Collecting zero-party data, Airbnb CEO interview, crypto volatility – TechCrunch

Again when most commerce happened on the native excessive avenue, consumers who exchanged personally identifiable data with retailers acquired one thing in return.

Outlets stored observe of consumers’ hat, shoe and gown sizes, together with their birthdays, anniversaries and private preferences. In return, consumers received a primary have a look at new merchandise and repair that anticipated their needs — personalised procuring.

For many of the web period, that work was carried out with instruments like browser cookies and monitoring pixels, however shopper need for better privateness (and elevated regulation) is forcing on-line entrepreneurs to rethink fundamental practices.

What if as an alternative of surreptitiously monitoring our habits, they simply requested us for related particulars?

Full TechCrunch+ articles are solely accessible to members.

Use discount code TCPLUSROUNDUP to avoid wasting 20% off a one- or two-year subscription.

“Consider the type of stuff you’d inform a retailer affiliate serving to you discover the precise items to buy for your loved ones,” says Ben Parr, president and co-founder of Octane AI. “That’s zero-party information.”

In a highly detailed post with multiple examples, he shares strategies for amassing zero-party information that can interact prospects and drive increased conversions.

It’s not simply e-commerce: New restrictions on information sharing and assortment will elevate buyer acquisition prices for all the things from auto gross sales to actual property. In case your startup is formulating a zero-party information technique, please learn.

On Wednesday, November 17 at 3 p.m. PST/6 p.m. EST, I’ll interview Ben Parr on Twitter Areas about zero-party advertising finest practices. To get a reminder, please follow @techcrunch on Twitter.

Have a fantastic weekend,

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

Demand Curve: How Zapier acquires prospects by way of its homepage

Picture Credit: zoff photo (opens in a new window) / Getty Photos

Your homepage is your most dear asset relating to explaining what you do and the worth you present.

At its root, it’s a sophisticated train in storytelling, however many startups fully overthink it, which is why learning how the competitors presents itself will assist you to save money and time on testing and optimization.

For example, Demand Curve’s Joey Noble tears down automation service Zapier’s homepage, delving into the copywriting and conversion ways which have helped the platform achieve tens of millions of customers worldwide.

Airbnb CEO Brian Chesky discusses the way forward for work and the one factor he’d do over

Picture Credit: Waldo Swiegers/Bloomberg / Getty Photos

In an expansive interview, Airbnb CEO Brian Chesky and TechCrunch Managing Editor Jordan Criminal regarded again at how the journey firm has tailored for the reason that starting of the pandemic.

Their chat lined matters as far afield as Airbnb’s “work wherever” coverage, the way it’s addressing legal responsibility points for hosts and his greatest remorse from the COVID-19 period:

I overrode the host cancellation coverage and refunded greater than a billion {dollars} of visitor bookings. I feel it was the precise factor to do. However I did it unilaterally, with out consulting the hosts. They received actually pissed off and it broke some belief with a few of our host neighborhood.

Debt-as-a-service supplier Sivo needs to energy the subsequent technology of lending startups

Picture Credit: zakokor (opens in a new window) / Getty Photos

Elevating debt isn’t straightforward for startups, and for fintechs with a enterprise mannequin that revolves round lending, elevating a line of credit score from banks or lending establishments can take a number of months.

Providing “debt as a service,” Sivo goals to rectify this drawback by way of its platform, which requires few agreements and charges, and makes elevating debt “as straightforward as plugging into an API,” reported Ryan Lawler.

“Early returns have been constructive: In nearly three months since launch, Sivo has acquired about $4 billion in demand and truly signed $1.5 billion in time period sheets from originators who want to leverage its debt-as-a-service providing,” he writes.

“And, in accordance with founder and CEO Kate Hiscox, the corporate is within the strategy of onboarding 600 originators who’re hoping to faucet into its programmatic debt traces.”

As valuations soar and IPOs speed up, the general public is taking up extra startup threat

Picture Credit: Nigel Sussman (opens in a new window)

Investing in firms which have astronomical valuations based mostly on anticipated development can work out very well. However when the gulf between expectation and actuality turns into too nice, markets can crash.

In line with Alex Wilhelm, right now’s IPO market and valuations are based mostly on actual development, however buyers ought to nonetheless stay cautious.

“The general public is more and more capable of put money into higher-risk tech firms, and as multiples rise, the quantity of air that tech valuations sit upon is increasing,” he writes.

“The general public is now in danger.”

Sweetgreen’s IPO pricing steerage illuminates valuation vary for tech-enabled firms

Picture Credit: Scott Olson (opens in a new window) / Getty Photos

This week, salad chain Sweetgreen set an IPO vary of $23 to $25 per share, giving it a a number of of about 8.2x and a valuation between between $2.5 billion and $2.7 billion.

That’s a variety of lettuce, however the pricing exhibits how a lot tech-enabled DTC companies can flex, writes Alex Wilhelm, who in contrast Sweetgreen’s vary to IPO pricing for Allbirds and Lease the Runway.

“Trendy software program multiples these will not be, however nor are they poor,” says Alex. “Actually, they’re higher than I’d have guessed, extra proof that I’m a mix of Scrooge and the Grinch.”

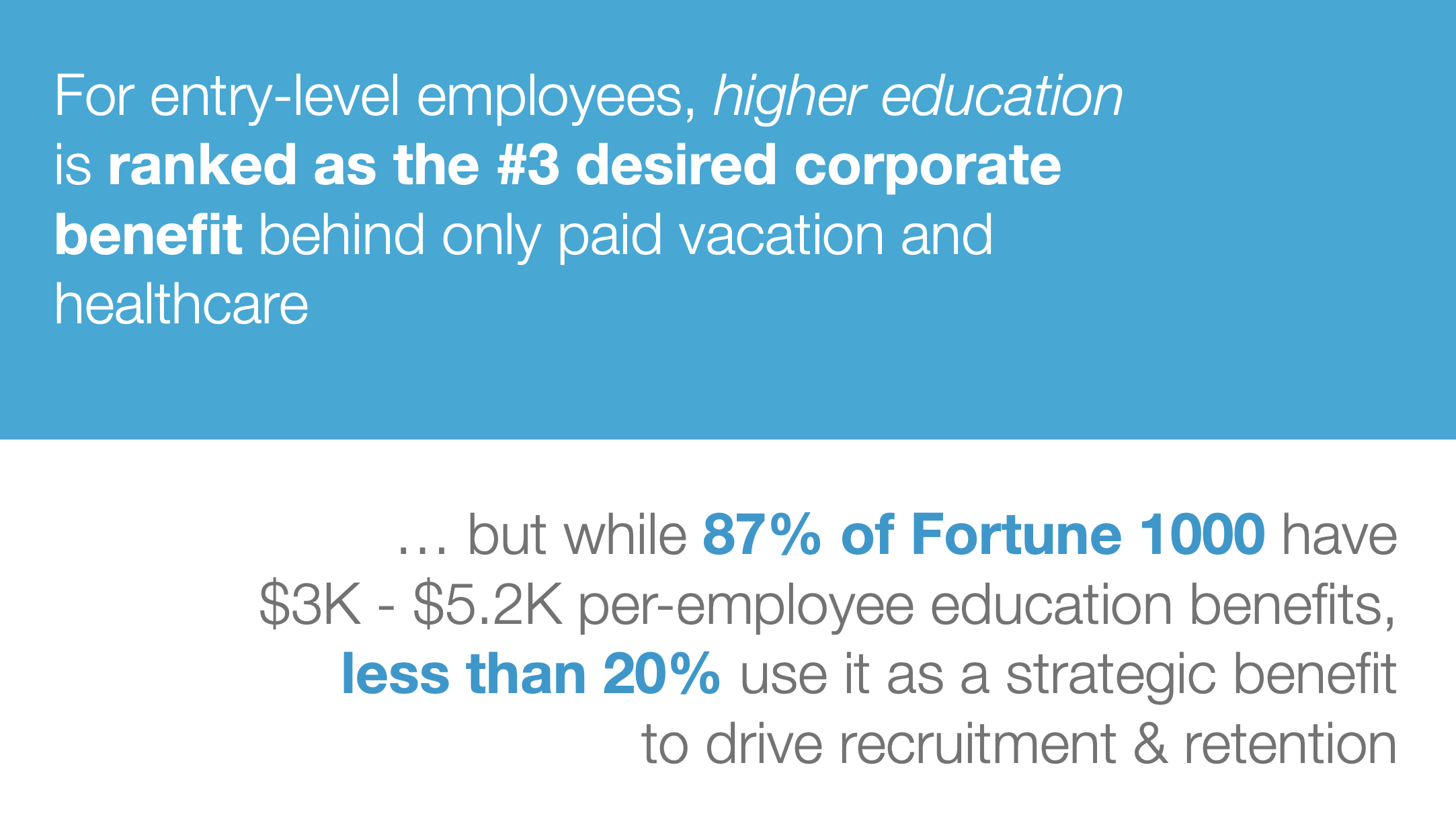

Aileen Lee and Rachel Carlson stroll by way of Guild Training’s early pitch deck

Picture Credit: Guild Training

For a current episode of TechCrunch Reside, Managing Editor Jordan Criminal spoke to Guild Training CEO Rachel Carlson, co-founder Brittany Stich, and Aileen Lee, founder and managing associate of Cowboy Ventures, in regards to the schooling upskilling platform’s origins and development arc.

Cowboy Ventures led a $2 million seed spherical in 2015 whereas the founders have been simply beginning their entrepreneurial journey.

“[We felt like we had to] present up and be a founding crew,” stated Carlson.

“We tried to pretend it a little bit bit. We had this nice mental first assembly, and on the subsequent one, I felt like I needed to present up and present her that I made a enterprise. I used to be rather less genuine.”

Learn how to make the most of distributed work

Picture Credit: Feodora Chiosea / Getty Photos

For a number of years, I’ve earned a residing sitting at a desk in my front room. Every day, I rise up, brew some espresso, and go to work.

“‘Distant’ is essentially deprived,” stated Phil Libin, founder and CEO of startup studio All Turtles and mmhmm at TechCrunch Disrupt. “We’re not distant, we’re distributed. We’re distributed deliberately in the identical method that the web is a distributed system.”

Managing Editor Eric Eldon interviewed Libin and Wendy Good Barnes, chief folks officer at Gitlab, to study extra about easy methods to foster firm tradition, handle people and rent effectively in a distributed office.

“It’s a lot simpler now versus getting in my automobile, commuting to an workplace, having to verify in and undergo safety — after which go sit in a room and be there for 5 – 6 hours,” stated Barnes.

“Now, you’ve got the pliability and also you’re intrigued and also you’re going to study quicker by way of the interview course of remotely.”

Expensify CEO David Barrett discusses going public and why expense administration is a $1T alternative

Picture Credit: Expensify (opens in a new window)

Fintech reporter Ryan Lawler interviewed Expensify CEO David Barrett this week in regards to the timing of the corporate’s IPO, and why they selected a conventional direct itemizing over a extra stylish SPAC.

“We’re aiming to be probably the most pro-employee IPO ever. So regardless that it’s a conventional IPO, apart from a group of insiders, all of our staff can commerce as much as 15% of their shares beginning right now. Usually, you may solely get that type of ‘day one’ liquidity in case you did a direct itemizing.”

Barrett stated getting liquidity for early shareholders was additionally a significant consideration, as the corporate is already worthwhile.

“It actually got here all the way down to — there’s no future the place we don’t find yourself going public sooner or later. So then it’s not if we must always go public, it’s actually about when.”

Crypto volatility continues to flummox Wall Road

Picture Credit: Nigel Sussman (opens in a new window)

The truth that Q3 earnings for Robinhood and Coinbase have been each under expectation has Alex Wilhelm questioning whether or not Wall Road is underestimating simply how risky the crypto market is.

“The pace of the crypto financial system as a complete could also be just too fast for public-market buyers to totally grok,” he writes.

“And the exchanges aren’t even the swingiest of crypto-themed investments.”

Whether or not to promote your organization is at all times going to be an enormous choice for founders

Picture Credit: temmuzcan / Getty Photos

To raised perceive what goes by way of a founder’s thoughts when contemplating a sale, Ron Miller hosted a panel at TC Periods: SaaS with:

- Jyoti Bansal, who bought his earlier startup AppDynamics to Cisco for $3.7 billion.

- Monica Sarbu, who bought her startup Packetbeat to Elastic.

- Nick Mehta, who bought his e-mail archiving startup LiveOffice to Symantec.

“It was 4 days of lengthy board conferences and discussions and debates and fights and attending to the choice. So it wasn’t a straightforward choice,” stated Bansal.

“Although, at $3.7 billion, everybody thought it ought to most likely be a no brainer; it wasn’t.”