Tech stocks are back, fueled by AI craze, slowing rate hikes

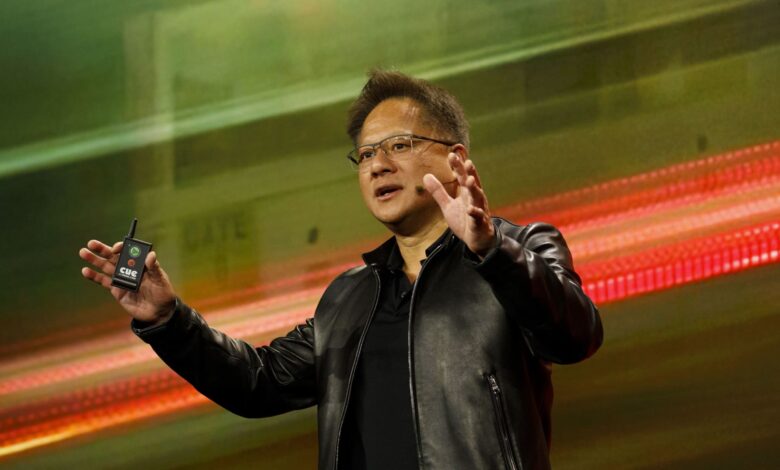

Jen-Hsun Huang, president and chief executive officer of Nvidia Corp., speaks during the company’s event at Mobile World Congress Americas in Los Angeles, California, U.S., on Monday, October 21, 2019.

Patrick T. Fallon | Bloomberg | beautiful pictures

forget debt ceiling. Tech investors are in buy mode.

The Nasdaq The Composite ended its fifth straight week of gains on Friday, up 2.5% in the past five days and now up 24% this year, outpacing other major US indexes. The S&P 500 is up 9.5% for the year and the Dow Jones Industrial Average is down slightly.

The excitement around the chip maker by Nvidia explode income statement and its lead in artificial intelligence technology fueled this week’s rally, but investors also snapped up shares of Microsoft, meta And Alphabeteach of them has its own AI story to tell.

And with optimism that lawmakers are close to reaching an agreement to raise the debt ceiling and the Federal Reserve can slow down interest rate increase, the stock market this year begins less like 2022 and like the decade of tech happiness that preceded it.

Victoria Greene, chief investment officer at G Squared Private Wealth, said in an interview on CNBC’s “Global Exchanges” program Friday morning: “The focus is on large-cap tech stocks. This has become a reality in this market. “You can’t deny the potential of AI, you can’t deny the earnings power these companies have.”

To start the year, the main theme in technology is lay off and cut costs. Many of the biggest companies in the industry, including Meta, Alphabet, Amazon and Microsoft, have cut thousands of jobs after a dismal 2022 due to revenue growth and stock price growth. In the income statement, they emphasize their effectiveness and ability to “do more with less,” a topic that resonated with the Wall Street crowd.

But investors have shifted focus to AI as companies are showcasing real-world applications of the long-hyped technology. OpenAI exploded after the release of its ChatGPT chatbot last year, and its biggest investor, Microsoft, is embedded core technology in as many products as possible.

Google, meanwhile, is touting its rival AI model at every chanceand CEO Meta Mark Zuckerberg rather more tell shareholders about his company’s AI advancements over the company’s bleeding money metaverse efforts.

Enter Nvidia.

The chipmaker, best known for the graphics processing units (GPUs) that power cutting-edge video games, is driving the AI wave. Stock 25% up this week hit a record and lifted the company’s market cap to nearly $1 trillion after first-quarter earnings beat estimates.

Nvidia stock is now up 167% this year, topping all the companies in the S&P 500. The next three top gainers in the index are also tech companies: Meta, Advanced micro-devices And Sales force.

The story for Nvidia based on what’s coming, as its revenue for the most recent quarter fell 13% from a year earlier as the games division fell 38%. But the company’s sales forecast for the current quarter is about 50% higher than Wall Street estimates, and CEO Jensen Huang said Nvidia is seeing “increased demand” for its core products. your data.

Nvidia says cloud providers and internet companies are buying GPU chips and using the processors to train and deploy general AI applications like ChatGPT.

“At this point in the cycle, I think it’s really important not to go against consensus,” said Brent Bracelin, analyst at Piper Sandler, which covers software and cloud companies. an interview Friday on CNBC’s “Squawk on the Street.”

“The consensus is, in terms of AI, bigger is bigger,” says Bracelin. “And I think that will continue to be the best way to keep up with AI trends.”

Microsoft, which Bracelin recommends to buy, is up 4.6% this week and is now up 39% for the year. Meta is up 6.7% for the week and has more than doubled in 2023 after losing almost two-thirds of its value last year. Alphabet is up 1.5% this week, bringing its gain for the year to 41%.

One of the biggest drags on tech stocks last year was the central bank’s continued interest rate hikes. The increase has continued into 2023, with the fund’s target range fed climb 5%-5.25% in early May. At the Fed’s last meeting, however, several members said they expected a slowdown in economic growth to eliminate the need for further tightening, according to the minutes released Wednesday.

Less aggressive monetary policy is seen as a bullish sign for technology and other risk assets, which typically perform better in a more stable exchange rate environment.

However, some investors fear that the tech rally has gone too far given the holes that still exist in the economy and government. Divided Congress is making it difficult to agree to a debt ceiling as the Treasury Department’s June 1 deadline approaches. The Republican negotiator, Representative Garret Graves of Louisiana, told reporters Friday afternoon at the Capitol that, “We continue to have big issues where we haven’t closed the gap.”

Finance Minister Janet Yellen say later on Friday that the United States will likely have enough reserves to push back against default until June 5.

Alli McCartney, chief executive officer of UBS Private Wealth Management, told CNBC’s “Squawk on the Street” on Friday that following the recent rally in tech stocks, “it might be time to get rid of a bit of the stock market.” that’s off the table.” She said that her team spent a lot of time looking at the venture market and where the deals were going, and they noticed some obvious sponges.

“Either you’re AI or you’re not AI right now,” McCartney said. “We really have to be ready to see if we hit the perfect debt ceiling, if we don’t hit the perfect landing, what does that mean, because at these levels, We’re definitely valuing the U.S. will hit the high note on everything and that seems like a horribly precarious place to be in the face of the risks out there.”