How to find the best pre-qualified credit card offers

With each issuer using its own approval criteria for applications, it’s difficult to know which credit card offers you’re eligible for. This can be especially difficult if you don’t have a long credit history either good credit score.

That’s where pre-qualified offers — and the tools you use to find them — can come into play. Pre-qualified offers not only help you find the card you’re most likely to get approved for, but can also help you find targeted offers that aren’t available to every applicant.

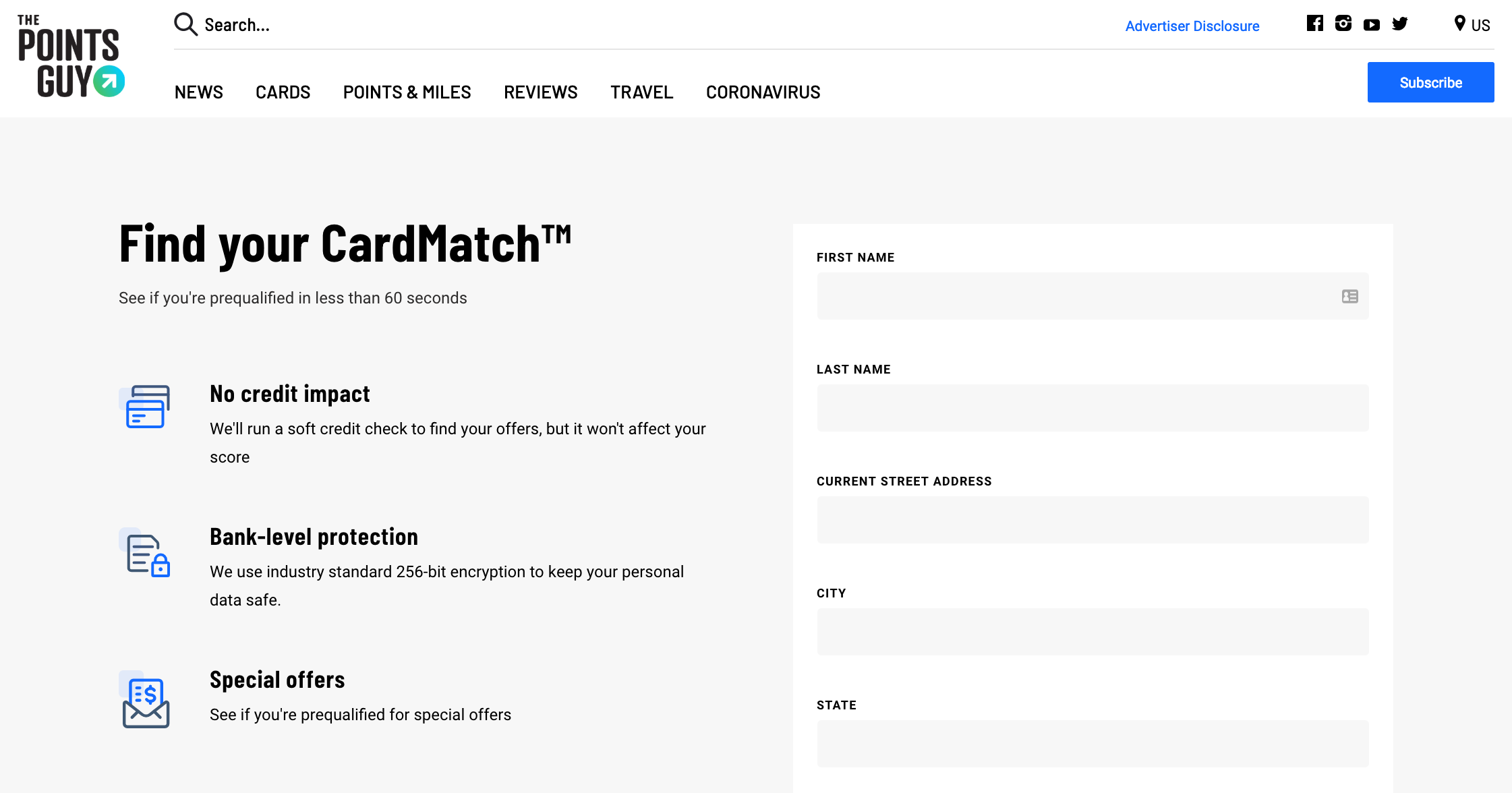

Today, we’ll walk you through how pre-qualified offers work and how you can use them. tools like CardMatch to find high bonuses and other special offers.

What is a pre-qualified offer?

When you receive a pre-qualified credit card offer, the issuer has reviewed your basic financial information and determined you are a good candidate for a specific credit card. Sometimes issuers send pre-qualified or even pre-approved offers via email, but you can also request pre-qualified offers using online tools different.

A pre-qualified offer is different from approved for credit cards when filling out the application. While issuers often take a general look at your creditworthiness, they don’t pull you Full credit report when you go through the pre-qualification process.

Instead, a pre-qualified offer is only intended to show that you are a strong candidate for approval if you formally apply. ARRIVE Open a new line of credityou will have to actually go through a formal registration process.

In other words, just because you receive a pre-qualified offer doesn’t automatically mean you’re guaranteed approval for a particular card.

There are many ways you can get pre-qualified credit card offers. Mail solicitations can be annoying as they pile up in your inbox, don’t be too quick to dismiss them all. You can get great personalized offers with High bonusesextended low interest rate introductory period and more.

Many issuers also have pre-qualification tools on their websites, incl Capital One.

Daily newsletter

Gift your inbox with the TPG Daily newsletter

Join over 700,000 readers to get breaking news, in-depth guides and exclusive offers from TPG experts

These tools can help people with mid-range credit scores determine which cards they’re most likely to get approved for without having to apply. temporarily lower their credit score.

Use CardMatch to find pre-qualified offers

One of the best resources for pre-qualified offers is CardMatch tool. This can help you filter and compare pre-qualified offers for cards like Capital One Venture X Rewards Credit Card, American Express Platinum® Card and American Express® Gold Card – and in some cases these are even higher than the standard public offering.

Check out the CardMatch tool to see which card you’re pre-qualified for. Remember that these offers are targeted and may change at any time.

How to use the CardMatch tool

First, you fill in your information into the CardMatch tool.

From there, you will be taken to a results page with relevant offers. Of course, your results will be provided to you and all this happens without the need for it official difficult investigation against your credit report.

We saw offers of up to 175,000 membership bonus points for Amex Platinum and 90,000 points for Amex Gold after the meeting Minimum spending required.

Compare that to their public welcome offers: the Amex Gold card currently offers 60,000 points after spending $6,000 on purchases in the first six months of card membership, while the Amex Platinum is currently offering a The public welcome offer is 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership.

Related: Check to see if you’re targeted for an enhanced Amex Platinum or Amex Gold offer through CardMatch

Issuer pre-qualification tool

Many issuers offer their own pre-qualification tools to help potential applicants understand whether they are likely to be approved for certain cards. In general, you may not find it Best welcome offer through this method. However, with Limited credit history And poorer credit score can use these tools to see what cards they can get.

Capital One pre-qualification

Capital One offers one tool to see if you are pre-qualified for certain credit cards, including:

Currently, you can’t use this tool to see if you qualify for Capital One’s premium product – product Capital One Venture X Rewards Credit Card – but it shows your approval rate on many other issuer cards.

The pre-qualification application is short, but you must provide your annual income, Social Security number, address and housing status.

I am pre-qualified for the Quicksilver, SavorOne, and Platinum cards. Additionally, I am currently a cardholder of the Venture Rewards Card.

Information about the Capital One Savor Cash Rewards Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Best Capital One credit cards

Explore preliminary selection

Discovery also has one on-site pre-qualification tool you can use.

Once I went through this process, I was pre-qualified for the Discover it Miles card and the Discover it Cash Back card. I’ve never owned a Discover card, which might explain why (and how) I qualify for these “top” Discover cards.

Information about Discover it Miles and Discover it Cash Back has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Best Discover credit card

Pre-qualification of Credit One Bank

Credit One Bank offers several credit card options. However, this issuer certainly can’t match Chase or Amex in terms of benefits offered or potential rewards earned.

At the time of writing, Credit One Bank Requires new customers to be pre-qualified for all new credit cards before applying.

I actually went through this process and just pre-qualified to apply for the Credit One Bank® Platinum Visa® to rebuild my credit. This could be because of me recently opened another credit card within the past few months.

Note that Credit One Bank lists its entire line of credit cards as potential options for pre-qualification (unlike Capital One, which pre-qualifies only select cards).

Information about the Credit One Bank Platinum Visa credit card to Rebuild has been independently collected by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Best Credit One credit cards

Will a pre-qualified offer negatively affect my credit report?

A pre-qualified offer is based on a Take a swipe at your credit report. Using the CardMatch tool or issuer prequalification tool to test targeted offers will not affect credit score, it also won’t appear as a hard spot on your credit report. This is because the publisher only receives a summary your credit score and accompanying report.

While the information collected at this stage can give the bank a solid picture of whether you will be approved based on certain criteria, your full report will not given.

Pre-qualified offers are not the same as formal applications. If you decide apply for a new line of credit, that will result in a hard inquiry on your credit report, regardless of whether you go through the pre-qualification process or not. And receiving a pre-qualified offer doesn’t guarantee that you’ll be approved for a new account.

Related: What is the difference between a hard pull and a soft pull on your credit report?

What is the difference between qualified and pre-approved?

Although some issuers use these terms interchangeably, there is a difference between a pre-qualified offering and a pre-approved offering.

A pre-qualified offer is based on a soft pull performed on your credit report once you have meet certain criteria that thing maybe make you eligible for a certain card or offer. Generally, a pre-qualification offer is the result of a consumer submitting a pre-qualification application (separate from the formal credit application).

On the other hand, pre-approved offers are typically pre-screened offers targeted to you. When you accept a pre-approval offer and apply, the issuer must honor the offer sent to you if you are approved for the card.

These are more common via direct mail, via email or mailed letters. Publishers with prequalification portals will often have a section where you can enter the invitation ID or number from your mailed offer to identify your targeted offer in the system.

Neither will pre-approved or pre-qualified offers hurt your credit score because they are the result of a light pull on your credit report.

However, if you decide to continue applying after one of these types of offers, it will result in a hard inquiry after you officially apply and give the credit issuer the right to pull the quote. your full statement.

Related: ‘Soft pull’ credit cards: Are they worth it?

Can you be denied if you are pre-approved?

Neither pre-approved offers nor pre-qualified offers count as final approval for the card. While it may mean your credit application is more likely to be approved, there are no guarantees.

Chances are you still can credit card declined for many reasons. The only way to know if you’ve been officially approved for a credit card is to submit a formal application.

Likewise, just because you’re not pre-qualified for an offer doesn’t mean you won’t get approved for a certain card if you officially apply.

Related: Refused a credit card? Here’s what to do when that happens

Bottom line

Whether you’re looking for the best targeted offers or just want a better idea of what card you’re likely to get approved for, finding pre-qualified offers abounds. value. Sometimes, like with Amex Platinum Offer via CardMatchyou can even find Lucrative sign up bonus or welcome offer which otherwise you will miss.

Whenever I consider a new credit card, I always check CardMatch and other pre-qualification tools to ensuring I get the best deal available.

Check CardMatch tool to see which card you’re pre-qualified for. Remember that these offers are subject to change at any time.