The Bad Assumptions Underpinning COP26 and the Impending Energy Train Wreck – Watts Up With That?

Visitor “Actuality generally is a harsh trainer” by David Middleton

The world is already in an “power disaster” of types because of the large misallocation of capital from functioning power infrastructure to legendary power infrastructure. This has largely been pushed by the false notion {that a} huge discount in greenhouse gasoline emissions is the one option to save our planet (cue George Carlin). As if this wasn’t dangerous sufficient, the COP 26 path “to net-zero emissions” is “paved with” nothing aside from “dangerous assumptions”.

October 28, 2021 – 04:00 PM EDT

The highway to Glasgow is paved with dangerous assumptionsBY SCOTT W. TINKER, OPINION CONTRIBUTOR

Whereas international leaders put together to trek to Glasgow for COP26 – the United Nations Local weather Change convention – Asia, Europe and Britain are experiencing energy crises, largely politically self-inflicted. The general public is paying the worth.

[…]

Because the information for attending to net-zero emissions, the Worldwide Power Company (IEA) – an intergovernmental group usually referred to as the “world’s power watchdog” – revealed its “Net Zero by 2050: A Roadmap for the Global Energy Sector” in Could of this yr, the place it describes a “slim however achievable” path to net-zero emissions.

[…]

As international leaders at COP26 put together to commit trillions of {dollars}, guided by this roadmap, it is very important perceive how complicated, and even implausible, are a few of the roadmap’s key 2050 assumptions.

Assumption No. 1: No new oil and gasoline fields, and no new coal mines or mine extensions.

Within the roadmap, unabated coal demand declines by 98 %, when in actual fact coal in Asia continues to expand considerably. Oil consumption declines by 75 %, and pure gasoline by 55 %.

These fuels are changed throughout the roadmap partly by increasing wooden, biomass and biofuels, regardless that bioenergy has been proven by many studies to not be significantly “inexperienced.”

[…]

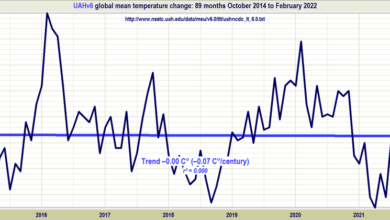

Assumption No. 2: Whereas inhabitants and the worldwide financial system proceed to develop, international power use really declines.

[…]

Assumption No. 3: Two-thirds of complete power provide in 2050 will come from wind, photo voltaic, bioenergy, geothermal and hydro.

[…]

Assumption No. 4: Within the roadmap, per capita CO2 emissions in developed economies, at present round 10 tons, and in rising and growing economies – for the greater than 6 billion folks different on Earth – at present round 4 tons, decline to zero.

[…]

Assumption No. 5: Investments in end-use power, power infrastructure, electrical energy era and low emissions fuels rise from simply over $1 trillion yearly to $4 trillion; cumulatively round $120 trillion within the subsequent 28 years. Staggering.

Reaching any single assumption might be very troublesome – however taken within the combination, it’s extremely unlikely.

[…]

But, many lecturers, assume tanks, advocacy organizations and authorities officers proceed to propound IEA roadmap-type pondering and produce experiences with 80 % or extra photo voltaic and wind. Actuality generally is a harsh trainer as we witness the numerous self-inflicted international power crises at this time, in programs with significantly lower than 80 %. Climate-dependent wind and photo voltaic can’t ship dependable power at scale with out intensive and costly backup.

[…]

The highway to inexperienced shouldn’t be paved with dangerous assumptions.

Scott W. Tinker is director of the Bureau of Financial Geology, a professor holding the Allday Endowed Chair at The College of Texas at Austin and produces international power documentary movies.

Assumptions, Meet Actuality…

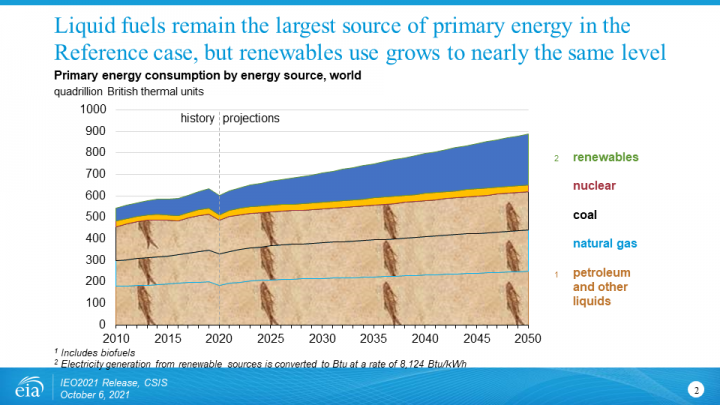

The US Power Info Administration’s 2021 International Energy Outlook paints a considerably extra lifelike path to 2050…

They forecast that fossil fuels will proceed to be the world’s dominant supply of major power for a lot of many years to come back…

Turning an “power disaster” right into a prepare wreck…

The identical EIA base case outlook that has fossil gasoline demand growing previous 2050, additionally options the global internal combustion engine (ICE) light duty vehicle (LDV) fleet peaking in 2038, with the electrical automobile inventory approaching 700 million models in 2050…

You may’t get there from right here…

With the intention to attain it’s forecast of 673 million EV’s on the highway by 2050, the EV manufacturing charge from 2041-2050 must common almost 29 million autos per yr. To place this quantity in perspective:

All of the mines Tesla must construct 20 million vehicles a yr

Frik Els | January 27, 2021Elon Musk and his merry band of govt vice presidents had plenty of advice for the mining and metals industry on the firm’s Battery Day occasion in September, the place the highway map to a $25,000 Tesla was laid out.

How straightforward it’s to mine lithium (simply add salt), simply how a lot of it there may be in Nevada (sufficient for 300 million EVs), methods to be environmentally pleasant (“put the chunk of dust again the place it was”) and, given these info, why miners haven’t been attempting tougher.

Since lithium is “similar to broadly obtainable”, in line with Musk and Tesla’s scientists, they’ve eradicated different arduous to come back by metals like graphite (exchange it with sand, obvs) and cobalt from batteries (at least in theory), Musk’s prime uncooked materials fear is nickel.

Nickel and dimed

[…]

Satan’s copper is within the particulars

MINING.COM used information from Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell provider and capability in over 90 nations, to calculate the deployment of uncooked supplies in Tesla vehicles on a gross sales weighted foundation in 2020.

By extrapolating these numbers, the corporate’s use of uncooked supplies, if it was producing 20 million vehicles a yr as a substitute of the five hundred,000 autos it made final yr, was decided.

[…]

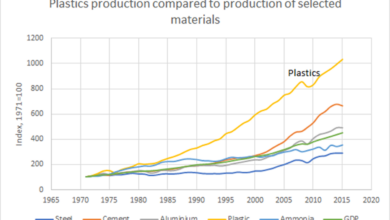

20 million Tesla EV’s per yr would require huge enlargement of graphite, nickel, lithium, cobalt and MagREO (magnet/heavy uncommon earths) manufacturing. Keep in mind that this huge enlargement in steel mining would happen whil international petroleum consumption was growing by 25%. On prime of this, graphite manufacturing must enhance by greater than 100% to assist the manufacturing of 28 million EV/yr.

Ever surprise the place most graphite comes from?

| Mine manufacturing (t) | Reserves (t) | ||

| 2018 | 2019 | ||

| China | 693,000 | 700,000 | 73,000,000 |

| Mozambique | 104,000 | 100,000 | 25,000,000 |

| Brazil | 95,000 | 96,000 | 72,000,000 |

| Madagascar | 46,900 | 47,000 | 1,600,000 |

| Canada | 40,000 | 40,000 | |

| India | 35,000 | 35,000 | 8,000,000 |

| Russia | 25,200 | 25,000 | |

| Ukraine | 20,000 | 20,000 | |

| Norway | 16,000 | 16,000 | 600,000 |

| Pakistan | 14,000 | 14,000 | |

| Mexico | 9,000 | 9,000 | 3,100,000 |

| Korea, North | 6,000 | 6,000 | 2,000,000 |

| Vietnam | 5,000 | 5,000 | 7,600,000 |

| Sri Lanka | 4,000 | 4,000 | |

| Namibia | 3,460 | 3,500 | |

| Turkey | 2,000 | 2,000 | 90,000,000 |

| Zimbabwe | 2,000 | 2,000 | |

| Austria | 1,000 | 1,000 | |

| Germany | 800 | 800 | |

| Different | 200 | 200 | |

| Tanzania | 150 | 150 | 18,000,000 |

| United States | – | – | |

| World complete (rounded) | 1,120,000 | 1,100,000 | 300,000,000 |

That’s simply MINING.COM… What do actual scientists say?

This paper proposes a CoMIT (Value, Macro, Infrastructure, Expertise) mannequin that can be utilized to analyse the affect of mass EV adoption on crucial uncooked supplies demand and forecasts that, by 2030, demand for autos will enhance by 27.4%, of which 13.3% might be EVs. The mannequin additionally predicts giant will increase in demand for sure base metals, together with a 37 and 18-fold enhance in demand for cobalt and lithium (relative to 2015 ranges), respectively.

| Metallic demand for autos (kt). | AL | CO | CR | CU | FE | LI | MN | NI |

| World Whole 2015 (est) | 12,345 | 5 | 317 | 2,049 | 116,765 | 8 | 52 | 171 |

| World Whole 2030 (proj) | 17,385 | 185 | 423 | 3289 | 106,731 | 147 | 271 | 808 |

| % Change 2015-2030 | 41% | 3600% | 33% | 61% | -9% | 1738% | 421% | 373% |

The approaching power prepare wreck has already left the station…

How Local weather Activists Triggered The World Power Disaster – OpEd

October 27, 2021 Michael ShellenbergerDuring the last decade, local weather activists have efficiently pressured governments, banks, and firms to divest from oil and pure gasoline corporations. At first such efforts seemed to be strictly symbolic. However in recent times years local weather activists succeeded in driving private and non-private funding away from oil and gasoline exploration and towards renewables. The result’s the worst power disaster in 50 years.

Below-investment in oil and gasoline exploration will not be the one reason for at this time’s power disaster. The financial comeback from the covid pandemic has pushed up demand. Lack of wind in Europe meant increased demand for each natural gas and coal. And a drought in Brazil meant it needed to import pure gasoline.

However the primary reason for power shortages is the half-decade-long under-investment in oil and gasoline pushed by local weather issues.

[…]

Usually, the anticipation of upper oil and gasoline demand causes corporations to extend funding in exploration. That hasn’t occurred. The principle cause, according to Goldman Sachs, is local weather activist strain on governments, corporations, and banks to divest from oil and gasoline exploration.

[…]

It’s not like oil and gasoline executives didn’t know that underinvestment would result in at this time’s value shocks. It’s that they had been ignored. When the previous CEO of Exxon, Lee Raymond, was requested what stored him up at night time he said, merely, “Reserve alternative.” Shareholders had demanded he cease investing. In 2020, underneath strain from local weather activists, JPMorgan Chase, America’s largest funding financial institution, removed Raymond from his position because the board’s lead impartial director.

A part of the issue is that neither firms nor governments are taking the appropriate actions. Some are going within the mistaken route. The U.S. Congress seems near approving a deal to pour $500 billion into renewables and its enabling infrastructure over the following decade. These taxpayer subsidies might additional cut back the motivation for personal corporations to put money into oil and gasoline. Even when they don’t, the Biden administration has moved to limit oil and gasoline drilling on public lands.

[…]

Because of this, overseas nations will profit from rising rising oil and gasoline costs at America’s expense. Saudi Aramco lately increased its funding in exploration and manufacturing by $8 billion. “After all we try to profit from the dearth of investments by main gamers available in the market,” its CEO stated.

Rising America’s dependence on overseas oil producers makes even The New York Instances, which has lengthy championed oil and gasoline divestment, nervous. A reporter there lately warned that “america and Europe might develop into extra susceptible to the political turmoil in these nations and to the whims of their rulers.”

Pundits are more and more evaluating President Biden to former President Jimmy Carter, and the 2020s to the Nineteen Seventies. And, certainly, at this time’s power disaster is eerily much like what occurred again then. Carter throttled oil and gasoline manufacturing, promoted renewables, and provoked a backlash that helped elect Ronald Reagan.

Michael Shellenberger is a Time Journal “Hero of the Surroundings,” and president of Environmental Progress. Comply with him on Twitter @ShellenbergerMD.

Taking 2021 as a place to begin, we’re taking a look at three many years of rising demand for fossil fuels and different dependable sources of power, whereas persevering with to misallocate capital from fossil fuels to unreliable power sources and electrical autos. This may drastically enhance the demand for power and mineral assets, whereas making power and mineral assets rather more costly and fewer reliably obtainable.

Whereas the tracks of this power prepare wreck had been laid in 2014, the previous 10 months have made this power business observer really feel like he’s been watching the best hits of Gomez Addams’ prepare wrecks…

Let’s Go Brandon!

Reference

Jones, Ben, Robert J.R. Elliott, Viet Nguyen-Tien. “The EV revolution: The highway forward for crucial uncooked supplies demand”.

Utilized Power. Quantity 280, 2020, 115072, ISSN 0306-2619, https://doi.org/10.1016/j.apenergy.2020.115072.

Associated