The Impending Climate “Crisis” in the Gulf of Mexico and Other Biden Frack Ups – Watts Up With That?

Guest “I fell for it too” by David Middleton

The featured image is from the RigZone article…

The Impending Climate “Crisis” in the Gulf of Mexico and Other Biden Frack Ups

A Crisis Could be Brewing in the Gulf of Mexico

by Andreas Exarheas | Rigzone Staff | Wednesday, March 30, 2022Jeopardized American energy security and a cost of thousands of U.S. jobs and billions in government revenue.

That’s what we could see if there is a lapse in the U.S. Department of the Interior’s (DOI) five-year program for leasing in the Gulf of Mexico, according to a new analysis by the American Petroleum Institute (API) and the National Ocean Industries Association (NOIA), which was prepared by Energy and Industrial Advisory Partners (EIAP).

The next five-year offshore leasing program must be in place by July 1, 2022, but is well behind schedule, and no offshore lease sales can be held unless DOI implements a new program, API noted in a statement posted on its website. Nearly 60,000 jobs could be lost without the five-year offshore leasing program and a delay could mean nearly 500,000 barrels per day less in Gulf of Mexico production from 2022 to 2040, according to the report. On average, $1.5 billion per year in government revenue could be lost with reduced offshore production, the report noted.

[…]

NOIA President Erik Milito said, “at a time of geopolitical uncertainty and rapidly rising energy prices, Gulf of Mexico oil and gas production is more important than ever”.

“Promoting opportunities for increased U.S. oil and gas production will help fortify our national security, alleviate inflationary energy prices, reduce our dependence on foreign sources of energy, and secure our energy from highly-regulated and lower emissions production sources here at home,” he added.

“The longer we go without being able to explore and develop new leases offshore, the longer we weaken a key, proven national strategic energy asset in the U.S. Gulf of Mexico,” Milito went on to say.

[…]

“Ending or reducing lease sales in the Gulf of Mexico will increase carbon emissions, send jobs overseas, increase the cost of energy for Americans, and take away the largest source of funding to restore and protect our Louisiana coast,” he added.

Since 1980, the U.S. Secretary of the Interior has been required to prepare a five-year program to best meet national energy needs for the five-year period, including a schedule of oil and gas lease sales and details on the size, timing and location of proposed leasing activity, an API factsheet notes. There will be no opportunities to obtain new leases for federal offshore development without a new five-year program in place, the factsheet warned, adding that companies have not been able to secure new offshore leases since 2020.

Biden’s maladministration had unlawfully refused to hold lease sales under the current five-year plan until a Federal judge threatened them with contempt of court. The lease sale that they did hold last November was unlawfully nullified by a corrupt Obama judge. Now, they are unlawfully refusing to issue a new five-year plan. All of this because… climate change. So, yes, this is an impending “climate crisis”.

Impending Climate Crisis: Gulf of Mexico

With a 5-year program, the Gulf of Mexico is projected to produce an average of 2.6 million barrels per day of oil and natural gas from 2022 – 2040. A delay in the program will mean nearly 500,000 barrels per day less over that time period.

In 2036, the lost Gulf of Mexico production could mean 885,000 fewer barrels of oil and natural gas per day – a 33% decrease from where we’d be with a 5-year program in place.

Impending Climate Crisis: Taxing Little Oil to Death

About 1/3 of Biden’s 36 proposed tax hikes will further reduce domestic oil & gas production. Three, in particular, are aimed at shutting down the thousands of small oil companies operating in these United States.

9. Repeal expensing of intangible drilling costs (IDCs): $10.7 billion tax increase

The expensing of IDCs allows companies to recover costs such as labor, site preparation, equipment rentals, and other expenditures for which there is no salvage value. IDCs often represent 60 to 80 percent of total production costs. This tax hike could result in the loss of over a quarter million good-paying jobs by 2023. As a recent letter by Rep. Jodey Arrington (R-Texas) and over 50 members of Congress explains, IDCs are neither unique nor lavish tax breaks for the oil and gas industry:

“IDCs are not credits, loopholes, or subsidies. They are ordinary and necessary deductions, and a far cry from the lavish tax credits flowing to wealthy green energy investors and electric vehicle owners. Our tax code is designed to levy taxes on net profits, not on dollars used for operational costs or capital expenditures. Every business since the inception of the tax code, has used cost recovery provisions.”

Biden is proposing to repeal many oil and gas tax provisions even though the cost of gasoline and energy is increasing, with the cost of gas at a seven-year high.

Not only would these tax increases further increase the cost of energy, they will also threaten millions of high-paying manufacturing jobs that the oil and gas sector supports. Biden routinely claims he is a champion of high-paying manufacturing jobs, yet these tax increases undermine this claim.

[…]

11. Repeal credit for oil and natural gas produced from marginal wells: $1.9 billion tax increase

This repeals a credit for oil and natural gas produced from marginal wells, which is limited to 1,095 barrels of oil or barrel-of-oil equivalents per year.

[…]

13. Repeal percentage depletion with respect to oil and natural gas wells: $13 billion tax increase

Percentage Depletion allows taxpayers to deduct the cost of oil and gas wells as a statutory percentage of the gross income of such property. This provision is used by small, independent, and family-owned oil and gas companies, and royalty owners like farmers and ranchers.

[…]

The percentage depletion allowance is particularly critical

Why is Percentage Depletion Important?

This provision supports the development of U.S. oil and natural gas, along with other mineral resources, that would otherwise be uneconomic to produce. This provision also enables independent producers (businesses with an average of 11 employees) to keep revenues that are vital to the future of their businesses and the operation of their oil and natural gas wells. It is because of percentage depletion that these operators can retain their earnings and many are reinvesting 100% of their cash flow back into American energy development. Royalty owners also rely on this tax provision.

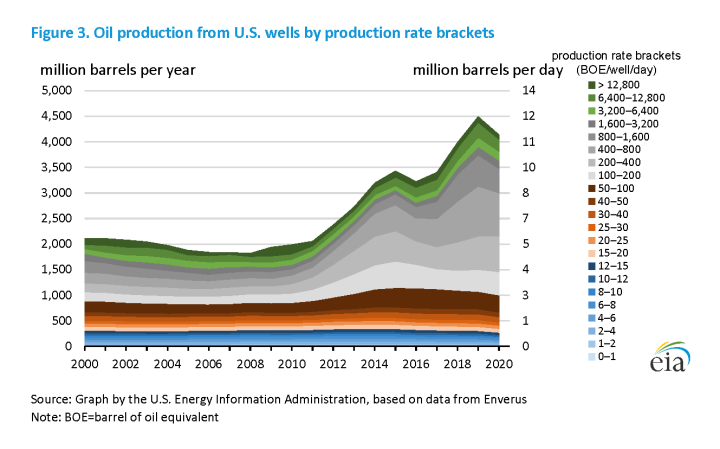

Loss of percentage depletion would place marginal well production in jeopardy. Stripper wells, which rely on percentage depletion, make up a significant portion of America’s oil and natural gas production. These wells, which generally produce less than 15 barrels of oil a day, account for nearly 7.4% of U.S. oil production. These wells also produce less than 90 thousand cubic feet a day, yet account for 8.2% of U.S. natural gas production. (Energy and Industrial Advisory Partners)

Stripper wells cumulatively produce about 500,000 BOE/d.

Rendering 500,000 BOE/d production uneconomic with a single dementia-ridden stroke of the pen, would result in the premature and permanent plugging and abandoning (P&A) of hundreds of thousands of wells, or worse, putting those companies out of business and hanging the P&A costs on taxpayers.

Between the treasonous actions of his Secretary of the Interior and his moronic tax proposals, Biden would quickly reduce US oil production by about 1 million barrels per day (bbl/d). While, at the same time, begging everyone from Saudi Arabia to Venezuela to increase their production. The Saudis won’t take his phone calls and Venezuela has very little chance of meaningfully increasing production after 20+ years of Marxist management.

Impending Climate Crisis: Draining the Strategic Petroleum Reserve

What to know about the U.S. emergency oil stash as Biden gears up to tap the reserves

March 31, 2022

Camila DomonoskePresident Biden is planning the largest-ever release from its emergency oil stash as the U.S. reels from a surge in gasoline prices

The president announced on Thursday a plan to draw 1 million barrels of oil per day for the next six months from the country’s Strategic Petroleum Reserve (SPR) – for a total of up to 180 million barrels.

The move comes after Russia’s invasion of Ukraine had sent crude prices surging, leading to sharply higher gas prices.

The administration had previously announced last year it was releasing 50 million of barrels, and the White House said earlier this year it would release an additional 30 million barrels – moves that had only temporary impacts on climbing oil prices.

[…]

Biden’s previous SPR release had no meaningful effect on oil prices or his poll numbers. The purpose of the SPR is to act as a cushion against supply disruptions, not falling poll numbers.

NOVEMBER 29, 2021

Recent legislation would reduce the U.S. Strategic Petroleum ReserveOn Tuesday, November 23, the White House announced plans to make 50 million barrels of crude oil available to the market through a combination of exchanges and accelerating previously announced sales. With these sales and several other legislated drawdowns, SPR inventories could decline from 618 million barrels (as of October 1, 2021) to about 314 million barrels by the start of the 2032 fiscal year, the lowest level since March 1983. The Infrastructure Investment and Jobs Act, passed earlier this month, includes a provision to draw down 87.6 million barrels of crude oil from the U.S. Strategic Petroleum Reserve (SPR) in fiscal years (FY) 2028 through 2031.

The SPR was established in the 1970s to alleviate the effects of unexpected oil supply reductions. The reserve was designed to hold up to 714 million barrels of crude oil across four storage sites along the Gulf of Mexico, where much of the U.S. petroleum refining capacity is located.

Crude oil can be released from the SPR under four conditions: emergency drawdowns, test sales, exchange agreements, and nonemergency sales. Emergency drawdowns and test sales are relatively rare. The most recent emergency drawdown occurred in 2011 in response to production disruptions in Libya, and the most recent test sale occurred in 2014. The SPR has released crude oil under exchange agreements 13 times since 1996, most recently after Hurricane Ida earlier this year. In these exchange agreements, crude oil is released to private companies and repaid in kind by specified dates with additional barrels, similar to monetary interest on a loan.

Congress has also authorized nonemergency sales of SPR crude oil to respond to lesser supply disruptions or to raise revenue for the U.S. Treasury. For example, the Fixing America’s Surface Transportation Act, passed in 2015, and The Bipartisan Budget Act of 2018 collectively call for the sale of more than 160 million barrels of crude oil from the SPR in FYs 2022 through 2027.

One of the SPR’s core missions is to hold enough oil stocks to fulfill U.S. obligations under the International Energy Program, the 1974 treaty that established the International Energy Agency (IEA). As a member of the IEA, the United States is obligated to maintain stocks of crude oil and petroleum products, both public and private, to provide at least 90 days of U.S. net import protection. The U.S. Department of Energy calculates this value by dividing the SPR inventory level by EIA’s sum for net crude oil and petroleum product imports.

As net imports of crude oil and petroleum products into the United States declined in recent years, the volume needed to meet the 90-day import coverage also fell. In October 2019, the United States exported more crude oil and petroleum products than it imported, becoming a net exporter for the first time in EIA data, which dates back to 1977. IEA members who are net petroleum exporters do not have stockholding obligations. Although the United States has occasionally imported more petroleum than it exported in some months since late 2019, SPR inventory levels have continued to provide sufficient coverage for net import protection.

SPR sales previously authorized by Congress will cut the SPR in half over the coming decade.

On the current trajectory, the SPR would be drawn down to 314 million bbl by 2032. Biden’s latest political stunt will now drop the SPR to 134 million bbl by 2032.

Impending Climate Crisis: Nothing Less Than Economic Treason

While the word “treason” is tossed around a lot, it has a specific legal meaning.

Article III, Section 3, Clause 1:

Treason against the United States, shall consist only in levying War against them, or in adhering to their Enemies, giving them Aid and Comfort. No Person shall be convicted of Treason unless on the testimony of two Witnesses to the same overt Act, or on Confession in open Court.

The definition is so specific that Aaron Burr and co-conspirators were acquitted of Treason charges even though they were apparently trying to raise an army to seize the Louisiana Purchase and set up their own western empire.

However, how else can the willful destruction of US energy security be described as anything other than economic treason? Biden and his puppet masters know full well that these United States will be dependent on petroleum and natural gas for many decades to come.

Note: Biofuels are both shown separately and are included in petroleum and other liquids.

Yet they are aggressively trying to destroy domestic oil production and restricting imports from Canada, while making our economy more dependent on Saudi Arabia, Iran, Russia, Venezuela and other nations, many hostile to these United States and emptying our Strategic Petroleum Reserve all because… Climate change.

Sure sounds like definition #2…

Definition of treason

1: the offense of attempting by overt acts to overthrow the government of the state to which the offender owes allegiance or to kill or personally injure the sovereign or the sovereign’s family

2: the betrayal of a trust : TREACHERY