“There are 9,000 approved oil leases that oil companies are not currently exploiting”… Aeuhhh? – Is it good?

Guest “Is she talking about WTF?” by David Middleton

This post is the first follow-up of: Democratic senators demand that oil companies increase production.

As I write this post (March 7, 2022 morning), West Texas Intermediate (WTI) is right around $120/bbl. It actually topped $130/bbl over the weekend. This morning, I paid $3,999/gal for regular unleaded gasoline in Houston, Texas. While I make a living searching for oil and gas and high oil prices are good for current profits. These prices may not be sustainable and could trigger the next economic downturn and oil prices.

The illegal management of Brandon increasingly faces questions about why it has not taken steps to increase domestic oil production. Here’s an often ironic political hacking response from the Democratic Party to questions:

Q We also know, you know, the President, most recently yesterday, talked about strengtheningic manufactured to lower the price of inflated items such as commodities. So why not apply the same logic to energy and increase domestic productionn here?

MISS. PSAKI: Well, there are now 9,000 approved oil leases that oil companies aren’t exploiting. So I’ll ask them that question.

Q Is there anything the administration can do to bring those suppliers back to pre-pandemic levels?

MISS. PSAKI: Do you think oil and gas companies don’t have enough money to drill into pre-approved places?

Q Just ask.

MISS. PSAKI: I will – I will point that question to them. And we can talk about it more tomorrow as you learn more.

First of all, WTF IS Ms. Psaki talking about here?

MISS. PSAKI: Well, there are now 9,000 approved oil leases that oil companies aren’t exploiting. So I’ll ask them that question.

As an employee of “them”, I will try to answer that question. However, “9,000 approved oil leases that oil companies do not exploit” is one non-sequitur, if not completely false. Miss Psaki was asked, “What can the administration do to bring those suppliers back to pre-pandemic levels?” Good, Oil production in the Permian Basin has exceeded pre-shamdemic levels. Her reaction was stupid. The number of “approved oil leases” (perhaps Federal mineral leases) is not the answer to that question. The only thing “the government” can do to increase oil production, is to avoid the devil’s path. From canceling the Keystone XL pipeline, to refusing to hold Federal rental sales operations, to threatening to deny approval for drilling permits, they get in their way as often as they can.

I will focus on Federal oil and gas leases in the Gulf of Mexico, as that is an area I have worked in since 1988, I have easy access to detailed production and rental data and GOM accounts for about two-thirds of the oil production from the Confederacy. .

If Ms. Psaki is referring to areas open to rent, there are 10,638 open lands in the Central Gulf of Mexico planning area.

Based on Lexco OWLapproximately:

- 38% of those GOM Center sites have never been leased in the history of U.S. Gulf of Mexico rentals… A pretty good sign that those areas aren’t promising.

- 28% of these areas are deepwater leases already drilled. These wells were either dry pits or found no economically recoverable hydrocarbons and were subsequently discarded.

- 15% of these sites are shelf life leases for production… Old fields have been plugged in, fallow, and infrastructure has been demolished as a result. BSEE’s Idle Iron Rule.

81% of open leases at Central GOM have never been leased, leased and have either failed drilling or are abandoned oil and gas fields. This is not to say that none of them are promising. A lot of oil and gas was discovered in old fields. There’s an old saying, “The best place to look for oil is where it was found.” That said, most of these leases have been recycled multiple times through annual rental sales over the past 50+ years. The prospect of major discoveries in the open Central GOM acreage is now rather slim. And, until they continue to keep the sale, as they are legally required to do, the expansion will be as useful as the mammary glands on a bull.

If Ms. Psaki is referring to leases currently held by oil companies, there are 1,771 operating leases in the Central Mexico Gulf planning area.

About 40% of leases are currently in operation either by production or by a production unit. Approximately 2% of leases have been renewed beyond the primary term by active, out of operation (SOO) or out of production (SOP) operations. It took a long time to perfect the work to the point where the prospect could be executed, submitted all the necessary plans and permits, and sanctioned the development.

About 45% are prime term leases (usually 5 years on shelf life and 10 years in deep water). The majority of these leases were previously leased and subsequently cancelled. Just because we bid on a parcel of land, doesn’t mean there will be an exploitable economic prospect on it during the prime lease term. Some of these leases will likely be drilled, some will expire and be recycled through the sale of future leases (if applicable).

More than 300 “pre-approved” leases are currently illegally blocked by Judge Obama is corrupt. These regions Bid received in November 2020 sale for rent. None of these contracts have been awarded.

About onshore production…

About 26 million acres of the Federation were leased to oil and gas developers at the end of 2018. Of that, about 12.8 million acres are producing oil and gas in economic quantities. This activity comes from more than 96,000 wells across about 24,000 oil and gas production leases.

About half of the leased area is “production of oil and gas in economic quantities.” The other half will consist of leases that no longer generate economic oil and gas, untapped prospects, and “trending”, “playing” or “protecting” acreage. Oil companies will often bid on whatever is open in hot games and trends, with the idea of creating exploitable prospects. They will also rent out space around good prospects and new discoveries to prevent other companies from snapping. Most of these types of leases will typically expire unpaid.

It’s rare for an oil company to bid on a “ready to drill” prospect. Once the lease is awarded, the companies will begin spending money on additional geophysical data, reprocessing the existing data, and performing the detailed geological and engineering work needed to bring the prospect forward. to the drillable stage. Even then, it will only be drilled if it remains economically attractive and can be financed by the oil company, provided the Federal government approves all necessary permits. So far, the only thing illegal management company Brandon has failed to stifle American oil production is approving drilling permits. To date, they have not blocked or delayed drilling permits on existing Federal oil and gas leases. I just pulled up BSEE APD (Drilling License Application) data for the Gulf of Mexico. In 2017, BSEE approved 820 APDs. In 2021, they approved 794 APDs. This is not surprising since they do not block the license. It would be blatantly illegal if they did. Under President Trump, BOEM organizes at least 2 rental GOM sales per year, as required by law. Under Brandon, we only had 1 rental sale of GOM. We only had that sale because a Federal judge ordered them to keep it. That sale is currently in limbo because another Federal judge blocked it… Because of climate change… 🤬

So Jen, what lease exactly are the “oil companies not working on”?

- Are you stupid enough to think that an “oil lease” has oil and gas just because it is an “oil lease”?

- Are you stupid enough to think that we can “exploit” because it is an “oil lease”?

Yes, those are rhetorical questions…

“Oil leases” are mineral rights to geographical areas of land/seabed. They have no oil because the government designates them as “oil leases”. In GOM Center, on the shelf, a standard “oil lease” is a 3-mile by 3-square-mile, 5,000-acre site. The standard deepwater leases are a bit larger, covering 5,760 acres… However, they are all just square plots of land. Well, not all… Some of the rentals along the edges of the protractor are smaller polygons. The geology of the Gulf of Mexico and oil moving into its geological traps have not heeded the US government’s future leasing plans.

Digital Wildcatter summed it up nicely here…

A funny thing happened on the way to save the climate…

Offshore energy

THANK | NATURAL GAS | OIL November 18, 2021 | 22:09 UTC

Carbon capture plays prominent role in Bay Area’s latest rental auctionAuthor Brandon Mulder

Editor Richard Rubin

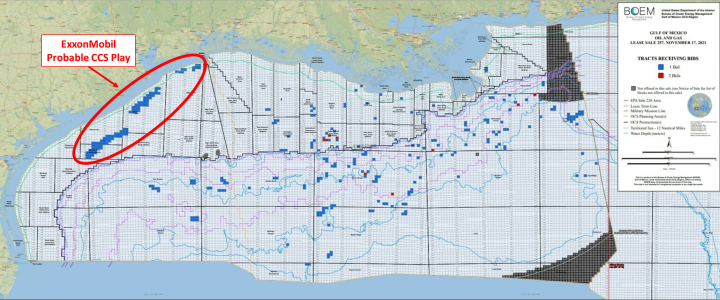

Coal, natural gas, oilCarbon capture and storage played a big role in Lease Sale 257, which saw a bumper crop of bids from oil and gas producers on November 17 for the U.S. Gulf of Mexico mining rights. .

Of the 317 bids received by the Ocean Energy Administration – the highest since 2014 – about 140 of them were for areas located in the shallow waters of the Texas and Louisiana coasts, areas cheap with depleted oil and gas reserves.

Hugh Daigle, an oil and gas researcher and professor, said: “The oil and gas reserves in these areas are pretty much already exploited at this point, so I can hardly imagine a company. into it with the idea of producing more oil and gas. at the University of Texas. “This is probably a hit from CCS.

The largest bidder for shallow water sites was ExxonMobil, which placed bids on 94 sites worth $158,000 each, according to BOEM data. The company’s regions are concentrated in the Brazos Region, Galveston Area, and High Island Region – locations close to the company’s $100 billion CCS hub will be located in southeastern Texas.

ExxonMobil did not confirm whether the 94 regions it bid on would be used for CCS. 18 statement to S&P Global Platts, the company said it “will work with the Department of Home Affairs on the plan for the blocks once they are awarded.”

[…]

“This is the first major lease in the Gulf of Mexico that comes after so many of these companies have made various carbon commitments,” Daigle said. “And so it’s probably not surprising that you’re starting to see some of these leasing decisions being driven not just by oil and gas production but also by other economic interests of the company.”

[…]

So… A corrupt Obama judge illegally blocked the sale of the rental agreement in November, the first sale in which CCS appears to have played a significant role, because it did not adequately address the issue. climate change issue.