“US Natural Gas Exports Rise” ≠ “U.S. Prices Higher” – Rising With That?

Guest “Can you say bass-ackwards?” by David Middleton

US natural gas exports increase = higher US prices: Who knows?

By Kurt Cobb, originally published by Resource Insights

February 6, 2022Few people noticed when energy reporters wrote in early January that The United States has become the world’s largest exporter of liquefied natural gas (LNG). Now, a group of US senators noticed and said those exports could increase heating and electricity costs for their components. In a letter to the energy secretarythey are asking the secretary to “conduct a review of LNG exports and their impact on domestic prices and the public interest, and develop a plan to ensure natural gas remains affordable.” affordable for American households.”

Who knew that natural gas exports from U.S. gas fields would increase domestic natural gas prices? Well, the natural gas industry certainly knows. Over the past decade, the industry has operated smartly under consistently low prices as it consistently overproduces gas into a flooded domestic market.

It has promoted and succeeded in loosening rules for exports in general and fast approval new export goods and basis. The U.S. Department of Energy still has de facto control over most natural gas exports. But the policy in the past 5 years has been to support and encourage the expansion of those exports.

The industry has always assumed that there will be plenty of gas due to the phenomenal growth in gas production from the deep shale deposits that new technology can now tap. The so-called shale gas revolution, which took place at the beginning of the last decade, heralded an era of abundance and cheapness — so much supply, in fact, that the United States would become a major exporter.

But the revolution seems to have stalled as the US natural gas production market has plateaued about 3 trillion cubic feet per month since the end of 2018.

[…]

There’s nothing resilient about Mr. Cobb’s completely dry slate pile.

But the revolution seems to have stalled as the US natural gas production market has plateaued about 3 trillion cubic feet per month since the end of 2018.

Mr. Cobb linked to the following chart to support his “plateau” situation:

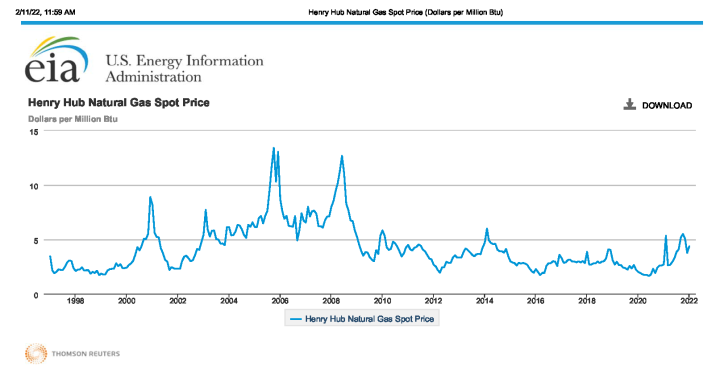

Natural gas prices have been falling since 2014, falling below $2/mmBTU for most of 2020.

Natural gas consumption has decreased in 2020 due to the catastrophic disaster. This resulted in a sharp drop in natural gas production. When the economy was freed from evil, the demand for natural gas increased rapidly. Prices and output subsequently recovered quite strongly. The daily production rate has exceeded the 2019 record.

And the forecast will continue to increase through 2023, supported by relatively higher natural gas prices.

US marketing natural gas production forecast to increase in 2022 and 2023

In February 2022 Short-term energy outlook (STEO), we forecast that the United States produce natural gas on the market will rise to a record-high average of 106.6 billion cubic feet per day (Bcf/d) in 2023. We estimate that spot natural gas prices at the US Henry Hub hub will average $3.92 per million British thermal units (MMBtu) in 2022, 8 years high and will average $3.60/MMBtu throughout 2023.

We expect that Henry Hub prices through 2023 will drive further US drilling and natural gas production. During the February STEO, we forecast US marketable natural gas production to grow to 104.4 Bcf/d in 2022, up 2.9 Bcf/d from 2021. In 2022 and 2023 , combined marketing output from Alaska and the Gulf off the coast of the Mexican Federation (GOM) will average 2.9 Bcf/d, while the remainder, about 97% of production, will come from the Lower 48 states of United States (L48) does not include GOM.

[…]

The current relatively high natural gas price environment will lead to more investment in natural gas extraction and drilling and maintain high production rates for at least the next several years.

There is no shortage of natural gas, at least in the US

“US natural gas exports increase = higher US prices: Who knows?“

No one is good.

At least no one who knows anything about natural gas or economics in general “knows” that increased natural gas exports equate to higher U.S. prices.

We can export natural gas because we produce more than we consume. If natural gas exports were banned, we wouldn’t have a surplus of natural gas.

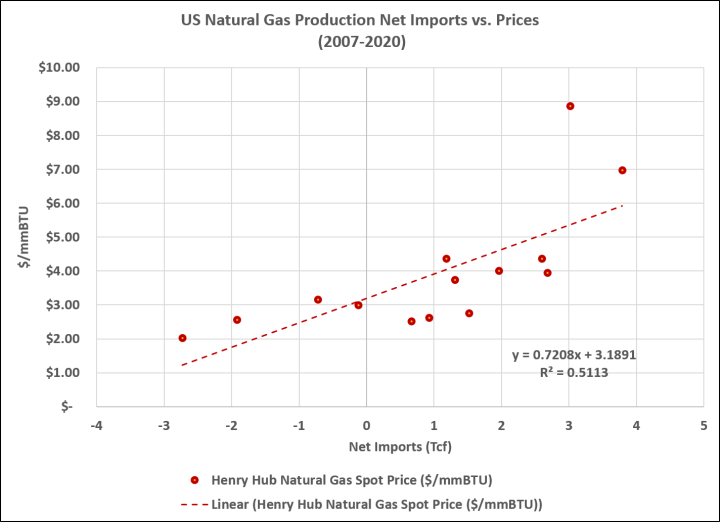

As the United States consumes more natural gas than it produces, we are net importers and prices are higher.

https://www.eia.gov/energyexplained/natural-gas/imports-and-exports.php

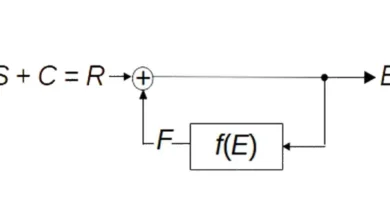

The relationship between production, consumption, net imports, and prices is not particularly confusing. While many other factors come into play, the price of natural gas is negatively correlated with the amount of gas we’ve exported since 2007, our peak natural gas import year.

https://www.eia.gov/energyexplained/natural-gas/imports-and-exports.php

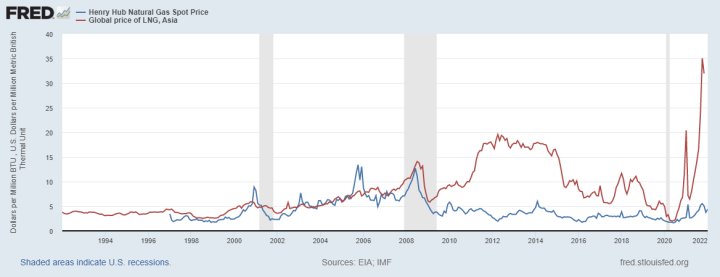

When countries produce less natural gas than they consume (net importers), they tend to pay more for gas. Liquefied natural gas (LNG) is much more expensive than domestic natural gas (Henry Hub).

https://fred.stlouisfed.org/series/MHHNGSP#0

Import prices in Europe Russian gas pipeline is currently equivalent to LNG. Europe imports most of its natural gas and pays 10 times more per mmBTU than the world’s top natural gas exporter.

The moral of the story is: The rise of US natural gas export imports = higher US prices!