BNPL competition heats up, Bowery Farming TC-1, Silicon Valley dreams – TechCrunch

Is Southeast Asia about to hit an inflection level for tech startups?

4 hundred million individuals within the area already use the web, however by yr’s finish, one estimate means that 80% of the inhabitants over the age of 15 in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam can be digital customers.

“As per Jungle Ventures’ calculations, the full worth of the area’s digital corporations is round $340 billion in the present day and is estimated to develop to $1 trillion by 2025,” says founding partner Amit Anand.

Full TechCrunch+ articles are solely accessible to members.

Use discount code TCPLUSROUNDUP to save lots of 20% off a one- or two-year subscription.

E-commerce, fintechs and the fast digitization of the area’s SME workforce are a couple of of the components reshaping the panorama for Southeast Asia’s startups, however provide chain know-how can also be a serious alternative, Anand says.

“With new offers and intentions to checklist within the U.S. being introduced extra ceaselessly, the area exhibits no signal of slowing down and the beginning of many extra unicorns is on the horizon.”

Thanks very a lot for studying TechCrunch+ this week!

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

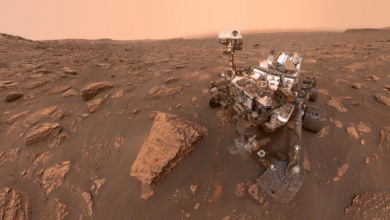

The Bowery Farming TC-1

Picture Credit: Nigel Sussman

Simply over a tenth of Individuals have jobs in meals and agriculture, so it’s straightforward to see why many people lack a eager consciousness about what we’re consuming or the place it comes from.

Our meals provide isn’t as safe or predictable as we assumed: Local weather change, security remembers, the COVID-19 pandemic and even immigration insurance policies can instantly influence what’s accessible on the retailer.

The technological leaps that made it attainable to feed (most of) the world won’t see us by the subsequent century except we alter course.

Plant-based protein has gotten loads of press, however vertical farming that leans on {hardware} and robotics has reached scale, studies Brian Heater, TechCrunch {hardware} editor.

In a four-part sequence, he explores the origins and operations of Bowery Farming, a worthwhile startup that has raised virtually $500 million since 2015 to create new tech and services that increase leafy greens offered in practically 900 markets.

Half 1: Bowery Farming is forcing us all to look up at the future of vertical agriculture

Half 2: Hacking lettuce for taste and profit

Half 3: Can LEDs ultimately replace the sun?

Half 4: The voracious fight for your salad bowl

Since Massive Tech got here to Denver, traders can’t purchase sufficient native startups

Picture Credit: Nigel Sussman (opens in a new window)

Denver, Colorado is nicknamed the Mile Excessive Metropolis, however enthusiastic traders don’t appear to thoughts the skinny air.

“Per a latest CB Insights report, Denver-based startups raised round $2.7 billion in all of 2020,” report Anna Heim and Alex Wilhelm in in the present day’s version of The Trade.

“The identical dataset says that startups within the metropolis have raised $3.1 billion by Q3 of 2021 — extra capital in much less time.”

Colorado’s central location and high quality of life have made Denver and close by Boulder engaging hubs for Massive Tech companies. Now that distant work has turn out to be the norm, distant funding within the space has dialed up as properly.

“Denver was prepared for the Zoom growth, and is reaping the — enterprise capital — rewards.”

Bank card and funds corporations compete for a slice of the rising BNPL market

Picture Credit: Photo Concepts (opens in a new window) / Getty Photos

Giving customers the comfort of deferring cost for a product just isn’t a brand new concept, however now that upstarts like Klarna, Afterpay and Affirm have taken the idea to the subsequent stage, legacy bank card corporations and cost companies are taking discover.

Mary Ann Azevedo and Ryan Lawler have recognized a “gradual emergence” within the BNPL house “of a symbiotic relationship between conventional monetary establishments, funds upstarts and main corporations.”

Visa introduced this week that many corporations are utilizing its know-how to energy point-of-sale BNPL options; final month, its rival rolled out Mastercard Installments, its bespoke providing.

“It’s probably not a shock that these bank card corporations are stepping it up in relation to BNPL,” reported Ryan and Mary Ann. “If something, it’s a marvel that it took them this lengthy.”

Pricey Sophie: Any recommendation for dwelling my desires in Silicon Valley?

Picture Credit: Bryce Durbin/TechCrunch

Pricey Sophie,

After looking for an H-1B job to immigrate to america for a number of years, I took a senior software program engineer place with an organization in Canada.

My dream is to immigrate to Silicon Valley to start out my very own enterprise. Any recommendation?

— Keen Entrepreneur

Closely VC-backed salad chain Sweetgreen heads towards public markets

Picture Credit: Adam Glanzman/Bloomberg / Getty Photos / Getty Photos

At a earlier job, I labored close to a Sweetgreen location, stopping in as soon as every week to select up our startup’s lunch order.

The salads had been scrumptious, however the costs undoubtedly made me recognize our free lunch coverage. Whereas studying Alex Wilhelm’s evaluate of Sweetgreen’s S-1, I recalled one thing else: at any time when I visited, I used to be normally the one buyer ready for a pickup.

Closely reliant on digital orders and workplace employees, Sweetgreen “is quite unprofitable and doesn’t look like on the cusp of a fast march towards profitability,” writes Alex.

On the identical time, “the corporate’s general marketing strategy seems sound on paper.”

Find out how to root out shadow IT and maximize SaaS investments

Picture Credit: MirageC (opens in a new window) / Getty Photos

In a contemporary, principally distant office, unapproved SaaS purposes utilized by particular person workers could result in duplicate subscriptions, wasted IT spend and higher threat of an information breach.

How do you thrust back the shadows? Simply shine a light-weight in your SaaS portfolio, in accordance with CEO and co-founder of Zylo, Eric Christopher.

“As soon as IT has a line of sight into all purposes in use and the way they’re used, they’re positioned to optimize investments,” he says. “Implementing self-service SaaS at your group is less complicated than you could suppose.”

Robinhood’s nasty quarter exhibits the ups, downs of buying and selling incomes

Picture Credit: Nigel Sussman (opens in a new window)

Any inventory that trades on the prospect of an organization’s development quite than its present enterprise worth is treading on skinny ice.

So when buying and selling platform Robinhood reported worse-than-expected Q3 income and revenue, and predicted This autumn income additionally beneath analysts’ expectations, the market responded.

In an in-depth examination of the corporate’s Q3 outcomes, Alex Wilhelm discovered that Robinhood’s person base, crypto buying and selling revenues and income per person all fell, which led to its profitability “taking a beating.”

If competitor Coinbase “has seen even a fraction of the downturn that Robinhood has skilled when it comes to crypto transaction incomes, it may have a troublesome quarter,” he says.

How 2 corporations leveraged natural and inorganic development

Picture Credit: Ivan Bajic (opens in a new window) / Getty Photos

Taking a considerate, balanced strategy to combining natural development with the booster shot of a merger or acquisition can unlock sustainable development, writes Progress Companions’ senior managing director, Chris Legg.

He highlights two examples of profitable M&A methods:

- Outdoors Inc.’s aggressive vertical acquisition spree to increase its choices whereas coming into fully new markets.

- Trusted Media Manufacturers’ take care of Jukin Media to diversify its content material and improve its promoting base.

Crafting a pitch deck that may’t be ignored

Picture Credit: Boris SV (opens in a new window) / Getty Photos

To seek out out what a pitch deck wants to face out, Managing Editor Danny Crichton hosted a panel at TechCrunch Disrupt that includes Mar Hershenson, the founding MD of Pear VC; Mercedes Bent, a accomplice at Lightspeed, and Saba Karim, who heads the worldwide startup pipeline at TechStars.

Their chat incorporates useful insights into how pitches have advanced over the previous yr, the VCs’ thought course of when studying decks and what founders ought to give attention to in the event that they don’t wish to be ignored.

“The decks are getting higher and higher when it comes to design,” stated Bent. “I feel increasingly individuals have realized that the visible illustration of your deck is simply as vital as the fabric and the content material that’s in there.

Originality undoubtedly helps an entrepreneur break aside from the group, stated Karim.

One of the best pitch deck that I obtained in a special format could be from an organization that not too long ago obtained into TechStars — it was truly a podcast model of their pitch deck that had my face on it. I went into Apple Podcasts and it stated, “Hey, Saba, right here’s my pitch.” That was superb! However the second or third time that occurs, it may not be as spectacular as a result of I’ve seen it earlier than.

Allbirds flotation ought to assist the market type the worth of tech-enabled IPOs

Picture Credit: Nigel Sussman (opens in a new window)

I’ve all the time had an curiosity within the origin of phrases: We use “bellwether” as a time period to explain trendsetters, but it surely initially referred to a sheep with a bell tied round its neck, which inspired the remainder of the flock to observe.

Equally, IPO filings provide a glimpse into an organization’s internal workings, however they’ll additionally provide perception into prevailing market developments.

Tech-enabled footwear maker Allbirds’ IPO submitting serves each functions fairly properly, studies Alex Wilhelm: The corporate expects to debut between $12-$14 per share, which might worth it about $2 billion on the higher finish of the vary — not removed from the place Hire the Runway debuted at in its IPO this week.