Stocks drop on Friday to cap tumultuous trading week from new Covid variant threat

Stocks fell on Friday, following a disappointing November jobs report, as the market ended a roller coaster week due to concerns about the Covid omicron variant.

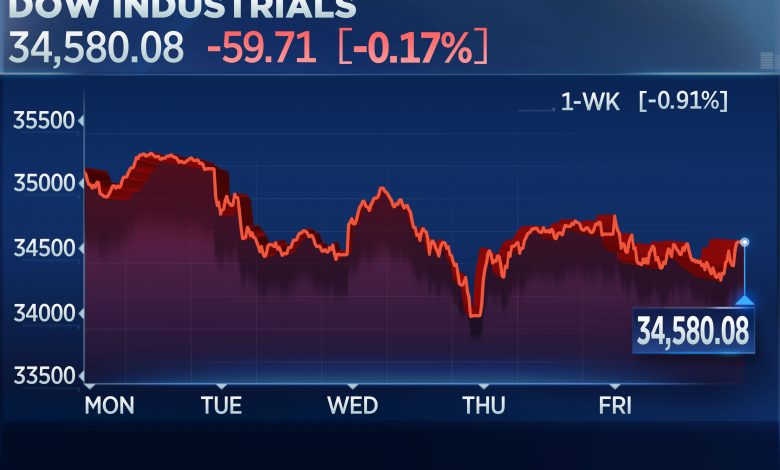

The Dow Jones Industrial Average fell 59.71 points to 34,580.08 points, leading to a loss of 1.9% in the year Boeing. The 30-stock index fell more than 300 points earlier in the session. The S&P 500 fell 0.8% to 4,538.43. The tech-focused Nasdaq Composite fell 1.9% to 15,085.47. The major averages have posted a bearish week.

Technology stocks were among the biggest losers on Friday as Tesla down 6.4% and Video Zoom down nearly 4.1%. DocuSign up 42.2% after the company issued fourth-quarter sales guidance, which is lower than analysts expected.

Stocks with strong links to the virus led the market in a week-long seesaw, and that continued into Friday. Companies that benefited from economic expansion, such as hotels and airlines, led the way. Las Vegas Sands fell by nearly 3.7% and Delta Airlines down 1.8%. Norwegian Cruise Line 4.5% off and Carnival lost nearly 3.9%.

“Uncertainty regarding Omicron is very high, but along with disappointing employment numbers and investors have decided to sell off before the weekend,” said Ryan Detrick, market strategist at LPL Financial. “.

November employment report showed job creation slower than expected last month. Nonfarm payrolls rose just 210,000 for the month, far below the 573,000 jobs predicted by economists polled by Dow Jones.

However, the unemployment rate fell sharply to 4.2%, better than the estimate of 4.5%.

“It is disheartening to see that we are unable to build on the strong October numbers, with uncertainty set to increase over winter,” said Steve Rick, chief economist at CUNA Mutual Group. takes place”. “That said, it’s not entirely surprising that this month isn’t likely to happen as the country prepares to respond to the COVID-19 variant Omicron and continues to battle rising inflation and a supply chain crisis. happenning. “

Elsewhere in the market, the Chinese ride-hailing giant Didi announced during Asian trading hours on Friday that it will begin to be delisted from the New York Stock Exchange and plans to list in Hong Kong. Shares fell about 22.2%.

Friday’s market moves continued a string of high volatility for equities as the market studies the new Covid variant omicron and what it means for investors. The omicron variant is now available detected in five US states, with symptoms so far reported to be mild.

Despite Thursday’s rally that saw the Dow rise more than 600 points, the 30-stock average was down 0.9% for the week. The S&P 500 Index is down 1.2% and the Nasdaq Composite has lost 2.6% this week.

Barclays told customers on Friday to stay on course and buy the market at a discount.

“We maintain our view that overall macro conditions and liquidity are supportive for the stock and recommend adding to the weakness, looking for a bull market to continue,” said Emmanuel Cau of Barclays. ,” said Emmanuel Cau of Barclays.

— with reporting from CNBC’s Nate Rattner.