Global investors buy more mainland China stocks

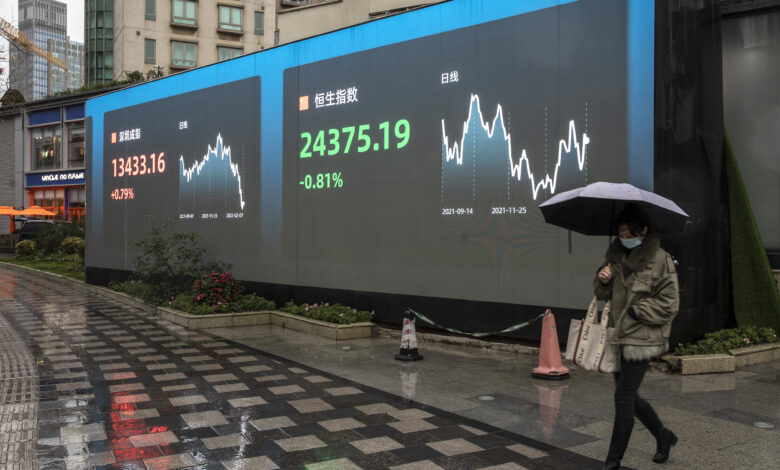

A public display shows figures for the Shenzhen Stock Exchange and the Hang Seng Index in Shanghai, China, on Monday, February 7, 2022.

Qilai Shen | Bloomberg | beautiful pictures

BEIJING – International investors are pouring more money into Chinese stocks, even as domestic investors remain cautious in mainland markets.

Mainland China stock funds saw a net inflow of $16.6 billion in January – just the fourth time since the pandemic that monthly inflows have been reported, according to research firm EPFR Global. exceeds $10 billion, according to research firm EPFR Global. The data shows that was followed by nearly $11 billion in net inflows in December.

“Investor interest in China really intensified in the fourth quarter of last year,” said Cameron Brandt, research director at EPFR, in a phone interview last week. “The impetus there, I think, is a perception – especially among institutional investors – that in emerging markets, China is, for a variety of reasons, something of a safe-game. in this year.”

The latest wave of buying, Brandt said, is from institutions, rather than retail investors, who have had less interest in China since early last year.

Different interest comes like Global investment companies are becoming more and more active on mainland Chinese stocks over the past few months.

In part, analysts are betting that Beijing wants to ensure growth in a year in which the ruling Communist Party of China will choose its next leaders at the national congress in the fall. At the same time, Chairman Xi Jinping is expected to assume an unprecedented third term.

“Everything will need to be perfect to [such] Jason Hsu, president and CEO of Rayliant Global Advisors, said in a phone interview last week.

China has also become “a good contrarian” this year because the domestic market is entering a period of easier stimulus and policy, while US Federal Reserve shake hands on a tightening cycleHsu said.

Goldman Sachs and Bernstein are so bullish that they’ve each released lengthy reports over the past few weeks recommending mainland China shares, also known as A shares.

The calls for optimism come despite worries about how regulatory uncertainty may have rendered those stocks “uninvestable”.

“We believe China A shares, an asset class worth $14 billion, have become more investment-worthy given the ongoing liberalization and reform measures in China’s capital markets.” , Goldman’s head of China equity strategy, Kinger Lau and his team said in an 89-page report Sunday. .

Over the past 18 months, Beijing has cracked down on repression Monopolistic activities alleged by Chinese Internet companies and heavy reliance on debt of real estate developers, among other problems. The sometimes abrupt policy changes have caught global investors by surprise.

EPFR data shows that global emerging market funds have moved to India during this time.

“Fund managers run a diversified fund, they’re less enthusiastic about China, certainly compared to other markets,” Brandt said.

The average allocation to China has fallen from 35% of the portfolio in Q3 2020 to 27% since January 1, according to Brandt. During the same period, he said fund allocation to India has increased from 8.5% to 12.7%.

Pessimistic market in China

Although mainland China’s stock market is the second largest in the world by value, it is significantly different from that of the United States, the world’s largest market.

Smaller speculative investors are institutions that dominate the mainland market, which has for many years been compared to a casino.

But there are signs of progress.

In a sign of how the market is maturing, the giant index MSCI decided in 2018 to add some Chinese A shares to the benchmark MSCI Emerging Markets Index. The move forced international funds that track the index to buy more A shares. But retail investors have dominated the mainland market so far.

Our overall view is that this year, [the] The Chinese market is not an easy bull market. It is more likely to buy based on hope and sell on reality and results.

Winnie Wu

China equities strategist, Bank of America Securities

Sylvia Sheng, global multi-asset strategist at the firm, said in a phone interview on Monday, Sylvia Sheng said weak sentiment in the country, coupled with better opportunities in markets development, has contributed to JP Morgan Asset Management’s neutral stance on Chinese stocks.

If growth improves in the second quarter, sentiment could also change, she said, noting: “We’re really looking to get more positive for Chinese stocks.”

The Shanghai composite up about 3% so far in February after a week-long shutdown for the Lunar New Year holiday. The index started the year with a 7.65% drop in January – its worst month since October 2018. Last year, the index posted a relatively muted gain of 4.8%.

Schelling Xie, senior analyst at Stansberry China, said in a phone interview on Friday, people’s sentiment about investing in A shares has dropped significantly. He pointed to uncertainty about the extent of regulatory change and economic growth.

Although some economists have said that The worst of China’s regulatory crackdown is over, They also said it did not mean reversing or ending the new rules.

Xuan Wei, chief strategist at China Asset Management, said it will take time for the market to rebuild confidence, but should not be too pessimistic at the moment. He added that there are opportunities for new energy and tech growth stocks.

China is open to foreign finance

While analysts evaluate the performance of Chinese stocks, the mainland market increasingly offers business opportunities for international investment companies.

The financial industry is one of the few fields that Beijing has eased ownership restrictions few years recently. Policy changes allowed Black stones, Goldman Sachs and UBS among others to buy full control of their local securities or mutual fund operations.

“One of the reasons why we are optimistic is that we work in an area where China has really opened up in a big, big way,” said Brendan Ahern, chief investment officer at KraneShares. The company sells one of the major US-listed exchange-traded funds to track Chinese internet stocks, KWEB.

“Overall, I think there is this disparity between what the Chinese think of China and what foreign investors think of China,” Ahern said.

KWEB is up 3.8% this year after falling more than 50% in 2021. Hong Kong’s Hang Seng Index up about 5.5% year-to-date, while Shanghai composite is a decrease of about 4.7%.

“Foreign investors generally ‘prefer to buy China for growth’ than banks and other industries with a lot of business,” said Winnie Wu, China equities strategist, Bank of America Securities. state industry.

However, she noted that state-owned enterprises have been leading the way lately, a trend that she suspects could lead to sustained gains for the market.

“Our common view is that this year, [the] The Chinese market is not an easy bull market, she said.