Jackpocket raises $120M to expand its lottery app into mobile gaming – TechCrunch

Apps that permit folks do nearly what they’d have beforehand needed to perform in individual have seen a growth within the final 20 months of pandemic residing, and considered one of them right this moment is asserting an enormous fundraise on the again of its personal robust progress. Jackpocket, which presently has 2.5 million energetic customers who use its app to purchase tickets to play lotteries in 10 U.S. states, has picked up $120 million in a Collection D spherical, funding that CEO and founder Peter Sullivan stated it plans to make use of to broaden from its core enterprise of lottery ticket gross sales right into a wider array of cell gaming, and to take its enterprise to extra markets each within the U.S. and additional afield, each by itself and in partnership with others.

“We anticipate by the top of Q1 to be in at the very least 5 different states,” Sullivan stated, including that expertise investments are additionally on the to-do checklist, by bringing in additional “greatest practices” from the worlds of e-commerce, subscriptions and cell pockets providers, alongside exploring different types of gaming.

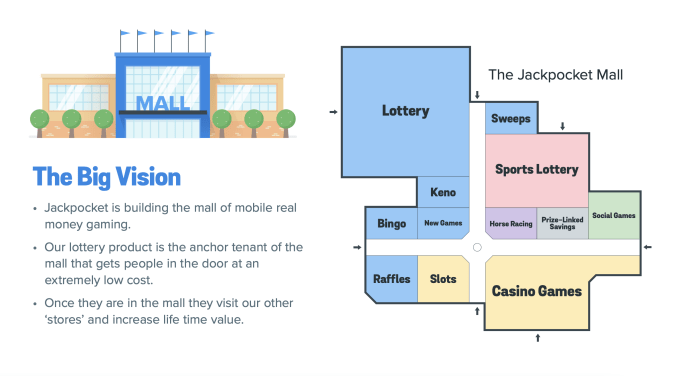

“What lots of people don’t know in regards to the lottery is {that a} share goes to good causes,” he stated. New areas that Jackpocket needs discover embody raffles, sweepstakes, bingo, social on line casino video games. “We need to present extra enjoyable sport play and possibilities to win, and extra methods to offer again.”

That is what Jackpocket’s growth technique appears to be like like in accordance with its most up-to-date pitch deck:

Left Lane Capital is main the funding, with comic Kevin Hart, Whitney Cummings, Mark Cuban and Manny Machado, among the many people collaborating, alongside earlier backers Greenspring Associates, The Raine Group, Anchor Capital, Gaingels, Conductive Ventures and Blue Run Ventures; and new backer Santa Barbara Enterprise Companions. (Jackpocket was based in New York but additionally has an operation out of Santa Barbara, CA; that’s the place CEO and founder Peter Sullivan is predicated and was talking from after I interviewed him for this story.)

Sullivan stated the corporate wouldn’t be disclosing its valuation with this spherical, which brings the entire raised by the corporate to simply beneath $200 million.

For some extra context: Jackpocket final raised cash solely in February of this yr, a $50 million Collection C spherical, when it was valued at $160 million post-money, in accordance with PitchBook data. However it has grown since then: its present 2.5 million energetic consumer determine is up 300% within the final eight months.

Sullivan stated that the thought for Jackpocket got here to him partially due to his father, who was, in his phrases, “a blue collar man born in Brooklyn who performed the state lottery in New York, however was pc illiterate.”

The yr was 2012, and one of many huge themes on this planet of tech on the time was the rise of apps that had been bringing previously-offline providers into the digital world; one other huge theme was the surge of curiosity in cell gaming. Placing these traits collectively, Sullivan noticed a possibility to construct an app to order lottery tickets — one thing that usually required folks to enter comfort shops that could possibly be carried out as an alternative from the cellphone.

“We positioned ourselves because the Uber or Instacart for lottery,” he stated.

Jackpocket is a component lottery ticket storefront, but additionally half virtualizer of the entire lottery expertise. As Sullivan described it to me, folks use the cell app to order lottery tickets. On the again finish, Jackpocket is doing the precise shopping for upfront, utilizing proprietary software program that it constructed to take “scans” of every ticket that the participant buys. Gamers can see the ticket, which is watermarked by Jackpocket to maintain it distinctive and genuine.

As with every kind of different real-money on-line gaming, Jackpocket is constructed with numerous levers in order that it complies with completely different laws round age, geographical location (it’s a must to be a resident of the state the place you’re taking part in). This contains utilizing GPS expertise to establish customers’ areas, but additionally checks to find out whether or not persons are utilizing VPNs, or are tied to computer systems through different purposes. Gamers additionally must add identification to confirm themselves and their ages.

The corporate has additionally made a play for being a extra “accountable” participant within the playing world. It screens consumer spending and doesn’t let anybody spend greater than $100 per day, or no matter restrict beneath that quantity they select to set.

Its enterprise mannequin is predicated on taking a 9% minimize on any transactions it makes itself. Meaning, in the event you put cash into the app to purchase tickets, you’re charged 9%, however in the event you use your winnings to play, you don’t. Nor are you charged to withdraw cash.

All the identical, and even with a transparent market alternative (its largest competitors on the time was the fragmented comfort retailer market) the startup discovered it very exhausting initially to boost cash.

“It was thought of taboo to do actual cash gaming on the time,” Sullivan stated of his expertise of knocking on doorways in Sand Hill Street within the early days, one cause why the corporate raised comparatively little (round $25 million) earlier than this yr’s Collection C. “9 years in the past traders wouldn’t speak to us, however I knew lottery would hbe the important thing right here,” he stated. “It’s the largest quantity of actual cash gaming, largest internet and lightest contact level and it really works properly cross-selling it to different codecs.”

The funding tide actually began to activate the again of the success of corporations like FanDuel and different real-money gaming has modified the tune for lottery, and Jackpocket, too. The corporate cites figures from trade group North American State and Provincial Lotteries that estimate that the entire annual spend from shoppers on lotteries is $85.6 billion. That is greater than the mixed spend in a number of different leisure classes: print and digital books ($1.8 billion), film tickets ($11.9 billion), video video games ($31.5 billion), live performance tickets ($10.4 billion) and sporting occasions ($17.7 billion).

“I noticed my dad purchase these tickets, however I by no means knew how huge it was,” Sullivan stated. And that’s not contemplating additionally the altering demographics of lottery ticket patrons, the place some 70% of patrons are beneath the age of 45 years previous. “It’s a extra tech-savvy and prosperous purchaser,” Sullivan stated, which additionally performs properly into an app-based expertise.

The previous two years’ specific set of circumstances, in the meantime, has additionally given an enormous fillip to corporations like Jackpocket, with the shoppers who would have beforehand visited their nook retailers to purchase gadgets like lottery tickets spending extra time at dwelling to socially distance and keep away from the unfold of Covid-19, and plenty of of these small shops that remained open switching to supply providers, or making it usually much less straightforward to pop in to purchase tickets.

The “cross-selling” different codecs, as Sullivan describes it, shall be an essential space to observe. It could possibly be about promoting different kinds of lottery-style experiences, but additionally doubtlessly partnering with the businesses like, say on the spot grocery supply startups, that are the digital extensions of the comfort shops which were lottery’s retail bread and butter to date, or different gaming corporations. That potential is one cause to boost a lot proper now.

“Cellular gaming and lottery is experiencing an thrilling and unprecedented stage of progress and growth. At Left Lane, it’s clear to us that Jackpocket is spearheading this progress and innovating at a tempo by no means seen earlier than on this trade,” stated Harley Miller, founder and managing accomplice of Left Lane Capital, in a press release. “We had been invigorated by the chance to participate on this historic second and sit up for supporting Jackpocket’s function on this panorama.”