Oil Industry Executives Take Down House Democrats In Congressional Hearings – Are You Happy With That?

Guest “Is failed math a prerequisite for Democratic Party politicians?” by David Middleton

These cretins are actually called the hearings, “Greated at the Gas Station and the Pain of America’s Pumps”…

Big Oil CEOs Testify in ‘Gouged at the Gas Station’ Hearing in Congress

By Sabrina Escobar

Updated April 6, 2022The executives of the biggest oil and gas companies testified Wednesday – and received interest from lawmakers – at a House committee hearing about their role in setting gas price at the pump.

The hearing – “Gotted at a Gas Station: Big Oil and America’s Pain Before the Pumps” – is intended to “review the role of the oil industry in the recent increase in gasoline prices in the United States,” according to a statement. memo sent by Congressman Frank. Pallone, a Democratic representative from New Jersey.

[…]

After hearing a bunch of crap from Democratic representatives, oil industry executives and former National Security Adviser HR McMaster responded:

Gretchen Watkins, president of Shell USA, a US subsidiary based in the United Kingdom Shell plc (code: SHELF), said: “Shell does not fix or control the price of crude oil” or the price that consumers pay at the pump. “Indeed, it is illegal for Shell to do so as nearly all Shell-branded retail stations in the United States are set by independent operators in the marketplace.”

Chevron (CVX) CEO Michael Wirth said the company has committed to increasing capital spending this year by more than 60% compared with 2021, with about half of that increase going to oil and gas production.

“I also want to be completely clear about Chevron’s position: We do not control the market prices of crude oil or natural gas, nor refined products such as gasoline and diesel fuel, and we do not drill concessions to price manipulation,” Wirth said.

David Lawler, president and president of American BP (BP), told the committee that all but about 10% BP stations are operated independently and the higher pump price may reflect oil entering the refinery that could have been purchased at a higher price and that is working through the system.

He said BP aims to establish Argos, a manufacturing platform that will increase Gulf production by 25%, and plans to spend more than $1 billion installing infrastructure that will reduce emissions from its manufacturing operations. export on land.

Retired US Army Lieutenant General HR McMaster, a senior fellow at the Hoover Institute at Stanford University, said Russia has been actively working to prevent disruption, reduce US exports and keep other countries their dependence on oil and gas.

[…]

Chevron CEO Michael Wirth also noted that about half of their CapEx increase is for renewable energy projects and low-carbon solutions, like CCS.

Wirth has restated Chevron’s plan to increase capital spending this year by 50%, with about half going to increase oil and gas production and half to renewable fuels and lower-carbon energy.

A recurring theme is the misconception that gasoline prices remain high while crude oil prices are falling.

“One of the things that confuses me… and drives people crazy, is why are gas prices still so high?” US Representative Diana DeGette, a Democrat and chair of the subcommittee said.

The Reuters article gives this chart:

Aside from a few spikes, the spread between retail and wholesale gasoline prices ranges from $0.75 to $1.00/gal.

Other taxes and fees on retail gasoline and diesel fuel, in cents per gallon, as of January 1, 2022 are: |

Gasoline | Diesel oil | |

| Federal | 18.40 | 24.40 | |

| Average of total state taxes | 31.02 | 32.66 |

That delta’s $0.49/gal average includes federal and state taxes. In other words, 1/2 to 2/3 of the difference between the wholesale and retail gasoline prices includes taxes.

These fundamentals have not changed.

Since the beginning of 2021, the actual price of crude oil has increased significantly faster than the retail price of gasoline.

Oil slope = 0.0862

The most important is repeat the truth that these oil companies own very few retail stores. They have no control over the retail price of crude oil or gasoline, nor benefit from a higher wholesale-retail spread.

Democrats demand control of oil companies’ cash flow

The Democrats’ craziest request is to have the oil companies hand over control of their cash flow to Congress…

During a hearing, Representative Frank Pallone, a New Jersey Democrat, asked top executives from ExxonMobil (XOM), Chevron, BP, Shell, Pioneer Natural Resources and Devon Energy to see them. committed to “doing whatever it takes,” including not just increasing output but reducing dividends and buybacks to lower prices for American consumers.

[…]

‘The answer is no dividends’

[…]

“We can increase production and return value to shareholders,” Chevron (CVX) CEO Mike Wirth said in response. BP (BP) US CEO David Lawler said he “cannot commit” to cutting buybacks and dividends.

Gretchen Watkins, President of Shell (RDSA) United States, said her company believes it can return value to shareholders, boost oil supplies and invest in renewable energy. “We’re going to do all of that,” Watkins said.

And Scott Sheffield, CEO of Pioneer Natural Resources (PXD), said his company would increase production but flatly refused to dial the dividend. “The answer is no dividends,” Sheffield said.

Lawmakers hit back with strong complaints, suggesting that executives should focus squarely on shareholders, especially during the war in Ukraine.

“In this Russian war you are ripping off the American people and it has to end,” said California Democratic Representative Raul Ruiz, who also mentioned a Dallas Federal Reserve Survey of which 59% of oil executives say investor pressure to maintain discipline is the main reason publicly traded oil producers are holding back growth.

“Gasoline prices cannot continue to depend on the whims of autocrats like Putin who can weaponize petrochemicals against us,” Ruiz said.

[…]

Is Congressman Paul Ruiz really that stupid? Talk about stupid…

I will repeat the really stupid thing…

Kernen: Are you one of the 26 House Democrats who voted for a bill to ban oil and gas exploration and production last year?

Representative Schakowsky: Look, the question is, having these things, what are the oil companies doing. Well, I a..I, I, I, I am against fracking. I think that’s a real problem.

Question: You voted yes to that.

Schakowsky: The question is, did the oil companies make the better decision, in this crisis right now, to raise costs, to please consumers, in a way, to do what they do. we’re doing, uh, th, thuh, the name of today’s hearing is [checks notes] “Cut into the gas pump”, um, [checks notes again] “Big Oil and America’s Pain Before the Pump.”

They had an option to do that. To increase their capacity now, not to damage, not to drill more, but simply, to their ability now to increase the amount of gas they produce.

https://www.linkedin.com/posts/david-blackmon-2325189_energyabsurdityoftheday-squawkbox-joekernen-activity-6917473407529795585-h6D9?utm_source=linkedin_share&utm_medium=member_desktop_web

She actually said this:

They had an option to do that. To increase their capacity now, not to damage, not to drill more, but simply, to their ability now to increase the amount of gas they produce.

Representative Jan Schakowsky (D-IL08)

That’s actually worse than what Representative Ruiz said,

Back to dividends and buybacks

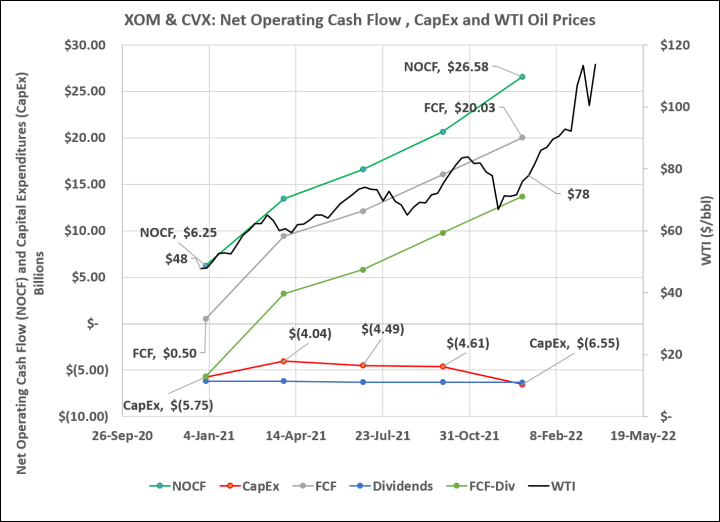

I do not currently own ExxonMobil (XOM) or Chevron (CVX) stock. I used to be a shareholder of XOM. One of the main reasons I buy XOM is the dividend. That is probably the main reason that many XOM shareholders bought this stock. Ask XOM, CVX and others to pause their dividends because Biden is incompetent war in Ukraine, preferably Leninist. Shareholders own these companies. Congress does not. Below is a chart of XOM & CVX’s net operating cash flow (NOCF), capital expenditures (CapEx), free cash flow (FCF), dividends and oil prices (WTI) for the last 5 quarters:

A few things stand out:

- The big oil companies XOM and CVX didn’t grow their CapEx as quickly as the big independents (PXD, DVN and EOG) we looked at yesterday. The big oil companies can’t do anything as quickly as the independents.

- Neither company increased their dividends. The question should be, “Why don’t you give more back to your shareholders”?

That’s where acquisitions come to play

One of the main purposes of businesses is to return value to their owners, shareholders in the case of publicly traded companies. Profits often take the form of stock appreciation and/or dividend payments. One of the ways that big companies, like XOM and CVX, increase their stock prices is share buyback. XOM actually suspended its buyback program in 2016 and only recently announced that it would “$10 billion worth of stock repurchases over the next 12 to 24 months. “CVX”said it now plans to repurchase shares worth between $5 billion and $10 billion annually, up from its previous $3 billion to $5 billion annual repurchase plan.“

The two companies combined will spend between $15 and $30 billion over the next two years on stock buybacks… $7.5 to $15 billion per year.

Background

To put this in context of their 2021 performance:

- Total Revenue: $436.8 billion

- Earnings before tax: $52.87 billion

- Income Tax: ($14.2 billion)

- Net Income: $38.67 billion

- Profit margin: 8.9%

- Effective tax rate: 26.9%

- CapEx: ($19.68 billion)

- Dividend: ($ 25.1 billion)

- Acquisition: ($7.5 billion to $15 billion)

In the year 2021, Apple aside $85 billion in stock buybacks and $14.5 billion in dividendshas a 42% profit margin and an actual tax rate of only 13%… Why don’t the Democrats scold Tim Cook?