Crypto Coach: How to account for your crypto transactions with the tax officer

Let’s be absolutely clear: Your Cryptocurrencies Are Taxable!

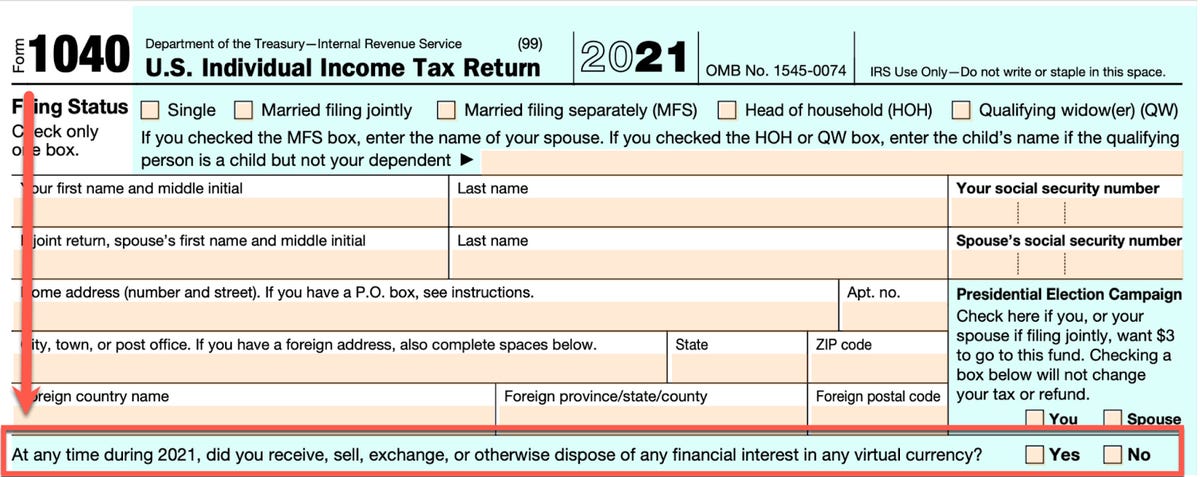

The cryptocurrency market is really hitting its stride in 2021. It brings more financial institutions and individual investors to buy, hold and sell coins than ever before. For tax year 2021, the IRS wants to know if you hold, sell, or trade virtual currencies (including NFTs); it is a required field for input. Form 1040 2021 includes a mandatory question about cryptocurrencies.

Cryptocurrencies are treated as property for tax purposes. You have a profit and a loss on your cryptocurrency. Depending on how many trades you have made, this can be a daunting task. Some exchanges just send you a Form 1099-B that just shows your proceeds (buy and sell combined) and asks you to submit a cost basis. If you don’t have this information, you’re stuck.

In the crypto world, if you buy and hold a virtual currency, you don’t have to pay taxes. For example, I bought 0.10 Bitcoin in 2021 for $6,000. Bitcoin has a cost base of 60,000 fiat (or $60,000). If I hold this Bitcoin or any virtual currency, throughout 2021, and I do not sell or trade it for another coin, I do not pay tax for 2021. I still have to tick “Yes” in the question above, but I owe no tax because no taxable events occurred. I simply hold the coin. We call this HODL in the crypto world.

Now let’s go one step further. Let’s say I sell Bitcoin in 2021 and Bitcoin is currently valued at $35,000. I sell that 0.10 Bitcoin for $3,500. I sold this Bitcoin with a loss of $2,500. When I calculate my taxes, I have a recognized loss of $2,500.

If Bitcoin went up to $100,000 and I sold 0.10 BTC for $10,000, I would now have made $4,000. We will owe capital gains tax on $4,000, not the original $6,000 we bought Bitcoin.

I would like to pause here. I know this is a lot, but I think you get the point. It’s like buying stocks, but now this is where it gets interesting. You also owe tax on the sale!

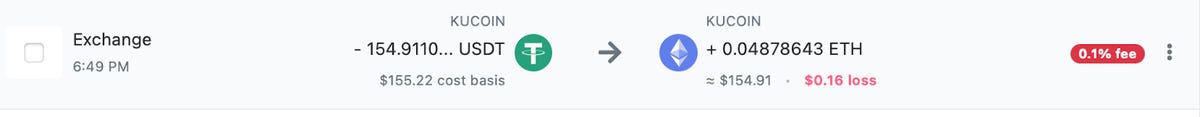

For example, if you buy 0.10 Bitcoin for $6,000 (Cost Base – $60,000 for 1 BTC) and you trade it for Ethereum (ETH), it is a taxable event. You will be responsible for the amount of capital gains, if any. Here is an example of a transaction I made where my tax software processed it:

I exchanged stablecoin Tether (USDT) for Ethereum, which is a taxable event, but the exchange incurred no capital gains but losses.

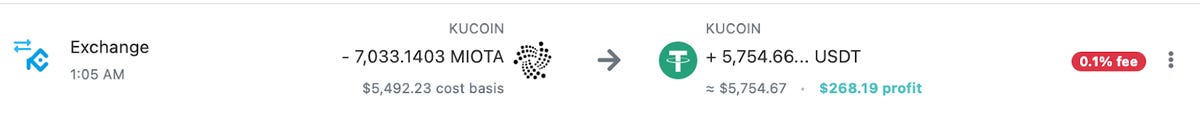

Here is another example:

I exchanged MIOTA (IOTA) for USDT. The exchange is a taxable event. Converting it to USDT is a capital gain of $268.19. Keeping track of all of this in a spreadsheet would be difficult. You can have hundreds of transactions in a year, if not thousands.

This is why I use crypto tax software. There are many you can choose from such as:

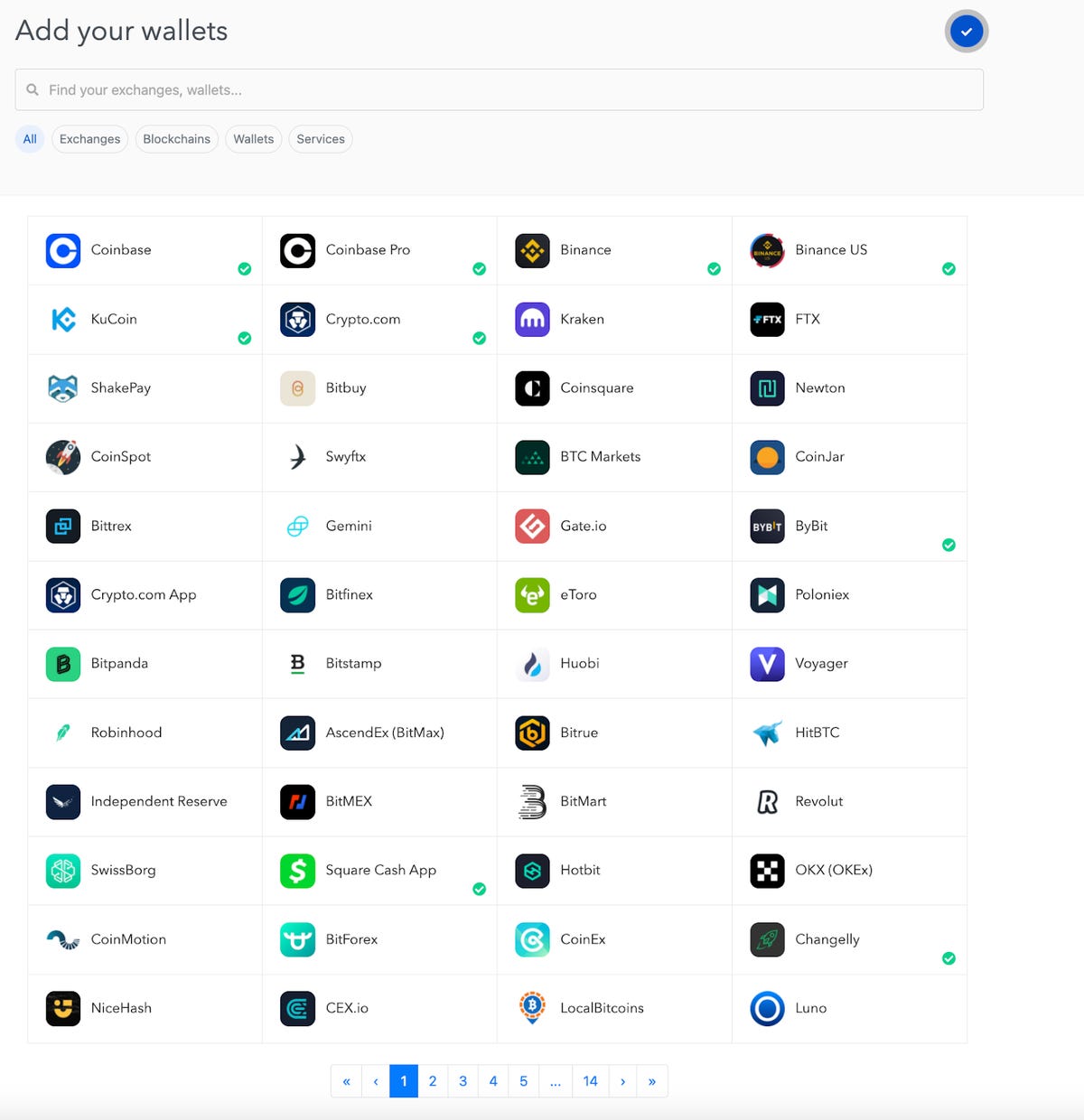

With crypto tax software you can connect your Exchange and Wallet to the software and upload all your transactions. I use Koinly to track all my transactions. I have connected all my Exchanges and Wallets including:

You can connect all your Exchanges and Wallets (see below). It’s simple to configure. Simply select your exchange and follow the instructions to connect via the API or upload a CSV.

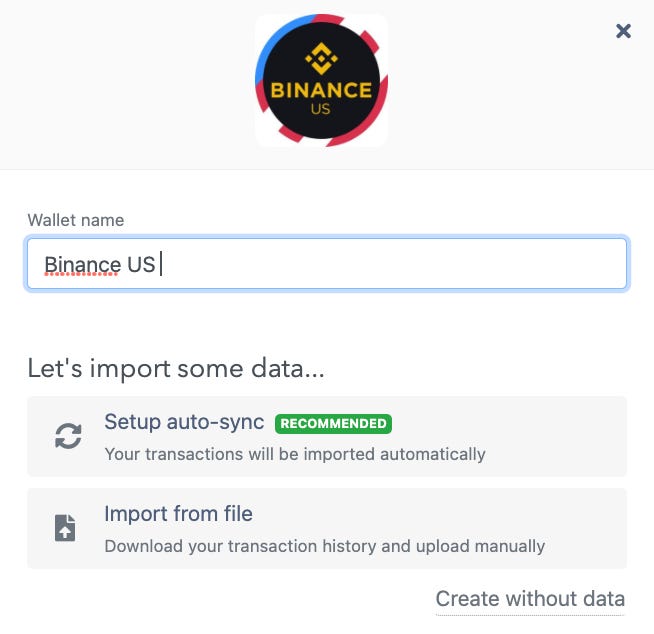

For example, if you choose, Binance.US, you can choose to Auto-Sync or Import from CSV.

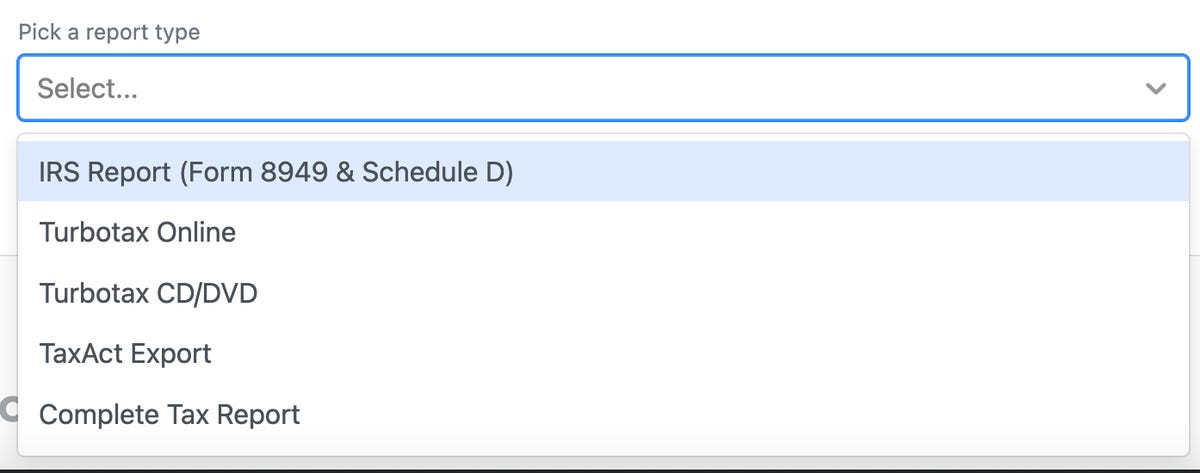

Tax software will calculate your losses and gains and provide all the appropriate tax reports. It supports direct upload to Turbotax as well as other options shown below:

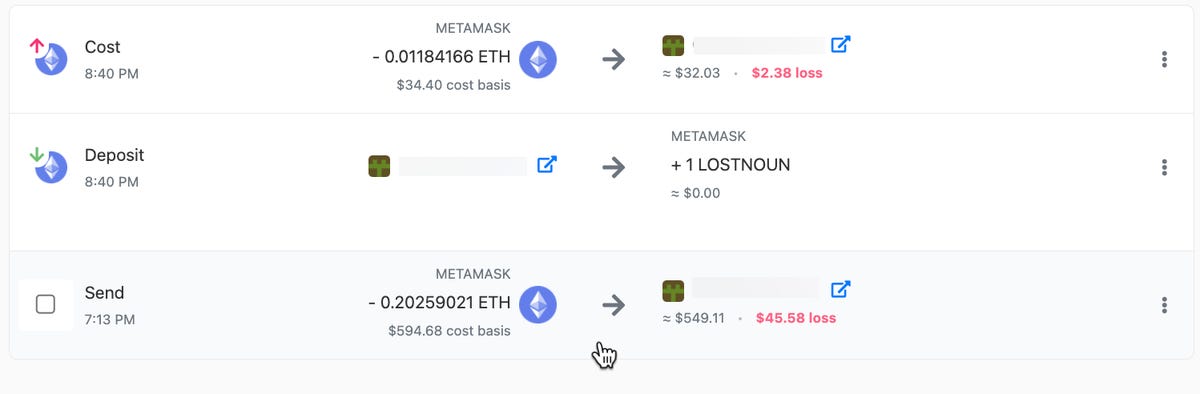

The software also supports taxes around NFT purchases. Buying and Selling NFTs is a taxable event. Here is an example of the tax implications of an NFT that I recently purchased:

Let’s break it. I bought NFT with ETH and you can see three transactions.

- Buy with ETH (ETH’s cost base is higher so I lost my purchase because the transaction to trade is a taxable event).

- NFTs deposited into my account are displayed.

- Cost – Gas fee

Now when I sell the NFT, if I sell it for a profit, I will track the cost basis and I will know what my capital gains tax is. If I sell it at a loss, I will know what my loss is on a cost basis.

Cryptocurrencies go up and down several times a day. Since trade-to-trades are taxable events, trying to manage everything in a spreadsheet is impossible. It is very important if you are trading or purchasing to have an automated way to track your transactions.

Look forward to our conversations in the comments below.

Acronyms in this column

As promised, here are the definitions of the acronyms I used:

Fiat – The currency that we normally use to buy goods and services. Examples include US dollars, euros, and yen.

HODL – Simply a catchphrase. Misspelling of the word HOLD. If you hold a coin through the ups and downs, you are HODLING. Some people even say Hold on dear life.