India’s Budget Expectations: Accelerating Infrastructure, Jobs, Reform

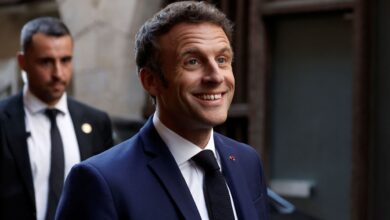

Nirmala Sitharaman, India’s Finance Minister, speaks during a news conference at the National Media Center in New Delhi, India, on Monday, November 15, 2021.

T. Narayan | Bloomberg | beautiful pictures

India will publish its annual budget on Tuesday.

It comes at a time when South Asia’s largest economy is trying to boost growth and return to pre-pandemic levels of expansion, while tackling a third wave of coronavirus infections.

Finance Minister Nirmala Sitharaman will release budget details for the fiscal year starting April 1. Economists are expecting measures to support growth while also allowing the government to reduce the deficit. deficits and debt accumulation.

“She will have to strike a balance between the continued demand for stimulus, continued capital appreciation, and fiscal consolidation,” Bank of America economists said. of America said in a January 25 note. They point out that with several Indian states going to vote early in February, there are some simmering concerns that the February 1 budget could turn into a populist one.

“Despite the pressure of opinion polls, we expect [fiscal year 2023] economists say.

Budget deficit

India’s fiscal deficit target for the new year will be closely watched by investors and rating agencies.

ONE budget deficit is the gap between government income and expenditure, and it implies that the country is spending more than it receives.

India plans to set a deficit target of 6.3% to 6.5% of GDP, local media reported, citing several government officials. The figure is slightly below the current year’s target of 6.8%, which Sitharaman has previously said is needed to get the Indian economy on track after the coronavirus outbreak derailed growth.

Citi analysts this month said their base-case projections predict a fiscal deficit target of 6.2% of GDP, but they pointed out that it “remains a political appeal.” widely.”

“A 60% GDP drop in the fiscal deficit will demonstrate the government’s determination to get back on track to fiscal discipline and comfort investors during the year that could lead the Global Bond Index,” they wrote. demand entry”.

Reports say that that Indian government bonds are likely to be included in several global bond indexes this year – which will be a major milestone for the country. The inclusion would allow debt capital to flow into India and could increase foreign ownership in Indian government securities.

Bank of America economists expect a relatively lower but still high fiscal deficit target of 5.8% of GDP, while Japanese investment bank Nomura expects a target of 6.4 % GDP.

“The government’s fiscal policy since the start of the pandemic has prioritized growth and fiscal transparency over fiscal consolidation, with the hope that the strong medium-term growth outlook will help debt sustainability.” “, Nomura analysts wrote in a recent note. “We hope this theme will survive.”

Fiscal transparency is where people are informed about how the government spends revenue from tax receipts and other sources.

Accelerated Infrastructure

Economists expect infrastructure boosting to be one of the key themes of Tuesday’s budget.

It comes amid signs that investment demand in the country may be finally picking up while pent-up consumer demand fades.

Last year, India said it planned to monetize state assets worth $81 billion over the next four years to boost infrastructure spending and stimulate growth. The government has planned for the private sector to lease assets such as gas pipelines, roads, stations and warehouses to the private sector to operate, the report said.

The government is also set to take the state-owned Life Insurance Corporation public this year, said to be India’s largest initial public offering.

“The clear implementation of the asset monetization pipeline, infrastructure pipeline and sterilization scheme will be on the government agenda and a focus of the market,” said Citi analysts. important school”.

Restore jobs and reform

Other likely budget priorities would include restoring jobs, supporting sectors not significantly affected by the pandemic, banking sector reform, climate policy as well as measures for the sector. health and education sectors, according to economists.

According to Radhika Rao, senior economist at Singapore’s DBS Group, while India’s national unemployment rate has risen back to pre-pandemic levels of around 7%, the labor participation rate has also increased. and the employment rate is lower than the level at the beginning of 2020. . That suggests employment conditions have not improved broadly, she said in a note this month.

“When this is coupled with a faster resumption of formal jobs compared to informal jobs and the dominance of casual labor (lack of a security net) as well as freelance work in the mix labor, the negative impact on income and purchasing power becomes clear”. Rao said.

“While agricultural jobs were little changed, manufacturing, followed by services, remained below pre-pandemic levels,” she added.

According to Rumki Majumdar, an economist at Deloitte, the government needs policies to revive and support micro, small and medium-sized enterprises, which are the biggest job creators in India.

She wrote: “Identifying their pain zones and offering solutions to make them part of ‘Atmanirbhar Bharat’ will help them recover. Atmanirbhar Bharat is part of a government push to make India more self-sufficient.

“Additionally, access to credit is critical and targeted credit support for these businesses should be considered,” added Majumdar.