How many FFEL borrowers can qualify for student loan forgiveness

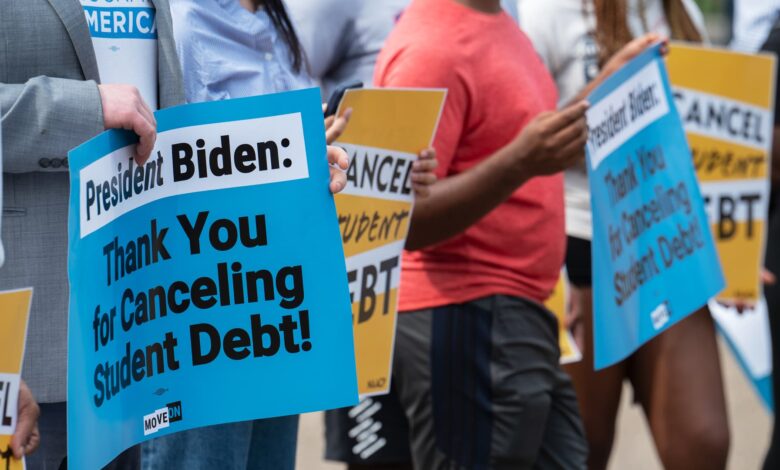

Student loan activists protest outside the White House a day after President Biden announced plans to cancel $10,000 in debt for students earning less than $125,000 a year in Washington, DC, on Jan. August 25, 2022.

Washington Post | Washington Post | beautiful pictures

When the U.S. Department of Education announced at the beginning of the pandemic that federal student loan borrowers could pause their payments, millions were soon uncomfortably surprised to know that they are not eligible for relief.

They were excluded because they owned a subset of federal student loans made before 2010, under a program known as the Federal Family Education Loan Program (FFEL). These loans are guaranteed by the government but are owned by private companies – and because the Department of Education does not own the debt, its policy of pausing payments does not apply to that debt.

After President Joe Biden announced last week that he would forgive up to $10,000 to federal student loan borrowers who did not receive a Pell Grant, which is a type of aid for low-income college students and up to $20,000 for those who already do, there is concern that borrowers with commercially held FFEL loans will be remove again. (Borrowers earning more than $125,000 per year, or couples or heads of households with incomes above $250,000, were also excluded.)

More from Personal Finance:

Are your student loans eligible for federal forgiveness? What we know

What President Biden’s student loan forgiveness means for your taxes

‘It’s a game changer.’ Pell Grant recipients react to student loan forgiveness

Fortunately, the Department of Education appears to be trying to find a way to avoid that outcome for the estimated 5 million borrowers who have an estimated commercial FFEL loan.

“The Biden administration is cutting the red tape and insisting that millions of borrowers previously ignored will be brought in,” said Ben Kaufman, director of research and investigations at the Center for Student Borrowers Protection. their daring student debt relief plan.

Here’s what borrowers need to know.

‘About half’ of FFEL loans are held for commercial purposes

The federal government begins large-scale student loans in The 1960s. However, back then it was not directly student loans. Instead, it guarantees debt provided by banks and nonprofit lending institutions, under the FFEL program.

That program was scrapped entirely in 2010, after lawmakers argued that direct student loans would be cheaper and simpler. Almost 10 million According to higher education expert Mark Kantrowitz, people still hold FFEL loans.

Today, Kantrowitz said, “about half is held by the US Department of Education and about half by commercial lending institutions.”

There are two reasons the government might hold FFEL loans. When these loans default, Kantrowitz said, the private companies that previously owned them turn them over to an underwriting agency on behalf of the federal government to repay the loan. Another reason is that the government bought out some loans during the 2008 credit crisis.

Borrowers who want to know where their FFEL loans can go Studentaid.gov and sign in with their FSA ID. Then go to the “My Aid” tab and search for your loan details.

Consolidation can help you qualify for forgiveness

If you’re one of the roughly 5 million borrowers with a commercially held FFEL loan, the Department of Education told CNBC you can call your servicer and merge into the Direct Loan Program to benefit from cancellation.

A department spokesman said there is currently no deadline by which borrowers need to do this, but there will probably be one.

Because all of these developments are so new, your student loan provider may not be aware of this option yet, says Kantrowitz.

If you are encountering a wall, it might be better to do the merge directly on StudentAid.gov website, he said. You want to fill in “Federal Direct Consolidation Loan Application. “

Consolidation can take a month or more

In general, it takes between 30 days and 45 days to process a consolidation application, says Kantrowitz.

You should check the status of your application if you do not receive a response within that time.

More forgiveness solutions may be coming soon

The Department of Education will work in the coming months with private lenders to ensure that commercially held federal student loan borrowers can also benefit from the forgiveness, according to one person. speak.

These borrowers will have more than a year to apply for the relief following the government’s application for student loan forgiveness, and they do not need to take any action now, the spokesperson said.

Payment pause still excludes some FFEL borrowers

Along with Biden’s student loan forgiveness announcement, the president also said he would extend the moratorium on payments on federal student loans through the end of December.

Unfortunately, borrowers with commercially held FFELs are still not getting relief, Kaufman said.