before the final vote on interest rates.

The Governor of the Bank told a House of Representatives committee yesterday that scrapping the kind of forward guidance implemented by his predecessor Mark Carney was “nothing to talk about”. He said it was “very good support” for the monetary policy committee, which votes on interest rates.

Bailey was accused of being an “unreliable boyfriend” after speculating about an October rate hike ahead of this month’s meeting. It was originally an attack on Carney following allegations of rate flipping. Financial markets were surprised when seven of the Bank’s nine rate-setters, including Bailey, chose to wait for more job market data before raising borrowing costs from historic lows of zero. ,first%.

Bailey told the committee he became concerned over the summer that markets were taking the view that central banks would not respond to a rise in inflation. “Anyone who thinks we’re not in the business of price stability and we won’t react is wrong,” he said. He declined to give instructions that the committee would raise rates at its November 4 meeting, “because that is clearly a ruling for the MPC, meeting by meeting”.

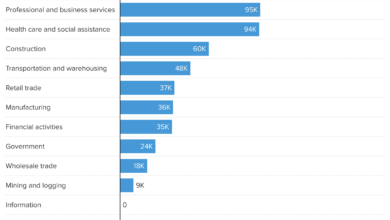

Labor shortages and wage inflation have become the biggest concerns of Bank of England policymakers, who are expected to focus on the issue when they meet next month. to decide on interest rates. Investors believe in a 90% chance of a price rally in December.

“The labor market is very tight and this is what I am and will be most concerned about, I can tell you, the focus that I am sure on our meeting when we have it in time,” Bailey said. three months.”

Jonathan Haskel, a Bank policymaker, warned in a speech to students at the University of Glasgow’s Adam Smith School of Business that wages could grow faster than productivity and push wages up. “From a standard of living standpoint this is of course great news, but from an inflation standpoint this has to be matched by productivity gains and so we have to be wary,” he said. Both Bailey and Haskel say they’re less worried about rising energy and transportation costs, which they expect to be temporary.

Bailey cites an increase in the number of people who are unemployed and not looking, and an increase in employment in the public sector. “The first thing businesses talk about is recruitment at the moment,” he said. According to the Office for National Statistics, the number of vacancies hit a record high of 1.1 million in the three months to September.

The Governor of the Bank defended the committee’s decision not to stop quantitative easing. The central bank has been buying gilts for more than a decade since the financial crisis to keep yields low and trading orderly. It will stop working next month.

He said he did not want people to lose faith in the Bank’s commitments to fixed quantitative easing. “I don’t think it’s reasonable to violate the policy we’ve had in place and the approach we’ve adopted for the future,” he said.