Warren Buffett’s Berkshire Hathaway sells more Bank of America, now cuts stake by nearly 15%

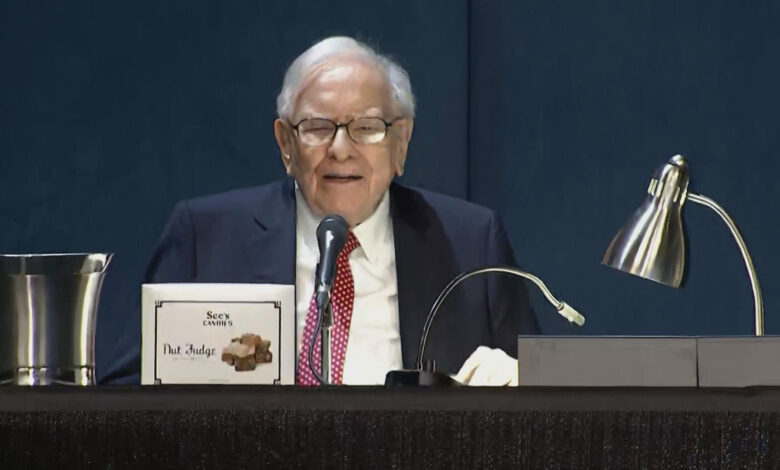

Warren Buffett speaks at Berkshire Hathaway’s annual shareholders meeting in Omaha, Nebraska on May 4, 2024.

CNBC

(This article is excerpted from the Warren Buffett Watch newsletter. Register here.)

Warren Buffett added about $6 billion to Berkshire Hathaway’s massive cash pile this summer with a series of Bank of America sell shares from mid-July.

According to one new application FridaySales of 21.1 million shares on Wednesday, Thursday and Friday generated $848.2 million, or an average price of $40.24.

Berkshire has sold Bank of America stock for six straight sessions. Since starting to reduce its holdings on July 17, the firm has sold the stock in 21 of the past 33 sessions.

In total, Berkshire cut its BofA stake by 14.5% by selling 150.1 million shares for $6.2 billion, an average of $41.33 per share.

BofA is Berkshire’s third largest holdingaccounts for about 11% of the company’s portfolio.

Berkshire remains Bank of America’s largest shareholder with 11.4% stake out of 882.7 million shares worth nearly $36 billion.

However, as sales continue to rise, that number is approaching Vanguard Group’s 639 million shares.

While there is some theories on why Berkshire sold a stock that Buffett said was as recently as last year he didn’t want to sellDespite his concerns about the entire banking industry, there has been no explanation from Omaha so far.

Buffett turns 94 on Friday. As of June 30, Berkshire’s cash pile was at a record $277 billion.