Activist Elliott makes inroads at Catalent to build value. Here’s what could happen next

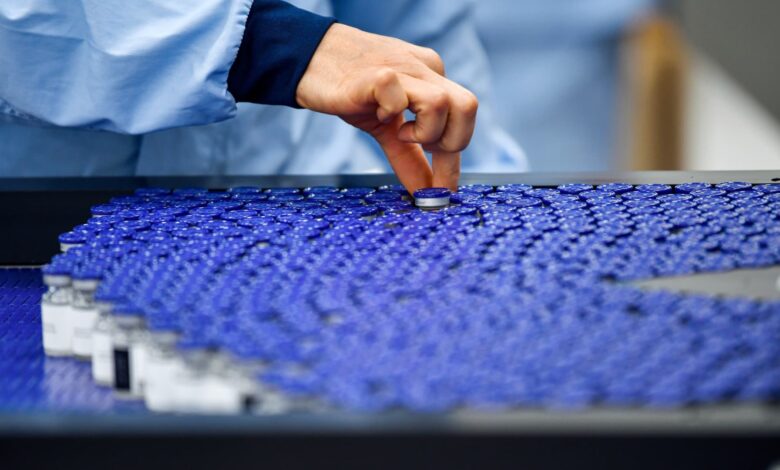

Rows of glass vials in a biologics laboratory in Sweden. Photographer: Mikael Sjoberg/Bloomberg

Bloomberg Creative | Bloomberg Creative Photos | Getty Images

Company: Catalent (CTLT)

Business: Catalent develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. The company operates through four segments. First, there’s Softgel and Oral Technologies, which provides formulation, development, and manufacturing services for soft capsules for use in a range of customer products. Biologics provides biologic cell-line, and it develops and manufactures cell therapy and viral-based gene therapy. This segment also handles the formulation, development and manufacturing for parenteral dose forms, including vials and prefilled syringes. The Oral and Specialty Delivery segment offers formulation, development and manufacturing across a range of technologies, along with integrated downstream clinical development and commercial supply solutions. Finally, the Clinical Supply Services segment offers manufacturing, packaging, storage, distribution and inventory management for drugs and biologics, as well as cell and gene therapies in clinical trials.

Stock Market Value: $8.86B ($49.16 per share)

Activist: Elliott Investment Management

Percentage Ownership: n/a

Average Cost: n/a

Activist Commentary: Elliott is a very successful and astute activist investor, particularly in the technology sector. Its team includes analysts from leading tech private equity firms, engineers, operating partners – former technology CEOs and COOs. When evaluating an investment, the firm also hires specialty and general management consultants, expert cost analysts and industry specialists. The firm often watches companies for many years before investing and have an extensive stable of impressive board candidates. Elliott has not disclosed its stake in this investment, but based on the firm’s history, we would expect it to be approximately $1 billion.

What’s happening?

On Aug. 29, Elliott and the company entered into a cooperation agreement pursuant to which Catalent agreed to temporarily increase the size of the board from 12 to 16 directors and appoint Steven Barg (global head of engagement at Elliott), Frank D’Amelio (former CFO and EVP, global supply, of Pfizer), Stephanie Okey (former SVP, head of North America, rare diseases, and U.S. general manager, rare diseases at Genzyme) and Michelle Ryan (former treasurer of Johnson & Johnson). The company will reduce the size of the board at the 2023 annual meeting; it agreed to nominate a slate of 12 candidates, including the four new directors. Catalent also agreed to establish a strategic and operational review committee, charged with conducting a review of the company’s business, strategy and operations, as well as its capital allocation priorities. This committee will include new directors Barg and Ryan. Further, John Greisch (former president and CEO of Hill-Rom Holdings) has been appointed executive chair of the board and will also chair the newly formed committee. Elliott agreed to abide by certain customary voting and standstill provisions.

Behind the scenes

Catalent is an outsourced manufacturer in the pharmaceuticals industry. This is a stable business in a growing industry operating in an oligopoly. It’s one of the three largest global contract development and manufacturing organizations, next to Lonza and a division of Thermo Fisher. The company was always seen as a market leader, but in the middle of 2022 the tides began to turn, largely due to two main factors. First, Catalent was negatively affected by a Covid cliff: During the pandemic, the government mandated that the company shut down much of its manufacturing and start producing Covid vaccines. This production led to $1.5 billion in revenue that recently went to zero. Second, Catalent had several self-inflicted wounds, including an acquisition that did not pan out like they expected and operational and regulatory issues. These are fixable issues that have sunk the stock from $142.35 in September 2021 to $48.82 this month, but they do not necessarily adversely affect the long-term intrinsic value of the company. That makes this situation an excellent opportunity for an activist.

In its most simplistic form, there are two basic elements to an activist campaign: success in the activism (for instance, getting the company to adopt your agenda) and execution of the activist agenda. Elliott has already accomplished the former, having entered into the cooperation agreement for four board seats. There’s also the establishment of a strategic and operational review committee and appointment of Greisch as executive chair of the board and as chair of the newly formed committee. While this committee’s purview is business, strategy and operations, we expect it will put an emphasis on strategy.

This is a very strategic asset, and there are likely to be several interested acquirers. In fact, on Feb. 4, Bloomberg reported that fellow life sciences conglomerate Danaher had expressed interest in purchasing Catalent at a “significant premium.” Catalent ended Feb. 3 at $56.05 per share, and the stock popped nearly 20% the following trading session. Ultimately, a deal with Danaher never materialized. Additionally, companies like Merck could be interested in buying the company or parts of it. Another possibility is an acquisition by private equity, of which Elliott’s PE arm could be an interested party. While as an activist Elliott will do whatever it feels is necessary to enhance shareholder value, in the past the firm has made significant use of the strategy of offering to acquire its portfolio companies as the best catalyst to enhance shareholder value. We would not be surprised to see that happen here. Catalent is the right size for Elliott, which recently partnered on buyout deals for Citrix Systems and Nielsen Holdings, each for roughly $16 billion. Elliott has also recently shown interest in this industry, partnering with Patient Square Capital and Veritas Capital to acquire Syneos Health (SYNH) for $7.1 billion. That acquisition is expected to close in the second half of 2023. Like Catalent, Syneos is an outsourced pharma solutions company: It outsources R&D for pharmaceutical companies, whereas Catalent outsources manufacturing.

Elliott quickly got Catalent to pursue a strategic exploration agenda, which indicates to us that there was not a lot of pushback by management. We expect that this review will conclude with a sale of the company. However, it is worth noting that Catalent has a relatively new CEO at the helm, Alessandro Maselli, who was promoted from president and COO in July 2022. A lot of the operational issues happened during his watch. If this does turn from a strategic review to an operational review, there is no guarantee that he keeps his job.

Ken Squire is the founder and president of 13D Monitor, an institutional research service on shareholder activism, and the founder and portfolio manager of the 13D Activist Fund, a mutual fund that invests in a portfolio of activist 13D investments.