Biden on plan to destroy US offshore oil production – Growth with that?

David Middleton’s “First, Good News” guest

JUNE 21, 2022

EIA expects 9 new Gulf of Mexico crude and natural gas fields to start in 2022In our June 2022 Short-term energy outlook (STEO), we forecast that new fields coming online in 2022 will account for 5% of natural gas production and 14% of US Gulf Offshore (GOM) crude oil production by year-end. 2023. We expect that GOM Natural gas output will average 2.1 billion cubic feet per day (Bcf/d) in 2023, 0.1 Bcf/d down from 2022. We expect It is expected that GOM crude oil production will average 1.8 million barrels per day (MMb/d) in 2023, roughly the same as in 2022. Currently, no GOM field is scheduled to launch in 2023. .

In 2021, 15% of total US crude oil production is produced in GOM, and 2% of US natural gas production is produced there. In our STEO, we forecast that the eight new fields in GOM will produce both oil and natural gas by year-end, based in part on data from Rystad Energy. We expect the 9th field, which produces only crude oil, to start in 2022.

We expect that the additional capacity will not sustain crude production at the same levels as late 2021. The additional capacity from these new fields will not increase natural gas or crude oil production in GOM. . We expect GOM natural gas production to continue for three years refuse; Annual GOM production last increased in 2019. The decrease in output from existing GOM fields was greater than the increase in production from new fields for natural gas and equal to crude oil.

Since the late 1990s, new developments in GOM have been aimed at oil reservoirs. Today, most of the natural gas produced in GOM comes from companion dissolved natural gas production in oil fields rather than natural gas fields. In 2020, total natural gas withdrawals in GOM from natural gas wells represent less than 30% of GOM’s total natural gas production, compared with 76% in 1999.

We expect vast areas of development of Argos, King’s Quayand Vito to start production in 2022. Each company has a peak production capacity of 100,000 barrels of oil equivalent per day (MBOE/d) or more, and each barrel is the result of a focused effort to reduce development costs mine development. Foreign manufacturers have made significant progress in simplifying and standardizing floating production systems and collaborating with various partners, including overseas construction service companies. , to reduce total costs and maintain competitiveness with domestic manufacturers.

However, sectors scheduled to start in 2022 could move into our 2023 forecast if their start dates are pushed back. Additionally, fields scheduled to begin in 2024 may begin earlier, resulting in changes to our original production forecast.

Main Contributors: James Easton, Kirby Lawrence, Jim O’Sullivan

Card: forecast / forecast, nature Air, STEO (Short Term Energy Outlook), liquid fuel, crude oil, oil, Gulf of Mexico, map

Despite the widespread production shutdown due to Year 2020 and Year 2021 During hurricane season, Gulf of Mexico (GOM) oil production is forecast to again hit 2 million bbl/d by the end of 2022, averaging 1.8 million bbl/d in 2023.

All these new oil and gas fields are deep water.

The King’s Quay Campus, on Green Canyon Lot 433 (GC 433) will be operated by Murphy Oil Corporation. The King’s Quay Floating Production System (FPS) will be installed to a depth of approximately 3,500′. Several undersea Miocene discoveries on the surrounding blocks will be developed as an undersea support for this facility, which can process up to 80,000 bbl/d of oil and 100 million mcf/d of natural gas.

The discovery well was originally drilled on GC 432 in 2009. The block was leased in 2006. Anadarko, Murphy & Samson won it with a bid of $105.6 million. The lease has a main term of 10 years and expires in 2016; however, Murphy and its subsequent partners were able to keep the contract by continuing operations, drilling delimited wells through 2021. The partner leased GC 433 and several pulse lots. around 2015, 2018 and 2020. Time is required to explore, identify, and make final investment decisions (FIDs) and develop deepwater oil fields. Despite Obama’s shortening of the main term of the deepwater lease from 10 years to seven, the partnership is still able to bring together components of the field because there is a “regular and predictable rental sales. ”

Now for the bad news

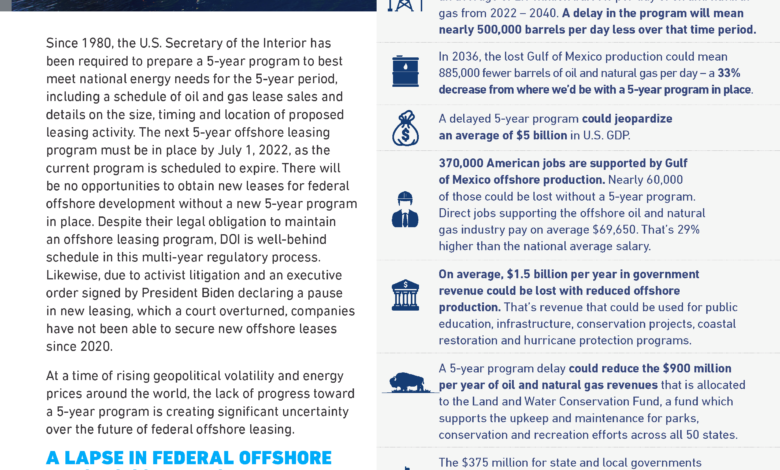

As Brandon was campaigning from his basement, he promise to stop all offshore drilling and leasing. In response to this, the National Association of Offshore Industries (NOIA) has prepared report, two scenarios are expected: 1) Stop allowing new wells on existing leases; 2) Stop selling new leases after the end of the current 5-year program (2017-2022).

Since occupying the White House, Brandon has not managed to fulfill the first promise. If the government stops allowing the existing leases to operate, they will be sued @ $$ es.

However, Brandon Maladministration management has been worse than expected in the rental sales sector.

Impact of a potential rental ban

Although no firm policy proposals have been made, one of the potentially restrictive policy changes discussed concerns oil and natural gas exploration activities in the Gulf of Mexico. Termination of new leases on the Outer Continental Shelf of the Union. For the purposes of this report, a “No Lease Scenario” has been developed to compare performance levels (project implementation, expenditure, oil and natural gas production), economic impact and government revenue for the Base Case. This scenario assumes no new rental sales are held from 2022, but existing leases will be unaffected and no other major policy or regulatory changes affecting oil and natural gas industry off the Gulf of Mexico will be issued.

They don’t wait for the 2017-2022 program to end. One of Brandon’s first violations was the issuance of an illegal executive order halting all rental transactions. They reluctantly organize Sale for Rent 257 in November 2021 to avoid contempt of court. However, a The corrupt Obama judge nullified the sale… Because of climate change. They then illegally canceled all remaining sales in the 2017-2022 program. We’ve now gone two years without rental sales in the Gulf of Mexico, and are likely to have at least a four-year hiatus.

Aside from canceling the remaining sales in the 2017-2022 program illegally, they have yet to come up with a new five-year plan, although Legal requirements do like that. In 2018, the Trump administration released its first draft of the 2019-2024 program, revising the final two years of the Obama-era 2017-2022 plan and extending it to 2024.

The Trump administration DPP has proposed a total of 47 rental sales for 2019-2024: 12 in the Gulf of Mexico region, 19 in the Alaska region, 9 in the Atlantic region, and 7 in the Pacific region.8 For comparison, the 2017-2022 program currently in effect includes a total of 11 OCS rental sales over a 5-year period: 10 in the Gulf of Mexico area, 1 in the Cook Inlet planning area of the Alaska region, and not available in the Atlantic or Pacific regions.

Too bad they didn’t fulfill that plan… However, Brandon’s illegality could have simply been to illegally cancel those 47 rentals as easily as the 4 they canceled.

Under the five-year program, the Gulf of Mexico is expected to produce an average of 2.6 million barrels (BOE) of oil and natural gas per day between 2022 and 2040. Delays in the program would mean almost 500,000 barrels (BOE) less per day during that period.

By 2036, lost production in the Gulf of Mexico could mean 885,000 barrels of oil and natural gas less per day – a 33% off from what we would have with the 5-year program in place.

NOIA’s report was released in May 2020, before the worst hurricane season of 2020-2021 and before the first two years of Brandon’s disastrous vacation in Delaware. With the schedule”regular and predictable rental sales”, the report forecasts GOM production will exceed 2 million bbl/d in 2023 and eventually peak at ~2.4 million bbl/d in the early 2030s.

Here is the EIA plot overlaid on the NOIA chart:

While hurricane damage from the Brandon damage cannot be analyzed at this time, we do have a clear example of political and hurricane damage to GOM’s oil production in the fairly recent past. In August 2020, hurricanes reduced oil production by about 450,000 bbl/d:

Super Typhoon Obama decreased by about 500,000 bpd from 2011-2013.

Mega-Apocalypse-Ginormous-Super Storm Brandon seems intended to do more damage.