Gas prices – they are lower than you think

Politicians and various math-savvy members of the media are doing a heroic job of informing Americans that we are paying ever higher prices for gasoline in our umbrellas. his bowl. Luckily for us, that’s just plain wrong.

On the surface, it looks pretty bad. Follow data from the Bureau of Labor Statistics. But remember, the price-per-gallon increase starts from an incredibly cheap starting point.

The point is, like gasoline itself, gas prices are volatile, subject to many seasonal fluctuations, and tend to average up over time. We simply have hard-to-retain memories that oil companies regularly ship it to consumers for seemingly random reasons: pipeline breaks, seasonal demand, regional wars , storm or new reform costs are made. We remember the rallies and forget the slow retracement to the mean.

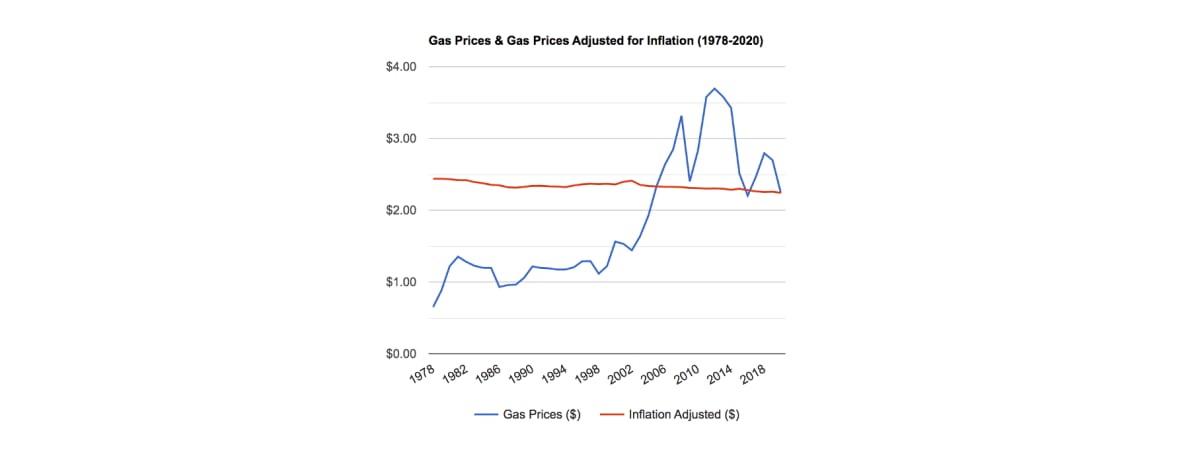

This spike occurred while overall consumer prices rose 7.5% in the 12 months leading up to the end of January, a 40-year high in the Consumer Price Index reported on Thursday – as So we understandably worry about energy costs when everything around us costs more. But when you look at the price of gasoline over the past 40 years, you get a completely different picture. If we analyze gas prices since 1980, what we are paying right now at the pump is actually trending closer to the 40-year historical average.

What the current price-per-gallon hysteria doesn’t explain is decades-old inflation. To fix that, we have to measure purchasing power in “constant dollars”, which takes into account the value of one dollar’s displacement over time. According to Platt Market Data, which tracks historical gas prices (on page 170 of This government report), the average price of a typical unleaded gallon was $1.25 in 1980. Fast forward 40 years to December 2020, and that would equate to $3.77 today when adjusted. according to inflation. However, for that month, the national average price we paid was just $2.17.

But what about the recent spike? By the end of 2021, lead-free had grown to $3.48, right where it is today, according to AAA. In other words, it is still less if gas price only consistent with the cycle of inflation over the past 40 years. You may think you’re paying too much, but gas is still one of the great incentives in the economy.

The source: Bureau of Labor Statistics

The source: Bureau of Labor Statistics

To be sure, what we’re experiencing is still a one-year price jump, but there have been similar rallies during the George W. Bush and Barack Obama presidential terms – rose sharply in 2008 and 2012 as the US entered and then pulled itself out of the Great Recession. If indexed for inflation, The all-time national average gas price peak in July 2008 was $4.10 would be equivalent to $5.31 in today’s dollars. With a lead-free barrel currently averaging $3.48 a gallon, we’re not there yet. Not even close. And remember, those prices include taxes.

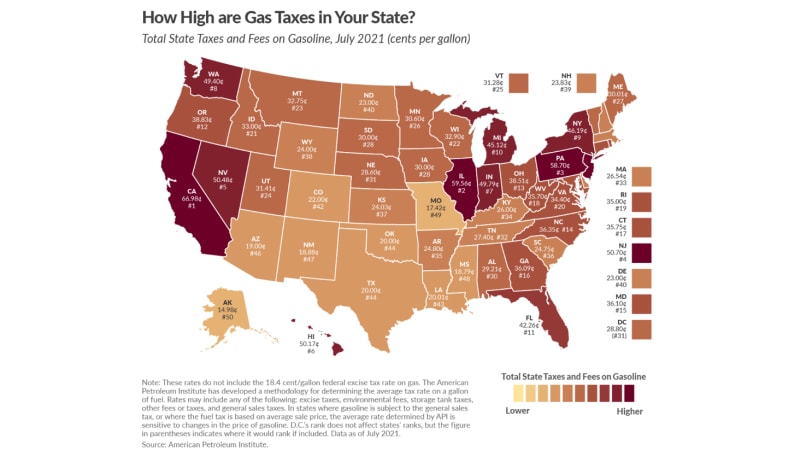

Ah, yes, taxes. Using information from the American Petroleum Institute, the Tax Foundation created a handy map Your pump price is actually made up of state taxes. Quoting the Tax Foundation’s website: “Countries tax gas in a variety of ways, including excise taxes per gallon collected at the pumping station, excise taxes imposed on wholesalers (passed on to consumers in the form of a higher price), and sales tax applies to the purchase of gasoline. “

The range of these revenues is surprising. California (of course) has the highest average gas tax, near 60 cents/gallon, while Alaska has the lowest, around 15 cents/gallon. There is also a federal excise tax of 18.4 cents per gallon. Blue states tend to tax gas at a higher rate, while red states ease the difficulty of pumping gas a bit. And those state taxes are likely to go up, as federal mandates are done on states abandoned by billionaires’ tax cuts starting in 2018. Budget Nonpartisan Center.

But despite it all, what if you still feel like you’re paying too much to fill your tank? You might ask, why doesn’t the US pump more oil out of the ground right here in the US, or keep turning the faucet arrive Strategic oil reserves to create more supply and thus purposefully lower the price?

Turns out, we don’t have to. In fact, in the first half of 2021, the United States exports more gasoline than it imports, according to U.S. Energy Information Administration’s petroleum supply report.

Here’s the weird thing: The U.S. basically exports almost as much petroleum product as it imports — about $130 billion each way, according to the report. census.gov. So why don’t we keep more of our domestically produced gasoline to make things easier for our citizens? Because the government has no control over that. Oil companies sell to (and buy from) any buyer who maximizes their profits, regardless of nationality.

That means you’ll witness the eerie, wasteful sight of a supertanker from the Persian Gulf at the Port of Los Angeles, like a super-submersible loaded with sweet American crude on its way. China. In fact, we export more oil to China than we import from Saudi Arabia. (For those who sing jingoists keep score, The US imports 5 times more oil from Canada compared to us from the Persian Gulf countries.)

> Automatic Logs Cheap gas price finder

If US refineries kept more of this oil at home, instead of selling it to China, wouldn’t we have to pay less for the pump? Probably. Supply does not always correlate with price.

Are you confused yet? You should. What is the lesson learned? The President of the United States has almost no control over the price of gasoline. It may be a leading economic indicator, but those wild swings are dictated only by the oil companies and Wall Street speculators who speculate in the spot market.

According to the EIA, changes in gas prices are due to taxes, marketing and distribution costs, refining and crude oil prices. Policies introduced by Donald Trump or Joe Biden (you can stop typing your Keystone XL rants right now) has almost no immediate impact on crude oil prices and thus gas prices. It’s all about instant supply and demand. As such, blaming any president for high gas prices is like blaming your dog because the gardener is charging you extra money to mow your lawn.

Does that mean you’ll stop hearing about high gas prices on the cable news or in the halls of Congress? Not difficult.

Mark Rechtin has been in the automotive industry for three decades and is the recipient of the Jesse H. Neal National Business Journalism Award.