3 events that will make the market for October

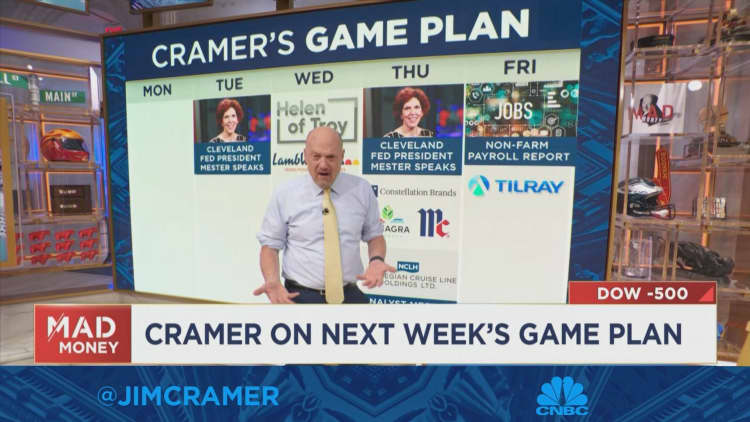

CNBC’s Jim Cramer on Friday said that three key events next week will determine whether the gloomy month for the stock market continues into October.

Here are the events:

related investment news

- The release of the non-farm labor report on Friday. Cramer said he expects it to show hiring and rising wages.

- Two speeches by Cleveland Fed President Loretta Mester, who Cramer believes is a key inflation driver on the Federal Open Market Committee. “She wants to protect us… from high inflation, even if that means raising interest rates into a recession,” he said.

The S&P 500 index ended its worst month since March 2020 on Friday. The Dow Jones Industrial Average and Nasdaq Composite fell 8.8% and 10.5%, respectively, for the month.

While it’s likely that both Mester and the report bring bad news, investors can protect themselves from a market crash if they follow a solid game plan, according to Cramer.

“Owning high-quality companies with good balance sheets and high dividends would benefit from a reduction in inflation, because that’s what’s going to happen.” he say.

He also previewed next week’s earnings plan. All earnings and revenue estimates are provided by FactSet.

Wednesday: Helen of Troy, Lamb Wesson

- Q2 2023 earnings released before the bell; conference call at 9 a.m. ET

- Forward EPS: $2.21

- Expected revenue: $521 million

- Announces Q1 2023 earnings at 8:30 a.m. ET; conference call at 10 a.m. ET

- Forward EPS: 79 cents

- Expected revenue: 1.21 billion USD

“We have seen this are from Nike last night – all that happened was that the downside was accentuated when the bulls only dropped water or moved slightly higher. That’s what I expect to happen to both when they report,” Cramer said.

Thursday: Constellation Brand, Conagra Brand, McCormick, Norwegian Cruise Line Holdings

- Announces Q2 2023 earnings at 7:30 a.m. ET; conference call at 10:30 a.m. ET

- Forward EPS: $2.81

- Expected revenue: $2.51 billion

He said he expects the company’s top performance to be “extremely good.”

- Announces Q1 2023 earnings at 7:30 a.m. ET; conference call at 9:30 a.m. ET

- Forward EPS: 52 cents

- Expected revenue: $2.85 billion

According to Cramer, the company needed to grow its business.

- Announces Q3 2022 earnings at 6:30 a.m. ET; conference call at 8 a.m. ET

- Forward EPS: 71 cents

- Expected revenue: $1.6 billion

Cramer said that the company’s earnings call will simply underpin weaker-than-expected Q3 earnings and a cut to its full-year outlook earlier this month.

- Investor meeting at 10 a.m. ET

Cramer says he expects Norway to perform better than competitor Carnival, capital struggles with higher costs in the latest quarter, but it’s unclear if that will be enough to help Norwegian shares.

Friday: Brand Tilray

- Announces Q1 2023 earnings at 7 a.m. ET; conference call at 8:30 a.m. ET

- Expected loss: loss of 5 cents/share

- Expected Revenue: $169 million

He predicted that the company would make a “bold” statement about legalizing marijuana and said he was weighing whether it could be a great speculative stock to own under the Biden administration. or not.

Disclosure: Cramer’s Charity Trust owns shares of Constellation Brands.