Morrisons offers last ditch rescue deal to ailing convenience retailer McColl’s | Business Newsletter

Supermarket giant Morrisons has proposed a final bailout deal for McColl’s Retail Group that would keep much of its 16,000-strong workforce.

Sky News learned that Morrisons made a proposal on Thursday night that the convenience store chain’s lenders be fully implemented and its pension scheme protected.

The proposal has been filed with PricewaterhouseCoopers (PwC), which advises McColl’s lenders, with a response expected.

It arrived within hours of McColl’s confirmation that it was on the the edge of calling the administrator unless a “financial solution” can be found to prevent its collapse.

McColl’s is a key partner of Morrisons, operating hundreds of smaller stores under the Morrisons Daily brand.

People familiar with the rescue proposal said it would be structured as a solvent deal rather than pre-package management, although it would not involve any meaningful value attributed to the stock. McColl’s London listing.

The deal would represent a significant financial commitment for Morrisons and its new private equity holders, Clayton Dubilier & Rice, because of McColl’s approximately £170m in debt.

The exact details of the proposal were still unclear on Friday morning, though an insider close to McColl said “a majority” of its 1,100 stores and 16,000 jobs would be retained after take over.

Without a rescue deal, McColl’s, one of Britain’s largest convenience store chains, could collapse within days, putting thousands of street jobs in jeopardy.

In addition to interest from Morrisons, EG Group, the petroleum retail giant owned by TDR Capital and the Issa billionaire brothers Mohsin and Zuber, has also expressed interest in a deal.

Sky News reported in February that McColl’s was scrambling to secure new funding that could allay concerns about its future.

The company is listed on the London Stock Exchange and employs around 6,000 equivalent full-time employees.

It raised £30m from shareholders in a cash call just eight months ago.

In Scotland, it trades under the name RS McColl.

Earlier this week, they warned that their shares would be suspended at the end of May because it would not be able to meet the statutory deadline for filing annual results.

PwC is said to be capable of handing over the role of administrator if the company’s demise cannot be prevented.

In November, McColl’s announced that it would expand Morrisons Daily conversions from 350 to 450 within a year.

If McColl’s were forced into management, it would be the largest UK retail default by workforce size since the collapse of the Edinburgh Woolen Mill Group in 2020.

Since then, both Debenhams, which employs around 12,000 people, and Sir Philip Green’s Arcadia Group, which has a workforce of around 13,000, have also gone bankrupt, becoming casualties of changing retail shopping habits. and pandemic.

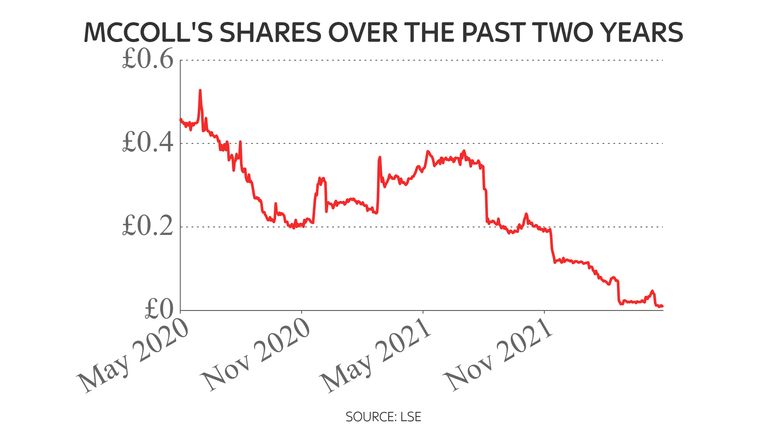

McColl’s shares have collapsed this year and the entire company is now worth just under £3.5 million.

Jonathan Miller, McColl’s recently departed chief executive, is said to have personally invested £3m in the fundraising last summer in an attempt to convince other shareholders to back the company.

Morrisons declined to comment, while McColl’s said on Thursday: “As previously disclosed on April 25, 2022, the Group is still discussing potential financial solutions for the business to address. short-term funding issues and create a stable foundation for future business.

“However, while no decision has been made yet, McColl’s confirms that unless an alternative can be agreed in the short term, it is increasingly likely that the group will be brought into administration. with the objective of achieving the sale of the Group to a third party buyer and securing the interests of its creditors and employees.

“Even if a successful outcome is achieved, it is likely to result in little or no value attributed to the group’s common stock.”

McColl could not be reached for further comment Friday morning.