Rocket Grid Balancing Cost – Raised by that?

By Paul Homewood

An interesting article from Elexon on the costs incurred in balancing the grid:

The Power System Operator (ESO) plays an essential role in balancing supply and demand by using the Balancing Mechanism (BM). Matching supply and demand requires payments to be made between the ESO and participating consumers and generators. Consumers and generators submit a price for the amount of energy they can supply in a half-hour period (Billing Period) to balance the system. In this Insight, analyst Angus Fairbairn looks at ESO’s cost balancing since 2015.

The System Operator role is becoming more and more challenging

The ESO role in the UK, carried out by the National Grid ESO, is becoming more challenging and costly. All electricity customers must pay these costs as part of the bill. In 2020, a number of contributing factors are the move to a more decentralized system and an increase in intermittent generation that promotes a net zero future. ESO also faces forecasting challenges with changing demand profiles due to COVID-19.

The source is used to keep the system balanced

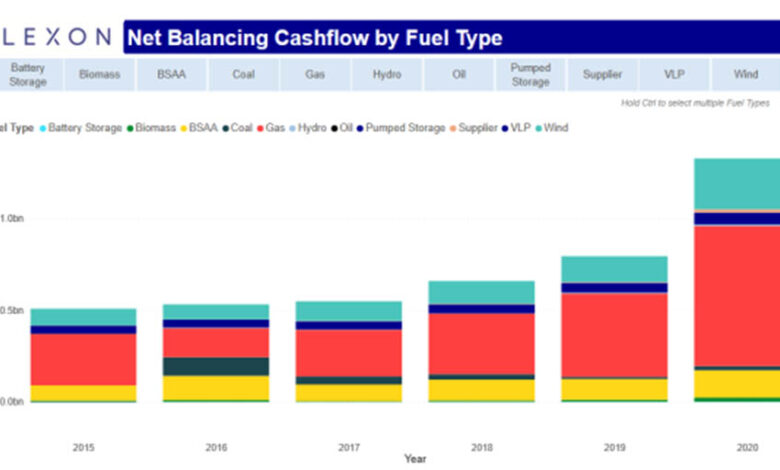

The chart below shows how payments for the balance of energy produced from different fuels have contributed to the net equilibrium cost since 2015. This chart includes only includes payments for balanced energy use within and outside of the BM in the Balanced Services Adjustment Action. Additional payments, such as availability or startup costs, are not included.

The net equilibrium cost was £506 million in 2015. The above-mentioned systemic pressures pushed net costs in 2020 to £1.3 billion, 67 per cent higher than in 2019 (£794 million).

Net bid and preferred cash flow

The chart below shows the changes in the Net Bid and Incentive cash flow from 2015 to 2020. Bids have negative volume because they reduce energy on the system. The bid price represents the amount paid by the balancing provider to the ESO and therefore the lower the bid price the more expensive the ESO and the negative price will represent the payment to the BM Participant.

Bid Cash Flow is the price (£/MWh) of one Bid multiplied by the Bid’s volume (MWh). A net positive Bid Cash Flow for one year means that ESO pays more to Equilibrium Service providers for negative Bids than ESO receives from positive Bids.

Prior to 2020, the annual net cost due to Bid was negative. This means that National Grid ESO received more money to reduce energy on the system than it was paid to Balanced Service providers to reduce energy on the system. Balanced Service providers will pay to reduce generation because they can save on operating and/or fuel costs. They can also pay to consume more electricity.

Negative net bid cash flow from Bid reduced total system balance costs by an average of £125 million per year between 2015 and 2019. This trend changes dramatically in 2020 with bid cash flows net positive, of £257 million paid from ESO to the Service Providers Balance to reduce energy on the system. This adds 19% to the cost of the Offer.

Positive net bid cash flow means more is being paid to BM Participants from ESO than Balanced Service providers are paying ESO to reduce energy on the system. Bids that result in payment from ESO to a Balanced Service provider will be negative in £/MWh.

Negative bids typically come from wind generators because they have no fuel costs and will lose payments from a Renewable Obligation Certificate (ROC). The ROC is paid for a certain number of renewable generators for each MWh of electricity that enters the grid.

The Offered Price represents the amount paid from the ESO to the Balancing Service provider. The higher the Offer Price, the more expensive the ESO. Offers have positive volume because they are an increase in energy on the system. The Offer Cash Flow is the price (£/MWh) of the Offer multiplied by the Volume of the Offer (MWh).

The Annual Net Incentive Cash Flow is always positive because Participants are very unlikely to have to pay to increase electricity on the system; to consume less or create more.

Since 2016, the net cash flow from Offers has increased. Between 2019 and 2020, the cost of Net Incentives has increased by 23%. As costs increase for both Bid and Offer, this means that the equilibrium cost has increased by 50% from 2019 to 2020.

Conclude

Spending on energy balancing for ESO increased significantly in 2020. There was more spending across all Bidding and Offer volumes with the biggest changes in energy reduction spending amounts. on the system through Bidding. Reducing energy on the system by 2020 results in significant financial costs rather than benefits for ESOs. There should be more Bid and at a higher price.

Low demand due to the impact of COVID-19, combined with difficulty in forecasting new demand profiles in 2020 may have increased the demand for energy balance. This is likely to have a short-term effect on the system. As locking constraints ease and working behaviors return to normal, system balancing can become more predictable and less expensive.

A significant increase in the equilibrium cost from low-carbon sources, such as biomass and wind was witnessed in 2020. This is a long-term trend, with the cost of biomass energy increasing. from 2017 and wind from 2016.

Economic incentives for renewable power generation with low fuel and operating costs make it more expensive to reduce power generation from these sources. This was witnessed with Wind Tenders where no fuel cost and financial benefit of generation (ROC) contributed to the lowest (most expensive) Bid in February. and November 2020.

Rising costs to manage renewable generation are likely to continue to drive a net zero future. National Grid ESO is addressing these costs with projects such as the ‘4D Thermal project’ with the Scottish and Southern Electricity Network (SSEN) covered in their 5-point Plan. In addition, new technologies such as battery storage) can also provide new tools to help integrate wind and other discontinuous generations into the system.

https://www.elexon.co.uk/article/bsc-insight-increasing-costs-for-balancing-the-gb-system/

The chart is actually very misleading, because it implies most of the balance payments are for natural gas. In fact, the payments for gas are meant to increase production when supply is short.

The real comments that can be drawn are:

The net equilibrium cost was £506 million in 2015. The above-mentioned systemic pressures pushed net costs in 2020 to £1.3 billion, 67 per cent higher than in 2019 (£794 million).

This number will continue to grow as more and more generations of interruptions are included.