Biden Continues to Lie About the Oil & Gas Industry – Watts Up With That?

Guest “This is getting repetitive” by David Middleton

For U.S. oil companies that are recording their largest profits in years, they have a choice. One, they can put those profits to productive use by producing more oil, restarting idle wells, or producing on the sites they already are leasing — giving the American people a break by passing some of the savings on to their customers and lowering the price at the pump.

Or they can, as some of them are doing, exploit the situation: sit back, ship those profits to their investors, and — while American families struggle to make ends meet.

Is Biden this stupid? Or is lying simply his default position? Every word that Biden uttered about the oil industry in his March 31 statement was either a bald-faced lie or a non sequitur:

It’s as if this idiot never had a real job in his life. I previously addressed the lies above here:

Biden followed this up with a lie about an oil company CEO.

One CEO even acknowledged that they don’t care if the price of a barrel of oil goes to $200 a barrel. They’re not going to step up the production.

This lie appears to refer to the comments Pioneer Resources CEO Scott Sheffield made in an interview with Bloomberg. This is what Mr. Sheffield actually said:

Not Even $200 Oil Will Make Shale Giants Drill Aggressively

By Tsvetana Paraskova – Feb 18, 2022[…]

Some private producers have boosted spending on more drilling, but the biggest listed independents are holding the line and vow to continue doing so in the medium term.

“Whether it’s $150 oil, $200 oil, or $100 oil, we’re not going to change our growth plans,” Pioneer Natural Resources’ chief executive Scott Sheffield told Bloomberg Television in an interview. “If the president wants us to grow, I just don’t think the industry can grow anyway,” Sheffield added.

The capital discipline from the public independents in the U.S. shale patch doesn’t bode well for U.S. gasoline prices and for President Biden’s approval ratings. Yet, companies like Pioneer Natural Resources, Continental Resources, and Devon Energy are keeping discipline and plan to grow production by no more than 5 percent annually.

“We project generating flat to 5% annual production growth over the next five years as we have previously noted,” Continental Resources CEO Bill Berry said on the Q4 earnings call this week.

Sheffield said on Pioneer’s call, referring to production growth: “Long term, we’re still in that 0% to 5%. It’s going to vary. We’re not going to change, as I said, at $100 oil, $150 oil, we’re not going to change our growth rate. We think it’s important to return cash back to the shareholders.”

“In regard to the industry, it’s been interesting watching some of the announcements so far, the public independents are staying in line. I’m confident they will continue to stay in line,” Sheffield said.

[…]

Scott Sheffield did not say that he didn’t care if oil prices went to $200/bbl or that Pioneer wouldn’t increase production. In order to increase production, companies need to increase their capital expenditures. Pioneer, like most oil companies, has been steadily increasing its capital expenditures in response to higher prices. Over the past five quarters, Pioneer Resources has increased their capital expenditures (CapEx) from $328M to $1,070M, while maintaining positive free cash flow in four of those quarters.

Free cash flow enables companies to grow, pay down debt and/or return value to shareholders.

Cash Flow

Cash flow is the net amount of cash and cash equivalents being transferred into and out of a company. Positive cash flow indicates that a company’s liquid assets are increasing, enabling it to settle debts, reinvest in its business, return money to shareholders and pay expenses. Cash flow is reported on the cash flow statement, which contains three sections detailing activities. Those three sections are cash flow from operating activities, investing activities and financing activities.Free Cash Flow

Free cash flow (FCF) is the cash a company produces through its operations after subtracting any outlays of cash for investment in fixed assets like property, plant and equipment. In other words, free cash flow or FCF is the cash left over after a company has paid its operating expenses and capital expenditures.Free cash flow shows how effectively a company generates and uses its cash. Free cash flow is used to measure whether a company has enough cash, after funding operations and capital expenditures, to pay investors through dividends and share buybacks. To calculate FCF, we would subtract capital expenditures from cash flow from operations. (See “What’s the Formula for Calculating Free Cash Flow?“)

Mr. Sheffield said that Pioneer was not going to significantly change their growth plans in response to short term swings in oil prices. He stressed that shale producers are actually unable to grow production at a significantly faster rate. Three major, nongovernmental, factors are inhibiting growth: 1) labor shortages, 2) material shortages and 3) shareholder demands for greater returns on investment. Biden may not understand this, but the shareholders own the companies, he doesn’t. Shareholders and financial institutions are demanding that greater returns on investment take priority over the sort of rapid growth that occurred from 2008-2014. Back then the “shale” players responded to >$100/bbl oil by growing production at a much faster rate, only to see their legs cut out from under them when OPEC flooded the market in late 2014.

No oil company has a dial they can just turn the production volume up and down in response to changes in oil prices. In order to increase production, oil companies have to drill more wells. This requires increased capital expenditures. Pioneer and most other oil companies are reacting to the higher price environment by slowly increasing capital spending; which is increasing production in a sustainable manner.

Biden then went on to repeat the unused permits and leases canard and added a new lie to his quiver of dishonesty.

A New Biden Lie: “Use it or Lose it”

Right now, the oil and gas industry is sitting on nearly 9,000 unused but approved permits for production on federal lands. There are more than a [12] million unused acres they have a right to — to pump on.

Families can’t afford that companies sit on these — their hands.

So, to help execute this first part of my plan, I’m calling for a “use it or lose it” policy.

Congress should make companies pay fees on wells on federal leases they haven’t used in years and acres of public land they’re hoarding without production.

Companies that are already producing from these wells won’t be affected. But those sitting on unused leases and idle wells will either have to start producing or pay the price for their inaction.

[T]he oil and gas industry is sitting on nearly 9,000 unused but approved permits for production on federal lands.

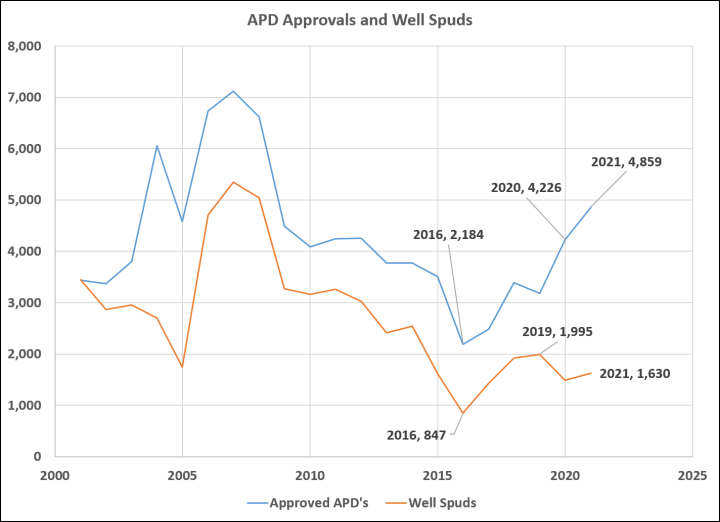

This is a lie. These aren’t “permits for production on federal lands.” These are permits to drill wells on Federal leases. No one is sitting on anything. When Biden was running for president, one of his oft-repeated promises was to halt all new permit approvals on Federal lands and waters. In response to that promise, oil companies with large lease positions on Federal lands, stockpiled enough permits to keep their drilling programs going for several years.

An APD is good for two years. At the end of that period, an operator can request a two year extension. Many of the excess permits will begin expiring at the end of 2022. The only reason why there are currently an excessive number of approved APD’s relative to well spuds, is the fact that Biden promised to halt permit approvals if he was installed in the White House.

There are more than a [12] million unused acres they have a right to — to pump on.

Another lie. No one is sitting on anything. Furthermore, the notion that we can “pump on” a lease just because it is a mineral lease, is just about the most moronic thing Biden has ever said… And that’s up against some very stiff competition.

Biden appears to be referring to onshore leases managed by the Bureau of Land Management (BLM).

About 26 million Federal acres were under lease to oil and gas developers at the end of FY 2018. Of that, about 12.8 million acres are producing oil and gas in economic quantities. This activity came from over 96,000 wells on about 24,000 producing oil and gas leases.

About half of the leased acreage is “producing oil and gas in economic quantities.” The other half would consist of leases no longer producing economic quantities of oil & gas, prospects that have been drilled & condemned, prospects that haven’t been drilled yet, and “trend”, “play” or “protection” acreage. Oil companies will often bid on whatever is open in hot plays and trends, with the notion of possibly working up drillable prospects. They will also lease acreage around good prospects and new discoveries to prevent other companies from “corner shooting.” Mineral leases have a primary term. A company can hold the lease for the entire primary term, so long as they comply with the conditions laid out in the lease agreement (contract). Many, if not most, of these sorts of leases will expire undrilled. The situation offshore is similar.

Rare is the occasion that an oil company bids on a “ready to drill” prospect. After leases are awarded, companies will start spending money on additional geophysical data, reprocessing existing data and performing the detailed geological and engineering work required to bring the prospect to a drillable stage. Even then, it will only get drilled if it is still economically attractive and can be budgeted by the oil company, provided the Federal government approves all of the required permits.

Rick Farmer laid the concept out quite clearly in this LinkedIn post:

Families can’t afford that companies sit on these — their hands.

Congress should make companies pay fees on wells on federal leases they haven’t used in years and acres of public land they’re hoarding without production.

We already do pay fees on federal leases that aren’t producing. Using the Gulf of Mexico as an example:

- Lease bonus: When a company submits a bid on an OCS (outer continental shelf) block in a Federal lease sale, they half to make a deposit equal to 1/5 of the lease bonus (bid amount). If the bid is accepted, they have to pay the remainder of the bonus. The 1/5 deposits are eventually refunded to companies whose bids were not accepted.

- Lease rentals: From the time the lease is awarded, until such time as production is established, the operator pays a lease rental. Annual rentals currently range from $5 to $11/acre. Most offshore leases are either 5,000 (shelf) or 5,760 acres (deepwater). Total annual rentals for an OCS block generally range from $25,000 to $63,360.

- Royalties: Once production is established, the Federal government receives 12.5% to 18.75% of the gross revenue from the oil & gas sales related to that lease. That’s 12.5% to 18.75% of the gross revenue… The government gets this right from the start, long before the operator recovers their investment in the asset. Oil & gas royalties are actually the Federal government’s second largest source of revenue, trailing only income taxes.

Was Biden (or his puppet masters) lying? Or was he just unaware of this? This information is easily accessed through the Bureau of Ocean Energy Management (BOEM).

Companies that are already producing from these wells won’t be affected.

[T]hose sitting on unused leases and idle wells will either have to start producing or pay the price for their inaction.

As discussed earlier, no one is “sitting on unused leases” and we already do pay a price to hold the leases. And the notion that we are sitting on “idle wells,” just beat Biden’s previous record for the most moronic thing he has ever said. When production ceases, the operator has one year to reestablish production or the lease is terminated and this happens:

Idle Iron

From the first signature on a lease, offshore operators know that they will have to clean up the area after they drill and produce hydrocarbons (oil and natural gas) and decommission the facilities and structures placed on the leased area, also called Plug and Abandonment (P & A).

The most common way to reclaim a site includes removing the superstructure and often selling it as scrap metal. Other situations may require that the structure be dismantled and removed, such as damage incurred from a storm, use of different equipment on the original structure or another company using the well. Any operation that is decommissioned and is no longer “economically viable,” infrastructure that is severely damaged or idle infrastructure on active leases, are considered “idle iron” according to NTL 2018-G03.

BSEE’s Idle Iron policy keeps inactive facilities and structures from littering the Gulf of Mexico by requiring companies to dismantle and responsibly dispose of infrastructure after they plug non-producing wells. BSEE enforces these lease agreements primarily for two reasons beyond the CFR requirement:

1. Environmental effects –toppled structures pose a potential environmental hazard due to the topsides and the associated equipment, electronics, wiring, piping, tanks, etc., that are left on the bottom of the Gulf of Mexico. These items pose a financial, safety and environmental burden, and must be removed from the bottom

2. Safety – Severe weather such as hurricanes, have toppled, severely damaged or destroyed the structures associated with oil and gas production. While any structure could be destroyed during a hurricane, idle facilities pose an unnecessary risk of leaks from wells into the environment and potential damage to the ecosystem, passing ships and commercial fishermen.

Idle Iron is the reason that the Western Gulf of Mexico shelf (shallow water) is pretty well permanently dead. Even if a new play was recognized, most of the infrastructure is gone. The Central Gulf of Mexico shelf will hang on for quite some time because deepwater production still utilizes much of the infrastructure.

As a 41-year veteran of the oil & gas industry, mostly working Federal leases in the Central Gulf of Mexico, I have never seen such a blatantly dishonest, corrupt and incompetent administration. For the alleged president of these United States to constantly lie about an American industry is inexcusable, particularly when his actions are hamstringing us.

A Federal mineral lease is a binding contract between the government and oil & gas companies. Only thoroughly corrupt dictators unilaterally alter the terms of a contract. Prior to Biden, this sort of lawless behavior was limited to the likes of Hugo Chavez and Muammar Gaddafi.

A Few Related Posts

Acronyms/Abbreviations/Jargon

- APD: Application for Permit to Drill

- bbl: barrel (42 US gallons)

- BLM: Bureau of Land Management

- BOEM: Bureau of Ocean Energy Management

- BSEE: Bureau of Safety and Environmental Enforcement

- CapEx: Capital Expenditures

- CEO: Chief Executive Officer

- CFR: Code of Federal Regulations

- EIA: Energy Information Administration

- FCF: Free Cash Flow

- NTL: Notice To Lessees

- OPEC: Organization of Petroleum Exporting Countries

- P&A: Plugged and Abandoned

- PXD: Pioneer Natural Resources Co.

- Spud: Start drilling a well

- WTI: West Texas Intermediate