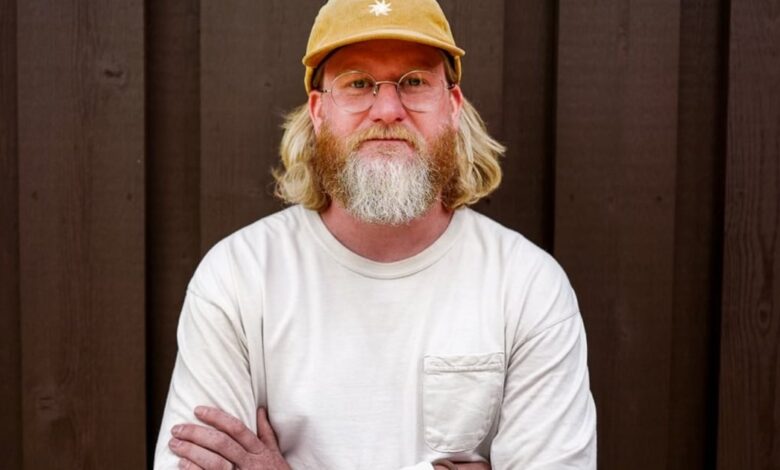

Amazon CEO Pillpack TJ Parker joins VC Matrix company

TJ Parker, a former Amazon executive, is joining the venture capital firm Matrix to rekindle his love of startups.

Parker is the CEO and co-founder of the online pharmacy Pillpack, which was acquired by Amazon in June 2018 for $753 million. Parker stayed at Amazon for about four years before leaving last year. He said the experience was less enjoyable but as impactful as he expected.

“People are relatively inclined to be happy and successful in particular environments,” says Parker. “For me, so far I am at the climax of [a] founder, start-up [type of] boys.”

Parker joins Matrix as a general partner on June 1. He talks about what he learned after being acquired by Amazon, the message digital health founders didn’t get from investors, etc. Interview has been edited for clarity and length.

Have you ever thought about what would happen if you kept PillPack longer?

I don’t regret the moment we finally decided to sell the company. Especially if you think about what’s happened since then, like we’ve had a chance to build [a] pharmacy on Amazon.com, which I think is a great opportunity. Amazon is now really the only major tech company that actually offers healthcare. We are a very important part of that. I think it gave us insight into what we wanted to achieve, which is to make the pharmacy more convenient for the consumer. [and to improve the] broader customer experience, supply chain, and more. I don’t know if that’s possible on the same time scale as an independent company. It will be super capital intensive. So we both had a great financial outcome for everyone involved investors, employees and founders, but I also think we were able to achieve it. what we set out to do and that will continue well after we leave.

PillPack was acquired in 2018. Do you have any advice for your younger self?

I think much of the magic of PillPack is due to its innocence. It’s hard to imagine what PillPack would be like without all the momentum going on. I was 26 years old when I founded the company. I have a deep understanding of the pharmacy experience — I’m a pharmacist, my parents own a pharmacy… but I’m extremely nave about broader motivations. So it’s a bit difficult in that context to want to give myself a lot of advice. But we take money from primarily consumer investors, not healthcare investors, because we’re trying to build a consumer business. I think that’s generally successful and I wouldn’t change that. But no generation of founders can do both. So I think it’s an interesting evolution. But it’s hard to put ourselves back in that position because if I knew what I know now, I don’t think we’d start PillPack. There’s a lot of things that we start off very naive about and that’s part of the magic of being completely honest.

How do you capture that magic again?

That’s part of the reason I switched to venture capital and didn’t start another company right now. I have gone from naive to a pseudo-expert. So I hope to find founders who can also have the same magic. I think they need to deeply understand the customer problems they are solving but it’s hard to recreate that innocence. So I’m excited to be partnering with founders who have the same ability to take that route and without all the baggage that I’ve been active in this space for over a decade.

Is there room for that kind of innovation at Amazon?

There is certainly a space to keep building but you are definitely building in the context of a very large company. And, for me personally, over time, it became clear that it was not a place where I would be both successful and happy. I thought I might have succeeded, but in the end you’re in a big company and it has all the pitfalls of any big company. So again, I think I’m very optimistic about what Amazon can and will build in the healthcare space. Obviously, I’m the foundation on which to build that. But personally, I want to go back to startups.

A lot of founders say investors don’t have the patience and ask for financing faster than healthcare allows. do you agree?

PillPack is a pretty strong counterpoint to that story, isn’t it? It took us 5 years from our founding until we reached a multi-billion dollar acquisition, 5 years from our founding until we reached hundreds of millions of dollars in sales. So I think healthcare is, well, harder than a lot of other categories but I think there are opportunities like risk and profit available in the healthcare sector. Of course, my intention is to build and work with founders who are building age-old companies, and that takes time regardless of category.

What message are digital health founders not getting right now?

I really think the founders got into healthcare and wrestled with the real complexities…[and] build elegant solutions that will succeed. I think there’s been a thread over the last decade about people really playing around the fringes and belts of healthcare delivery. I hope that everyone can take all the lessons we’ve learned and take those engaging experiences in a little simpler places and apply them in much more complex times. in health care.